******************************************************************

Publisher’s Note: Are you looking for a great Valentine’s Day gift? We were going through some areas of our office and found a box of beautiful rose pendants that were widely popular a few years ago. These are 24K gold and pure silver — a hard combination to find in any jewelry store. Click here now to learn more about these elegant pendants and put a big smile on a special person’s face on Feb. 14! But hurry, we sold a bunch of these for the holiday season and we only have 49 of these left!

******************************************************************

Last weekend, the incoming Biden administration released a list of planned executive actions, some of which are sure to create some market headwinds.

The repeal of the Trump tax cuts and the imposition of a mandatory $15 per hour wage standard will likely have the broadest impact on investor sentiment. Extensions on student loans and evictions, rejoining the Paris Climate Agreement, reversing travel bans on Muslim countries, reinstating the Iran Nuclear deal, granting amnesty for 11 million immigrants and the expansion of the Affordable Healthcare Act are not likely to impede the market in the near term.

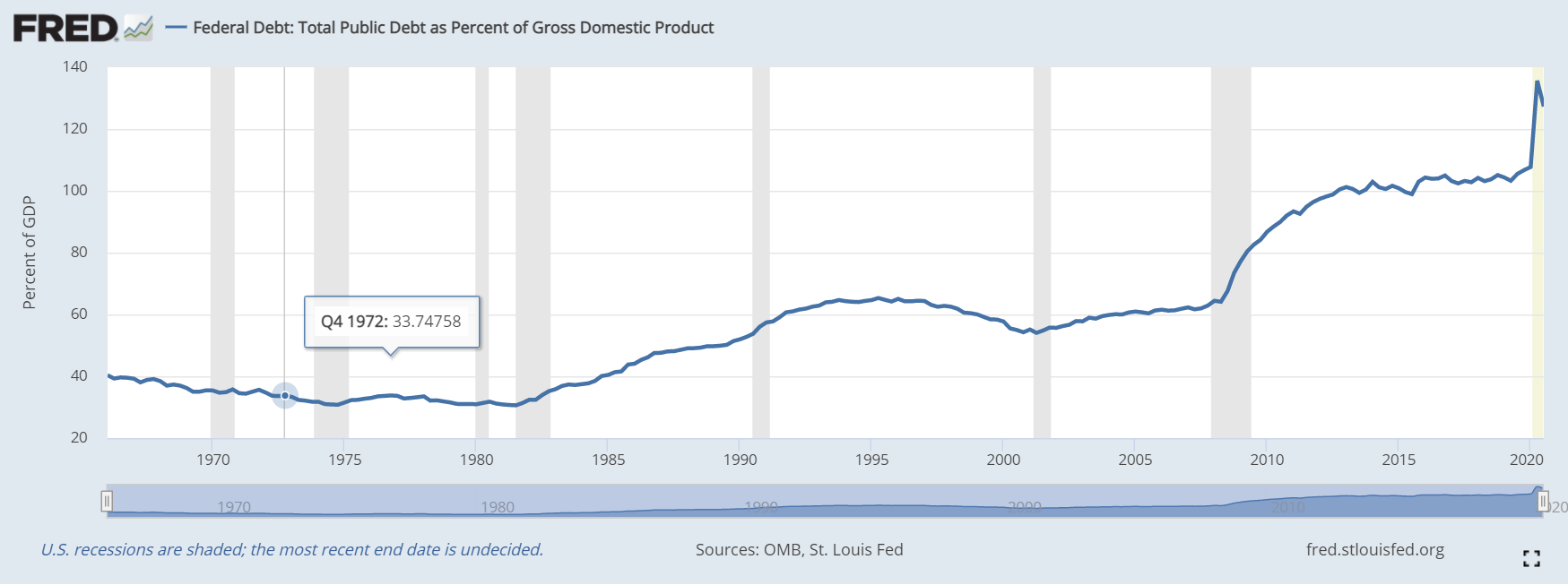

But, such executive orders have collectively raised questions about policy directives and the ability to finance ambitious spending plans. The market cares deeply about tax policy, and campaign promises have a tendency to morph into different-looking policies when they are finally implemented. The national debt ended 2020 at $27.75 trillion, is going to top $30 trillion shortly and will keep rising at a rapid clip due to both pandemic-related relief stimulus and spending on infrastructure, health care and education.

On Jan. 6, the yield on the 10-year Treasury note popped up through the 1.00% level, traded to 1.19%, where it ran up against a 20-week downtrend line (the blue line) and retreated back down to 1.09% by last Friday. Weak retail sales and employment data put the brakes on the selling pressure within the bond market, but it now appears that long-dated yields are going higher.

If, and when, the 10-year Treasury bond yield breaches 1.10%, the chart above suggests that the next level of overhead resistance lies at 1.5%. The bump in yields is being attributed to commodity inflation, huge deficit spending and a weakening dollar. The countervailing force is the $120 billion per month in quantitative easing (QE) being conducted by the Fed, as the large-scale asset purchases of treasuries, mortgage-backed securities and corporate bonds are intended to push down longer-term interest rates.

Any incremental rise in yields along the 3-10 year curve increases interest on the national debt by hundreds of billions of dollars. So, it’s probably not a big deal if the 10-year T-Note yield rises to 1.5%, but, a further rise to 2.5%-3.00% will get the market’s attention if gross domestic product (GDP) growth doesn’t coincide with the increase in bond yields.

Ideally, as economic growth is restored, and the Fed is able to taper QE late this year, or in early 2022, the dollar should hold its value and even rally while rates tick higher based on a healthier economic outlook. Under these conditions, the stock market has historically performed quite well, as revenue and earnings growth have improved for most, if not all, market sectors.

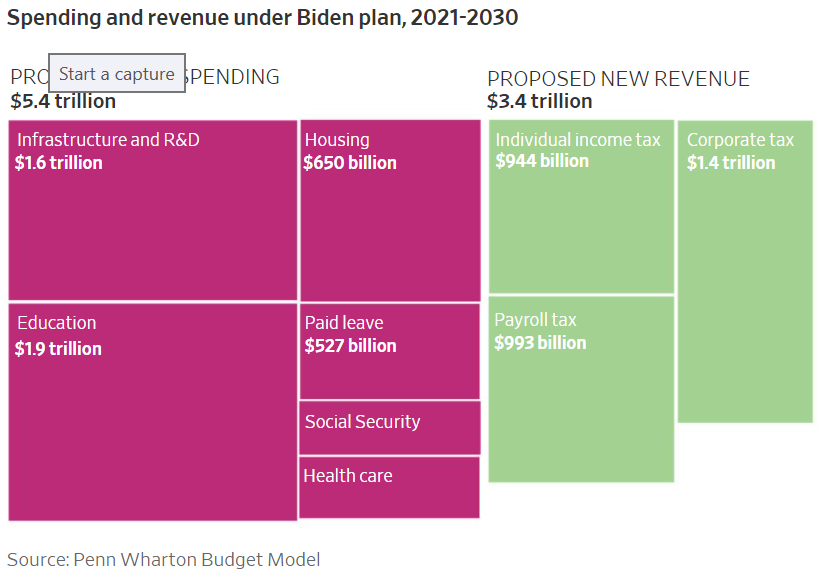

The long-term chart of the dollar above shows where the important levels of support are easily able to be identified. A breach of the 88.0 level opens the way lower to 80.0, where central bank intervention would be a real possibility. Incoming Treasury Secretary Janet Yellen is a supporter of a strong dollar policy, and, without a doubt, she and Fed Chairman Powell have a big job on their hands. They have to maintain low interest rates and a stable dollar, while President Biden and Congress earmark $5.4 trillion in new spending by 2030.

If enacted, the Biden budget would elevate federal spending to 24% of gross domestic product by 2030, according to the Wharton study, and exceed the spending spikes during the 2008-2009 financial crisis and the 2020 pandemic crisis, while adding another $2 trillion in deficits to the spiraling national debt. I think it’s safe to say that the dollar will trade lower and Treasury yields will rise further as U.S. debt-to-GDP ratio climbs toward 130%.

So, where should investors target attractive income-generating assets in a weak dollar, rising-rate and increasing-stock market environment? Convertible bonds and convertible preferred stocks are one class of securities that outperforms under these conditions. A world awash in liquidity, and a world where capital flows come out of bonds and rotate into equities is prime for convertible debt, as the performance of these assets are tied to the corresponding common stocks. Yet, all of them mature at par, if not converted or called away at significant premiums.

By themselves, converts are not easily traded by individual investors, as small lots of crème de la crème securities are hard to locate. However, there are a few closed-end funds that are well diversified, employ about 15-20% leverage, trade at attractive discounts to Net Asset Value (NAV), generate annual yields of 6-7% and pay a dividend on a monthly basis.

Within my Cash Machine income advisory service, we’ve had the Allianz GI Diversified Income & Convertible Fund (ACV) as a long position since March 2018. During that time, it has returned more than 78% to my subscribers and still pays a juicy 5.82% current yield. Put simply, convertibles are one way that income-oriented investors can have their cake and eat it, too.