It was back in early April of this year that Fed Chairman Jerome Powell was turning up the volume on his policy mantra that inflation is “transitory” and price pressures would see relief in the near term. Six months later, wage, commodity, finished goods, transportation and consumer discretionary inflation are still very persistent with few reports of supply-chain bottlenecks loosening up.

Inflation is trending higher, and the Fed is set to begin tapering by the end of the year, sending bond yields higher. The forthcoming Biden economic plan, in some form, is sending a message of stoking inflationary pressures further. According to Briefing.com “The 5y5y forward rate increased five basis points to 2.41%, overtaking its high from May. The inflation gauge is now at its highest level in seven years.” And this number is well below the current rate of inflation at 5.4%.

The yield on the 10-yr Treasury note is 1.67%, a level not seen since this past May, and WTI crude traded up to $84.20/bbl. Treasury Secretary Janet Yellen tried to smooth over the situation this past weekend. In an interview on CNN, she said spending in President Joe Biden’s domestic infrastructure and Build Back Better packages would be allocated over the next 10 years, but she did not say whether that would exacerbate inflation.

“I don’t think we’re about to lose control of inflation. On a 12-month basis, the inflation rate will remain high into next year because of what’s already happened. But I expect improvement by the middle to end of next year — second half of next year,” Yellen said.

Middle of next year? That’s a lifetime for today’s stock market investor sentiment, and yet the S&P 500 is trading at a new all-time high without the full participation of the semiconductor sector and the so-called FAANG stocks of Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet (GOOG). Oil and gas, banks, insurance, asset managers, private equity, trucking, shipping, big-box retail, food processors, auto parts and computer hardware were standout performers last week as companies benefiting from higher commodity prices, rising bond yields and the ability to easily raise prices. Those beneficiaries have been the basis for embracing the idea that there is no better alternative than the stock market for generating inflation-beating returns.

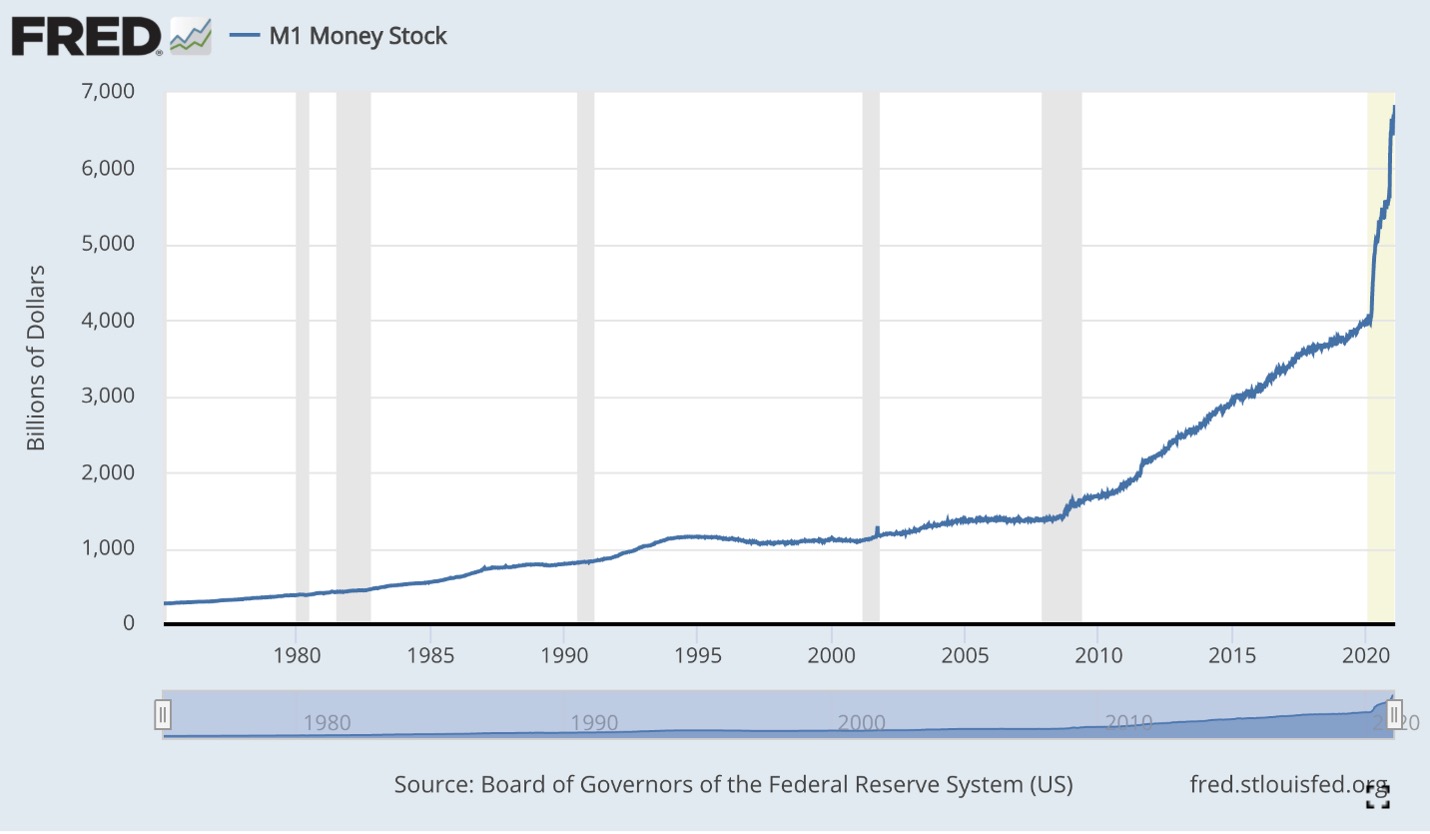

Most of the inflation dialogue targets raw materials, energy prices, wages and shipping expenses, but there should be some attention paid to monetary inflation and just how the skyrocketing money supply and debt-to-gross domestic product (GDP) data could impact the dollar and interest rates going forward.

I’d like to believe Powell and Yellen in their mutual conviction about inflation tempering, but the current data do not support their optimism. That said, the stock market has shown that it can tolerate rising interest rates at these nominally low levels. When rates rise gradually, it is billed as a sign of confidence in the economic outlook. When rates rise quickly, it is viewed as a nervous expression by investors of inflationary pressures and the specter of the Fed being forced to raise rates to keep inflation in check.

It stands to reason that the market can withstand the 10-yr Treasury note yield challenging the 2.0% level by the end of the year, as sector rotation continues to reward inflation-sensitive stocks and exchange-traded funds (ETFs) that most benefit from the economic upturn. For the income investor, there is plenty to do to ride the inflation wave of generating outsized yield and capital appreciation, but investors have to think a bit outside of the box.

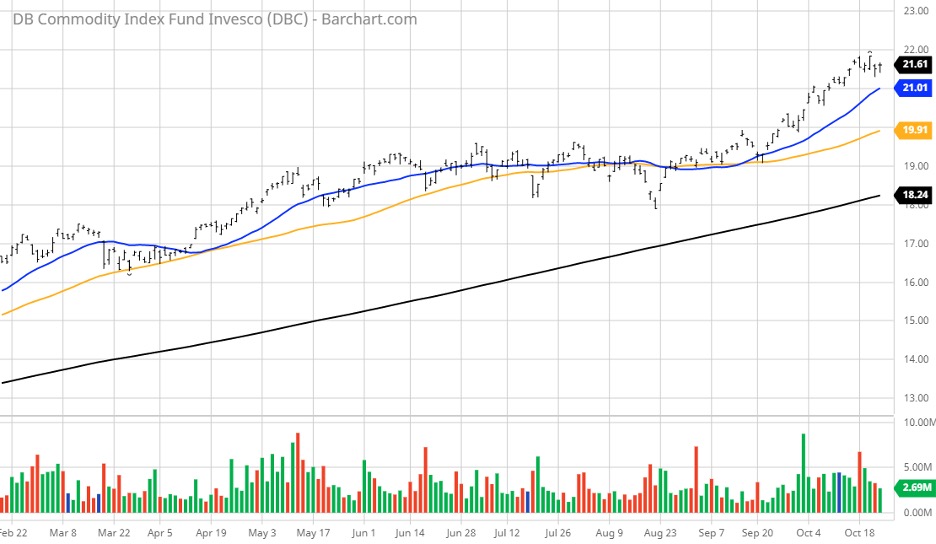

Rather than fight inflation, there is the argument that investors “go with it” and position their portfolios to reflect the tailwinds of rising prices. The commodities market is in a powerful uptrend at present and much of the global economy is still stuck in first gear, with China showing a slowdown in growth last week amid the supply-chain bottlenecks. Further outbreaks of COVID-19 are also making the global recovery very uneven and problematic for several economies that are key suppliers to these raw materials markets.

To this end, income investors seeking yield outside the Treasury, corporate debt and other fixed-rate assets, where price erosion is evident, can find wonderfully high-yielding dividend opportunities. Those opportunities exist in blue-chip integrated energy/commodity stocks and ETFs enjoying higher spot prices, and convertible debt that appreciates with the underlying equities it is tied to, as well as business development companies (BDCs) and senior loan funds. Those opportunities consist of floating-rate loans, real estate investment trusts (REITs) that can raise rents and lease terms quickly, and covered-call funds that are selling volatility back to the market in premier stock holdings.

With some due diligence, and a good set of stock, ETF and closed-end fund screening tools, an inflation-sensitive blended yield of 5% or more is well within the realm of probability for income investors seeking to ride the inflation wave and keep pace with the rising cost of living. Fighting the Fed is usually not a good idea, but fighting the tape is never a good idea.