For investors who are interested in getting into precious metals such as gold, the Aberdeen Standard Physical Gold Shares ETF (SGOL) may be worth considering.

The fund was designed to track the spot price of gold and has roughly $3 billion allocated to physical gold bars stored in a Zurich-based vault. For investors looking for greater peace of mind regarding their investment, the fund’s vault is audited twice a year and the holdings are posted daily to the fund sponsor’s website.

The fund is structured as a grantor trust, which prevents trustees from lending the underlying gold. Moreover, due to its structuring, investors do not need to worry about filing a K-1 tax form or other tax-related necessities related to this particular investment. Further, SGOL shares currently trade at 1/100th of the spot price for gold, which may appeal to investors wishing to place smaller orders.

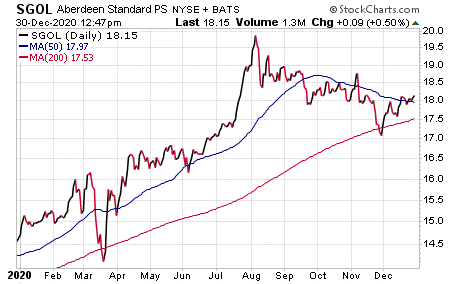

SGOL has the lowest expense ratio of any fund in this particular category, coming in at 0.17%. The fund has $2.62 billion in assets under management and $2.67 billion in net assets. Year to date, it has a total daily return of 23.57%. Unsurprisingly, the fund felt the March lows, but in mid-April, the fund hit a new all-time high since the start of 2020.

In early August, SGOL hit its latest all-time high at $19.50. As of today, the fund is currently trading at $18.14. Though it saw a small drop in late November, it has worked its way back up.

Chart courtesy of www.stockcharts.com

Aberdeen Standard Physical Gold Shares ETF (SGOL) can be an appealing fund for investors wanting to make their way into precious metals as it provides updated information on its sponsor’s website and tracks the daily price movement of gold at a far less expensive price than similar funds, such as SPDR Gold Shares (GLD).

Moreover, precious metals often are considered a tactical allocation, with about five to 10% of one’s portfolio dedicated to this asset class. SGOL’s non-correlated price pattern can be an attractive attribute, since it potentially can help offset losses elsewhere during periods of market stress.

Even so, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goal.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)