The three best bank stocks to buy now include a leading financier of the technology industry, a global investment bank and a rapidly growing regional bank at the forefront of financial technology (fintech) innovation.

Bank stocks are a favorite of legendary investor Warren Buffett due to their importance to society, simple business models and excellent long-term return profiles. However, an investment in this sector brings unique characteristics, benefits and risks due to their susceptibility to global market trends and fiscal and monetary policies.

The global banking industry has greatly benefited from the influx of cash into the world economy brought about by government policies designed to provide a fiscal stimulus and to combat the COVID-19 pandemic. Those policies, combined with rising inflation rates in countries like the United States, have helped spur capital markets and investment activity. The new capital has allowed many banks to generate record-breaking returns.

As a result, bank stocks have been some of the best-performing investments over the past 12 months and should continue to be as financing demand and activity increases alongside the global economic recovery.

Valuation Metrics of the 3 Best Bank Stocks to Buy Now

Three critical metrics to keep in mind when evaluating bank stocks are: return on equity (ROE), return on assets (ROA) and the (share) price-to-book (P/B) ratio. ROE measures a bank’s profit as a percentage of the company’s shareholders’ equity. ROA, meanwhile, gauges the profitability of the institution compared to the assets the firm has on its balance sheet. The higher the ROE and ROA, the better. Investors generally prefer an ROE of at least 10% and a ROA of 1% or greater.

Last, but not least, is a bank’s P/B ratio. Similar to the (share) price-to-earnings (P/E) ratio, P/B details to investors how expensive or cheap the stock is by comparing the share price to the firm’s net value of assets. Generally, a lower P/B ratio means a better deal for investors.

3 Best Bank Stocks to Buy Now: #3

SVB Financial Group (NASDAQ:SIVB)

SVB Financial Group (NASDAQ:SIVB), founded in 1983, is a banking and financial holding company headquartered in Santa Clara, California, with more than $142 billion in total assets. Its principal subsidiary is Silicon Valley Bank which specializes in providing financing and advisory services for technology firms. The company possesses a market capitalization of $30.5 billion and offers commercial banking, investment, private banking and asset management services across its four core business segments: SVB Capital, Global Commercial Bank, SVB Private Bank and SVB Leerink.

SIVB has consistently generated some of the best metrics across the entire banking industry. The company boasts a compound annual growth rate (CAGR) of 22.0% for revenue over the past five years and an earnings per share (EPS) CAGR of 28.4% over the same period, resulting in a five-year return rate of 443.5%.

COVID-19 has provided more of a boost to this Silicon Valley Bank than nearly any other financial institution. SVB Financial Group’s unique position as the pre-eminent financier in the technology space has allowed it to capitalize on the explosion in technology demand during the pandemic, with the company posting record-setting revenue and profit gains in first-quarter 2021. Revenue climbed by 71.3% and net income by 294.9%, compared to first-quarter 2020 figures, leading to a return rate of 175.5% over the past year and growing EPS by a further 61.1% over the same period.Those results are well above industry and S&P 500 averages.

SIVB did not only see its income statement figures grow. Its total assets on the balance sheet increased 23.2%, including a 128.9% surge in cash, over the trailing 12 months. What makes SVB Financial’s metrics even more impressive is that it has maintained a 1.1% ROA and increased its ROE to 16.1% from 14.5% in Q1 2021, compared to the end of fiscal year 2020. It can often be challenging to maintain ROA and ROE ratios after a sudden jump in assets or shareholders’ equity as it takes time to allocate the new capital to maintain relative earnings, much less increase relative returns.

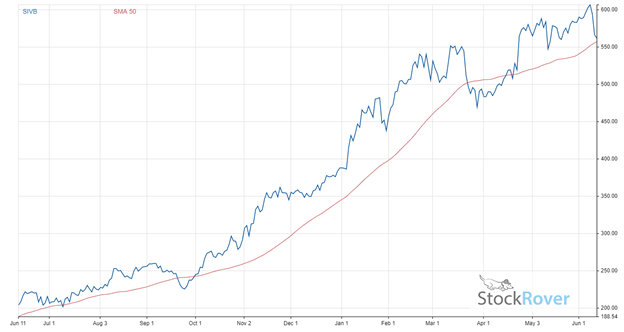

The company’s consistent ability to comfortably outperform the market has caused SIVB’s share price to surge by 429.3% over the last five years and by 153.3% over the past 12 months. The stock’s one-year growth alongside a 50-day moving average is displayed below.

Chart provided by Stock Rover.

The one downside to SIVB is its relatively high P/B and P/E ratios of 3.4 and 18.1, above industry averages of 0.9 and 13.8. However, the slight premium in share price seems well worth it for a stock with as much upside and growth as SVB Financial. Stock Rover assigned a value rating of 84 to SIVB, above the industry average of 78, showing the stock still is undervalued.

COVID-19 pandemic-related technology innovation gains are expected, according to an October 2020 McKinsey & Co. report, with companies in Silicon Valley where the bank does business playing a key part in those advances. Artificial intelligence alone is expected to add $15.7 trillion to the global economy by 2030. Few financial institutions are better positioned than SVB Financial Group to embrace changing tailwinds in the coming decades.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $575.50, 4.7% higher than its latest closing price of $549.67. With analysts projecting a 24.0% growth in sales for 2021, SIVB received a “Buy” recommendation from Stock Rover and a place among our three best bank stocks to buy now.

3 Best Bank Stocks to Buy Now: #2

Goldman Sachs Group Inc (NYSE:GS)

Goldman Sachs Group Inc (NYSE:GS) is a leading international investment bank and financial holding company based in New York City with business segments in global markets, asset management, consumer banking, wealth management and investment banking. Since being founded in 1869, Goldman Sachs has been seen as the pinnacle of high finance and currently presides over $2.1 trillion in assets under supervision and a market capitalization of $128 billion.

Like many financial sectors, Wall Street banks have seen a boom in business as the global economy continues its recovery from the COVID-19 pandemic. However, Wall Street’s recovery has outpaced all expectations and outperformed most other related industries. If anything, COVID-19 has proved to be a blessing in disguise for Goldman Sachs and its competitors.

The Federal Reserve’s (Fed) attempt to prop up the United States economy by slashing interest rates, instigating corporate bond buyback programs and printing money has flooded the financial markets with trillions of dollars, bolstering the stock market and encouraging new bond issuances, equity offerings, mortgage lendings and merger and acquisition deals. Those financing activities are the bread and butter of investment banks like Goldman Sachs. The Fed’s actions combined with new government stimulus packages have proven to be so beneficial that it has led to an average sales growth rate of 56.8% and an average one-year return rate of 70.9% within the capital markets industry over the past year.

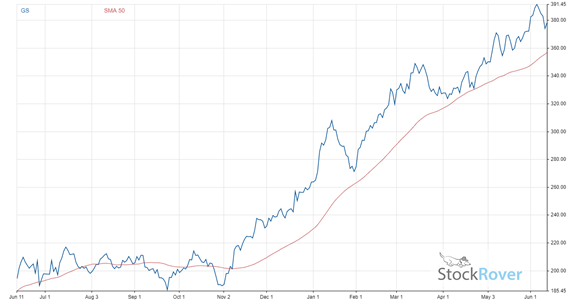

Goldman Sachs has managed to beat industry figures, with its stock price soaring by 93.9% over the past year on the backs of a 62.2% jump in revenue and a return rate of 98.4% over the trailing 12 months. The company has seen its EPS jump from $21.03 in 2019 to $24.74 in 2020 and is expected to shatter last year’s figures with an astounding EPS of $18.60 in Q1 2021 alone. GS’s stock price over the past year is shown below alongside a 50-day moving average.

Chart provided by Stock Rover.

However, the stock’s climb is likely not over yet as Wall Street companies, from JP Morgan Chase to Wells Fargo, reported bullish economic and industry outlooks in April 2021. With a near-record level of savings in the U.S. economy, gross private savings rose to more than $7.8 trillion in Q1 2021. Many analysts predict a significant boom in consumer spending in the coming months, auguring well for financial institutions, especially Wall Street banks, with Goldman Sachs projected to experience a 12.1% sales growth in 2021.

The company also excels in bank valuation metrics, possessing stellar ROA and ROE ratios of 1.2% and 12.9%, displaying a consistent capability to generate returns above competitors. GS’s P/E and P/B ratios of 9.4 and 1.5 are also well below the industry averages of 16.3 and 2.9, designating the company’s share price as a bargain relative to companies with similar financials.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $391.57, 5.3% higher than its latest closing price of $371.78, earning GS a “Buy” recommendation from Stock Rover and a place among our three best bank stocks to buy now.

3 Best Bank Stocks to Buy Now: #1

Signature Bank (NASDAQ:SBNY)

Signature Bank (NASDAQ:SBNY) is a New York-based regional commercial bank specializing in providing commercial lending, wealth management and asset management services through its 37 private client offices across New York, California, Connecticut and North Carolina. Signature Bank is the youngest and smallest bank on this list, being founded in 2001 and possessing a market capitalization of just over $14 billion. The company currently manages more than $85 billion in assets.

Signature has seen a meteoric rise over the past 10 years, with one of the best-annualized return rates in the banking industry at 17.2%. The company’s returns also have gotten better over time, with a one-year return rate of 146.8% and a three-year return rate of 106.4%. However, the best is yet to come for SBNY.

As a relatively young company, Signature can be more flexible and proactive in its business plan than more established players in the industry, with the company pursuing an ever-increasing focus on technology. In 2019, SBNY launched its revolutionary real-time digital payments platform, Signet, designed for cryptocurrency, allowing clients to send, receive and process transactions 24/7, 365 days a year.

The platform has been immensely successful and, combined with recent excess liquidity in the economy, has allowed the bank to experience a $37 billion jump in total deposits since Signet’s launch in Q1 2019, rising from $36 billion to nearly $74 billion, as users are encouraged to maintain account balances of $250,000. With the global cryptocurrency market capitalization projected to skyrocket as high as $11 trillion by 2026, Signature Bank seems set to produce a windfall of new revenue from Signet in the foreseeable future.

Although still higher than the regional banking industry averages of 8.4% and 0.6%, the bank’s most significant point of concern is its relatively low ROE and ROA ratios of 9.2% and 0.7%. However, the good news for investors is that the low ratios are not due to bad investments but are instead a rare instance of being signs of a company’s rapid growth over the past two years.

The influx of deposits, which has increased by $10.5 billion in Q1 2021 alone, has led to a significant decrease in investments and, subsequently, returns relative to the company’s assets and equity. SBNY has already begun to take steps in addressing its new capital by issuing and purchasing more than $28 billion in new loans, mortgages, leases, securities and other investments since Q1 2020, leading to an increase in revenue by 22.1% over the past year. Signature Bank executives also anticipate an additional $2 billion to $4 billion in new loan issuances and security investments each quarter for the near future, leading analysts to project an 18.5% jump in revenue for 2021 and a bump of 16.9% for 2022.

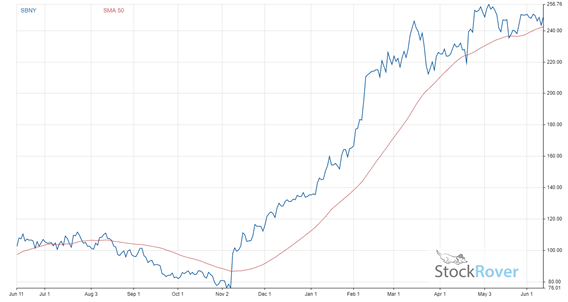

SBNY’s growth and upside potential have caused its share price to increase by 136.5% over the past year and by 84.8% so far this year. The change in share price over the past year and a 50-day moving average line are charted below.

Chart provided by Stock Rover.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $267.59, 11.6% higher than its latest closing price of $239.78, earning SBNY a “Strong Buy” recommendation from Stock Rover and a place among our three best bank stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)