Best blockchain ETFs to invest in feature a relatively new technology made up of complex blocks of digital information.

It increasingly is used in banking, investing, cryptocurrency, etc. Blockchain exchange-traded funds (ETFs) own stocks in companies that have business operations in blockchain technology or profit from it in some way.

Why invest in blockchain ETFs

Many investors may be wary of risking an investment in blockchain due to the technology’s association with volatility of the cryptocurrency market. However blockchain is not the same as cryptocurrency. In fact, blockchain ETFs invest in stocks of regulated companies, many of which are well established blue-chip technology firms such as IBM (NYSE: IBM).

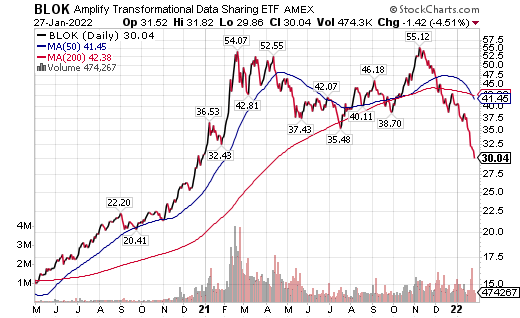

Consider Amplify Transformations Data Sharing ETF (BLOK) as the best option

BLOK is the most prominent blockchain ETF on the market. This actively managed fund selects global companies to develop and apply blockchain technologies. It follows a blended strategy, investing in a mix of value and growth stocks and is composed mostly of companies operating in the software, information technology services and capital market industries.

This ETF invests a minimum of 80% of its net assets in stocks of companies engaged in the development and utilization of blockchain technology. Its top holdings are in Galaxy Digital Holdings Ltd. (OTCMKTS: BRPHF), a Canada-based financial services and investment management company focused on cryptocurrency and blockchain; Silvergate Capital Corp. (NYSE: SI), the holding company for a bank serving the digital currency industry; and Coinbase Global Inc. (NASDAQ: COIN), the operator of the cryptocurrency exchange platform.

Chart courtesy of www.stockcharts.com

As an actively managed fund, the 0.71% expense ratio is reasonable considering the group average and getting an actively managed portfolio. It is incredibly important to be responsive to the latest trends given how rapidly the blockchain space is evolving.

The fund has climbed 140.77% during the past year. As cryptocurrency and blockchain technology gain popularity and use, it can be concluded that this ETF could continue on its rampage.

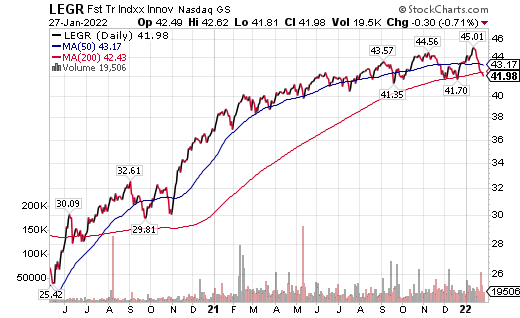

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

LEGR ranks second best among blockchain ETFs. It deserves its spot based on asset size, tradeability and below average costs. It tracks the Indxx Blockchain Index, which mirrors the performance of companies that actively utilize, invest in, develop or have products that are positioned to benefit from blockchain technology.

Chart courtesy of www.stockcharts.com

The ETF’s top three holdings are in companies that have experienced high growth and soaring stock price increases over the past year. These companies include Advanced Micro Devices Inc. (NASDAQ: AMD), a semiconductor manufacturer; NVIDIA Corp. (NASDAQ: NVDA), a graphics processing unit manufacturer; and salesforce.com Inc. (NYSE: CRM), a cloud-based customer relationship management software company.

However, LEGR disperses its exposure to the industry through weights separated by tiers: active enablers and active users. “Active enablers” are actively developing blockchain technology products or systems for their own internal use and for the sale and support of other companies. “Active users” are companies that are using blockchain technology that is generally supported by an active enabler of blockchain technology.

Within the portfolio, active enablers receive 50% of the portfolio weight, while active users receive the other 50%. The selected companies are weighted equally within each category.

Over the past year, LEGR has seen a 45.43% return on investment. This is consistent with the increased interest in cryptocurrency and adoption of blockchain technology. As companies increase their utilization of blockchain technology, this ETF will drastically go up in value.

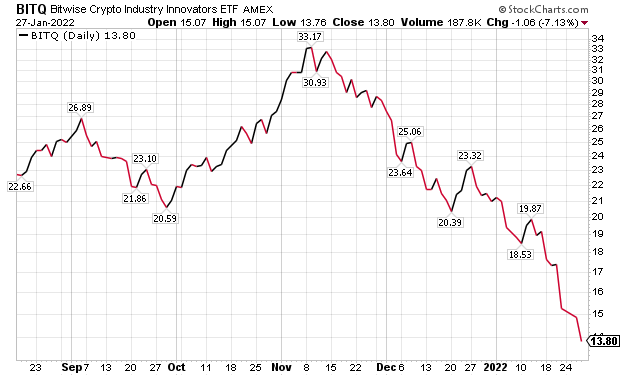

Bitwise Crypto Industry Innovators ETF (BITQ)

BITQ is an index fund that offers exposure to the fast-growing bitcoin and crypto economy without the complications of owning cryptocurrencies directly.

Chart courtesy of www.stockcharts.com

This fund targets at least 85% of the portfolio in crypto-trading, crypto mining and mining equipment firms and service providers such as Coinbase (NASDAQ: COIN), Silvergate Capital (NYSE: SI) and MicroStrategy (NASDAQ: MSTR). The other 15% of assets go to “supporting” companies such as PayPal (NASDAQ: PYPL), Nvidia (NASDAQ: NVDA) and Square (NYSE: SQ).

Bitwise is the world’s leading crypto asset index fund manager with assets reaching $1.6 billion. So, if you are looking for blockchain exposure, there are few better companies to invest in.

These three blockchain ETFs offer investors viable ways to pursue the cryptocurrency craze without the risk of investing without diversification in just one stock. The best blockchain ETFs to invest in offer avenues for investors seeking to gain exposure to the growing industry a chance to do so.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)