Will the bots rule the world?

While the fear and promise of artificial intelligence (AI) has been heightened by recent high-profile news events such as the release of the remarkable ChatGPT software, the reality for investors is that AI is a good place to search for potential profits.

One such fund that provides exposure to this fascinating market segment is the Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ). AIG tracks a market-cap-weighted index of developed market equities involved in artificial intelligence (AI) and big data.

AIQ is passively managed to invest in developed market companies that are involved in the use of artificial intelligence to analyze big data, whether for their own operations, as a service to other companies or through the production of related hardware.

The fund determines this classification based on a composite analysis of public filings, products and services, official company statements and other information regarding direct involvement in the artificial intelligence and big data categories. AIQ’s constituents are market-cap weighted with a semi-annual re-weighting and are reconstituted annually.

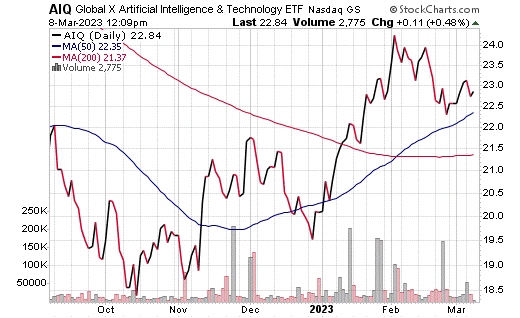

AIQ had a rough 2022 in terms of share price performance, as did most tech sectors. Yet since the October lows, AIQ has spiked to a robust 23%! That’s proof of the new interest in this bleeding-edge market segment.

Chart courtesy of www.stockcharts.com

The fund has an average weighted market cap of $319 billion and an average spread of 0.75%. It currently has a 1.04% dividend yield and 79 holdings. Among the top holdings and percentage of the fund’s portfolio are Tesla (NASDAQ: TSLA), 3.88%; Meta Platforms Inc. (META), 3.82%; NVIDIA Corp. (NVDA), 3.60%; Salesforce Inc. (CRM), 3.49% and Apple Inc. (AAPL), 3.19%.

While AIQ provides investors with access to exciting new technology in artificial intelligence and big data, I urge all interested parties to exercise their own due diligence in deciding whether or not this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.