Five metals stocks to buy as a way to buffer inflation during an economic bounce are benefiting from rising prices for metals such as gold and steel.

The five metals stocks to buy are climbing after record-setting prices worldwide for copper, iron ore, steel and aluminum, according to BoA Global Research. Those prices have jumped more than 20% above their average for the past 10 years, the investment firm stated in a recent research report.

The annual inflation rate in the United States soared to 4.2% for the 12 months ended April 2021, rising from 2.6% for the 12-month rate in March and 1.7% in February, according to U.S. Bureau of Labor Statistics data. The 4.2 percent increase reported in April marks the largest jump for a 12-month period since a 4.9-percent spike for the 12 months ended September 2008, the agency reported.

The trend should continue since is likely that growing inflationary pressure may not ease “imminently,” BoA reported in its May 25 research note. Management at some of the metals companies have reported that they plan to protect their margins by raising prices, if needed.

Gold Offers Most Reliable Inflation Hedge in Assessing 5 Metals stocks to Buy, Pension Leader Says

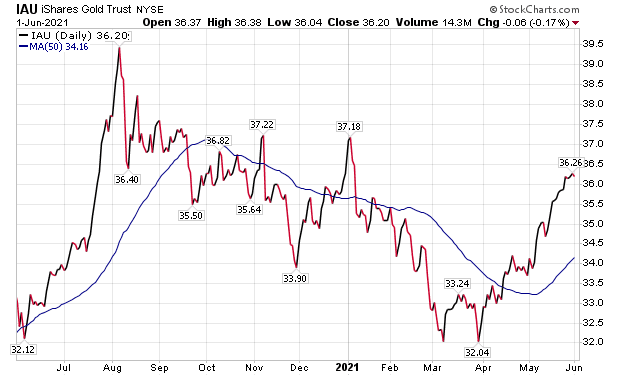

Gold offers the “most reliable inflation hedge” among the various metals, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. Carlson, who also leads the Retirement Watch investment newsletter, counseled that he recommends having a base inflation-hedge in gold through exchange-traded funds (ETFs), such as iShares Gold Trust (NYSE:IAU).

Chart courtesy of www.StockCharts.com

“An investment in a metals and mining company often will result in more than an investment in a metal, Carlson continued. The companies usually have some debt that can be used as leverage to lift returns, he added.

Once the price of the metal is high enough to pay the company’s fixed costs, any further price increases enhance margins for the organization and thereby boost its bottom line.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

5 Metals Investments to Buy Include Diversified Sector Funds

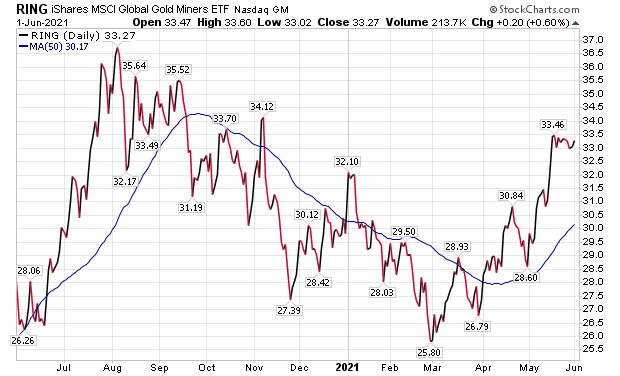

“Investors who want to seek these leveraged gains should invest in a diversified mutual fund or ETF,” Carlson said. “Those who want an inflation hedge should choose a fund focused on gold mining companies. A good choice is iShares MSCI Global Gold Miners (RING).”

Chart courtesy of www.StockCharts.com

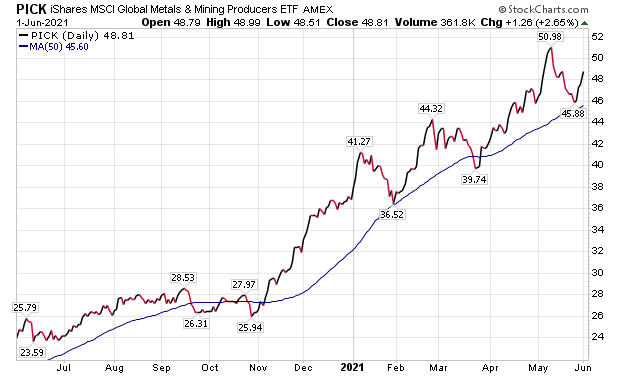

For investors who want a broader portfolio that will benefit from both inflation and global growth, consider iShares MSCI Global Metals & Mining Producers (PICK), Carlson counseled.

Chart courtesy of www.StockCharts.com

5 Metals Investments to Buy Include BHP Group Ltd.

“If you’re worried about inflation draining value from the money you have, commodities are one of the best places to seek shelter,” said Hilary Kramer, who heads the GameChangers and Value Authority advisory services. “And if you have a feeling the building boom is only going to accelerate once Congress decides on an infrastructure package, there’s even a good chance of making long-term money on the mining stocks. In that scenario, I prefer base metals because they are consumed in industry and construction… forcing the miners to keep digging in order to satisfy demand.”

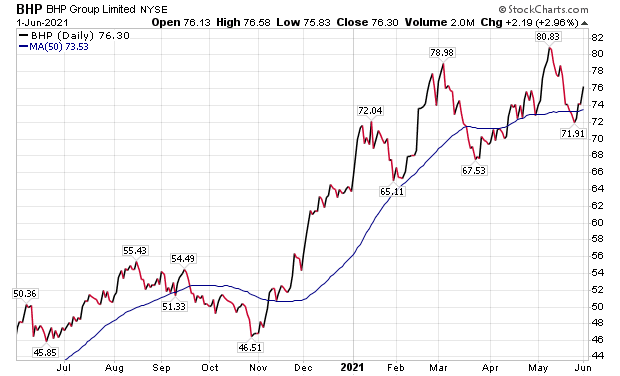

Kramer, who also hosts the nationally aired “Millionaire Maker” radio program, said one of her favorite metals stocks is BHP Group Ltd. (NYSE:BHP), the biggest miner on the planet across many metrics. The odds are good that BHP Group is a major supplier of virtually any metal one may want, she added.

Chart courtesy of www.StockCharts.com

“As a bonus, I worked on the initial investment banking here years ago, so I’m sentimental,” Kramer continued. “The 4.2% dividend yield at least matches current inflation, which is more than Treasury bonds can say, and any upside on the stock over time will be a nice bonus.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

BHP Group’s share price has climbed 19.9% in the past 52 weeks and 64.6% thus far in 2021. Value-conscious investors may be interested that BHP Group’s price-to-earnings ratio of 27.8 is more economical than the S&P 500 Index’s 36.5.

Nucor Joins 5 Metals Stocks to Buy

One metals stock that has been on a huge run in the past year with no signs of stalling is Nucor Corp. (NYSE:NUE), a Charlotte, North Carolina based producer of steel and related metals.

“Superman might be the man of steel, but he’s got nothing on a tremendous company that actually forges the steel used to build the world, Nucor Corp.,” said Jim Woods, who leads the Successful Investing and Intelligence Report investment newsletters, as well as the Bullseye Stock Trader advisory service. Woods, who also co-edits the Fast Money Alert trading service with economist Mark Skousen, PhD, chose Nucor as his entrant in the five metals stocks to buy.

Columnist Paul Dykewicz meets with Jim Woods to discuss stocks to buy.

Nucor not only manufactures and sells steel and steel products, the company also is involved in all aspects of the steel business, including hot-rolled, cold-rolled, and galvanized sheet steel products, plate steel products, wide-flange beams, beam blanks and H-piling and sheet piling products. Woods continued.

“You get the picture,” Woods said. “If it’s steel, then Nucor does it.”

Chart courtesy of www.StockCharts.com

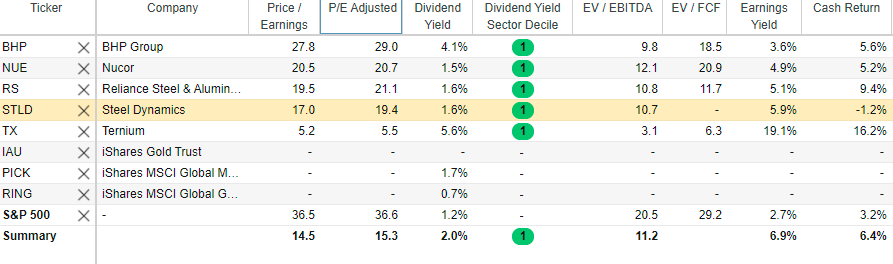

P/E Ratios of 5 Metals Stocks to Buy Are Modest Compared to S&P 500

Strong demand due to the economic reopening, the anticipated flood of money into infrastructure and rising steel prices have combined to help Nucor deliver earnings growth of 213% year over year in its latest quarter, Woods explained. Aided by strong earnings growth of the past several years, Nucor has vaulted into the top 9% of all companies in terms of increased earnings, he added.

Any doubters should consider that Nucor’s share price has zoomed 164.6% in the past 52 weeks and 109.0% so far in 2021. Investors who are worried that Nucor has soared too far, too fast should note that the stock has a price-to-earnings ratio of 20.5, compared to 36.5 for the S&P 500 Index.

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

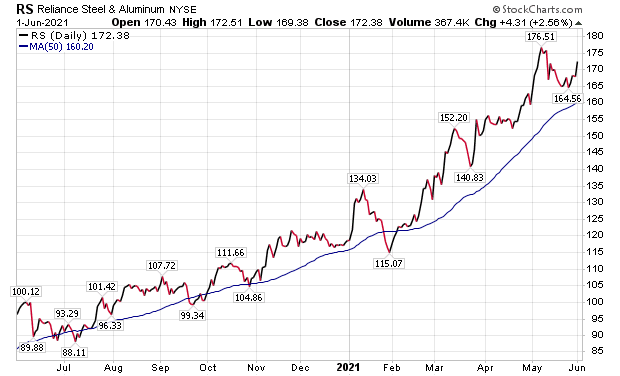

Reliance Steel Snags Slot With 5 Metals Stocks to Buy

Reliance Steel & Aluminum (NYSE:RS), a Los Angeles-based metal solutions provider and the largest metals service center company in North America, operates a network of about 300 locations in 40 states and 13 countries outside of America. The company offers value-added metals processing services and distributes a full line of more than 100,000 metal products to 125,000-plus customers in a wide range of industries.

Reliance has found a niche in fulfilling small orders with quick turnaround and increasing levels of value-added processing. In 2020, Reliance’s average order size measured $1,910, approximately 49% of its orders included value-added processing and about 40% of those orders were delivered within 24 hours.

Reliance Steel’s stock price has jumped 78.7% in the past 52 weeks and 45.1% thus far in 2021. Value-oriented investors may be interested that the company’s price-to-earnings ratio of 19.5 is roughly half that of the S&P 500 Index’s 36.5.

Reliance Steel’s Spot With 5 Metals Stocks to Buy Aided by Cash Flow

BoA gave Reliance Steel a price target of $185 per and praised its cash return to shareholders, as well as support for the share price through buybacks. Plus, the company has a track record of free cash flow generation.

BoA wrote that its price target for the company could be affected negatively by a delayed economic recovery, execution risk due to its acquisition strategy and any sharp corrections in prices. Potential catalysts for the stock, BoA noted, are: 1) aggressive buybacks or dividend increases, 2) higher metal prices and 3) more attractive consolidation opportunities than currently modeled. Additional upside could come from mergers and acquisitions (M&As), as well as stronger pricing and demand than currently forecast.

Chart courtesy of www.StockCharts.com

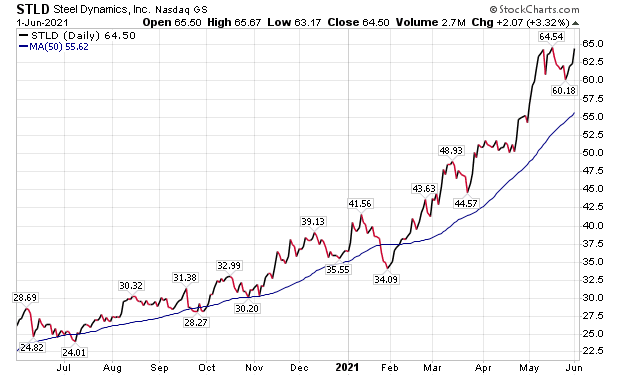

Steel Dynamics Strides Among 5 Metals Stocks to Buy

Fort Wayne, Indiana-based Steel Dynamics, Inc. (NASDAQ/GS: STLD) is one of the biggest domestic steel producers and metals recyclers in the United States. With facilities throughout the United States and in Mexico, the company produces a wide variety of steel products, such as hot roll, cold roll, and coated sheet steel, structural steel beams and shapes, rail, engineered special-bar-quality steel, cold finished steel, merchant bar products, specialty steel sections and steel joists. Plus, Steel Dynamics produces liquid pig iron and processes and sells ferrous and nonferrous scrap.

Steel Dynamics announced on May 14 that company founder Mark D. Millett, its president and chief executive officer, added the role of chairman of the board on that date. The chairmanship opened when Keith E. Busse, a company founder, stepped down from that post but stayed on as a director.

BoA gave a $68 share price objective to Steel Dynamics, based on valuation modeling and assumptions. Uncertainty about achieving the price target comes from steel and scrap price volatility, possible project delays, the course of the economic recovery and potential excess supply, the investment firm noted.

The stock price of Steel Dynamics has jumped 143.9% in the past 52 weeks and 75.6% in 2021, as of June 1. The company’s price-to-earnings ratio of 17.0 is less than half the S&P 500 Index’s 36.5.

Chart courtesy of www.StockCharts.com

Ternium’s Upward Trend Takes It Among 5 Metals Stocks to Buy

Another fast-rising steel stock has been Luxembourg-based Ternium (NYSE:TX). Its share price has leaped 150.5% in the past 52 weeks and 37.0% in 2021, as of June 1. In addition, the company’s price-to-earnings ratio of 5.2 is at a huge discount compared to the S&P 500 Index’s 36.5.

Chart courtesy of www.StockCharts.com

Ternium manufactures and processes a wide range of steel products using advanced technology. With 17 production centers in Argentina, Brazil, Colombia, United States, Guatemala and Mexico, the company manufactures high-complexity steel products that supply the main industries and markets in the region.

Ternium describes itself as Latin America’s top flat steel producer, providing high-value-added steel products for customers in the automotive, home appliances, HVAC, construction, capital goods, container, food and energy industries. After reaching record earnings before interest, taxes, depreciation and amortization (EBITDA) in the first quarter of 2021, the guidance offered by Ternium management called for producing a sequentially higher EBITDA in the second quarter largely driven by rising realized steel prices, offset partially by higher cost per ton due to increased iron ore, scrap and slab costs affecting the company’s inventories.

5 Metals Stocks to Buy Sidestep Worst of COVID-19 Crisis

Progress in the COVID-19 vaccination process gives renewed hope that new cases and deaths could fall further in the weeks and ahead. Part of the optimism stems from the Food and Drug Administration (FDA) recently approving a third COVID-19 vaccine, manufactured by Johnson & Johnson (NYSE:JNJ), which requires just one dose rather than two, as the first two market entrants do.

COVID-19 cases worldwide have reached 171,046,311 and caused 3,557,281 deaths, as of June 1, according to Johns Hopkins University. Also as of June 1, U.S. COVID-19 cases totaled 33,287,124 and have resulted in 595,211 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five metals stocks to buy offer an inflation hedge to investors, amid a $1.9 trillion federal stimulus package, increased COVID-19 vaccine availability and an improving economy. Those factors and others are fueling the five metals stocks to buy.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special Father’s Day gift pricing!