Four small-cap pharmaceutical stocks to buy despite big bank failures have found market niches to develop products that people really need and want.

The four small-cap pharmaceutical stocks to buy focus on companies that have a market capitalization between $250 million and $2 billion. They often can grow at faster rates than bigger pharmaceutical stocks but often have less long-term financing than mid-caps stocks of $2-$10 billion, large-cap stocks between $10-$200 billion and mega-cap stocks above $200 billion.

Financing is important due to the two major bank failures of the past week. The leaders of both banks and businesses needed to recognize that the economic environment changed when the Fed became serious about reducing inflation in 2022 with rate hikes.

Apparently some, such as Santa Clara, California-based Silicon Valley Bank (NASDAQ: SIVB) and New York’s Signature Bank (NASDAQ: SBNY), did not recognize the new circumstances. Not even an auditing firm like KPMG LLP fully recognized the risk, since Silicon Valley Bank failed just 14 days after receiving a clean report and cryptocurrency-focused Signature Bank collapsed 11 days following it receiving its report with no red flags about financial fallout, according to the Wall Street Journal.

“When the Fed is openly supporting stock markets and economic growth, it’s easy to make money by taking a lot of risk,” said Bob Carlson, a pension fund chairman and also leads the Retirement Watch investment newsletter. “But when the Fed changes course, risk management is important to success and survival. SVB had weak risk management. Investors need to look beyond a firm’s financial numbers and try to determine if it has adequate risk management policies.”

Retirement Watch head Bob Carlson discusses investing with Paul Dykewicz.

As a pension fund chairman, Carlson is seasoned about managing investment risks. He has served on the Board of Trustees of the Fairfax County Employees’ Retirement System since 1992 and been elected to serve as chairman every year since 1995.

Four-Cap Pharmaceutical Stocks to Buy as Alternative to Giants

Another seasoned guide to investing in pharmaceutical stocks is Mark Skousen, PhD, who recommended a profitable one in his Forecasts & Strategies investment newsletter when the overall market struggled during the pandemic. Dividend-paying and New York-based Pfizer Inc. (NYSE: PFE) rose 54.76% from December 2015 to July 2021, while Skousen recommended it.

One of the challenges in investing in pharmaceutical stocks is entering and exiting at the right times, since new product development is not assured of success. Skousen chose a proven large-cap stock and held it through the first part of the COVID-19 pandemic.

Pfizer proved to be an astute investment when it teamed up with a smaller industry partner, BioNTech SE (NASDAQ: BNTX), a Mainz, Germany-based biotechnology company that has grown beyond the mid-cap stage and now is at the low end of the large-cap range with a market cap of $31.31 billion. Even though Pfizer did not acquire BioNTech, the two companies collaborated to provide one of the first and most effective COVID-19 vaccines in the world.

BioNTech was a mid-cap stock as recently as 2019, when it had a market cap of $7.68 billion before the pandemic. The share prices of BioNTech and Pfizer both rose during the pandemic but Skousen, who also leads the Five Star Trader advisory service that features stocks and options, identified weakness developing in the stocks and the market when he informed his subscribers to take profits. As an economics professor, Skousen also tracks inflation and recession risk closely.

Mark Skousen, a scion of Ben Franklin and head of Five Star Trader, meets Paul Dykewicz.

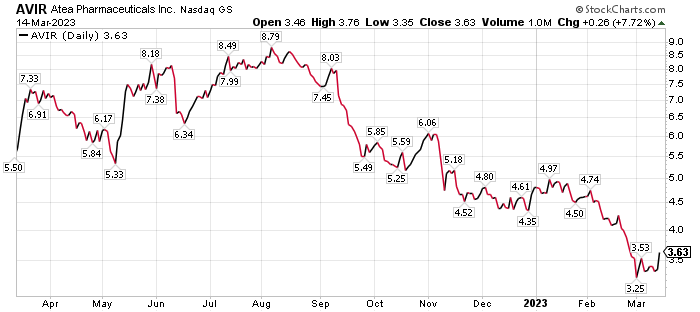

Four-Cap Pharmaceutical Stocks to Buy Include Atea Pharmaceuticals

Atea Pharmaceuticals Inc. (NASDAQ: AVIR), a clinical-stage biopharmaceutical company based in Boston, has been focusing on the discovery and development of oral direct acting therapeutics such as bemnifosbuvir for COVID-19 and other viral diseases. The “commercial opportunity” for Atea is enhanced by data from a study that suggests the drug’s role as a monotherapy in COVID-19 could serve “significant unmet need” in the patients who are at highest risk of disease progression, but the least likely to be prescribed an oral antiviral, according to Chicago-based William Blair & Co.

“Despite growing apathy to COVID-19 in the general public, the COVID-19 oral antiviral market opportunity remains massive and is expected to remain a long-term multibillion-dollar opportunity, especially when considering waning immunity, new variants and decreased usage of vaccines,” William Blair biotechnology analyst Tim Lugo wrote.

A significant market exists in “government stockpiling” that could be worth billions of dollars due to the size of the opportunity and the precedent of Tamiflu stockpiling, Lugo predicted. While investor focus is likely to remain on COVID-19 development, the product pipeline of Atea Pharmaceuticals is showing encouraging progress, he added.

William Blair maintains an “outperform” rating on the stock, citing a differentiated platform and portfolio of product candidates for the treatment of viral diseases. The investment firm also foresees value in the shares that currently are trading at a negative enterprise value.

Atea Pharmaceuticals reported a fourth-quarter 2022 net loss of $34.3 million, or $0.41 per share, wider than William Blair’s estimate of $31.3 million, or $0.38 per share, but narrower than consensus analysts’ estimates of $37.6 million, or $0.44 per share. The company ended the latest-fourth quarter with $646.7 million in cash and equivalents, compared to $665.0 million at the end of the prior quarter.

With reduced prioritization of the company’s AT-752 dengue program, its management now anticipates a cash runway into 2026.

Chart courtesy of www.stockinvestor.com

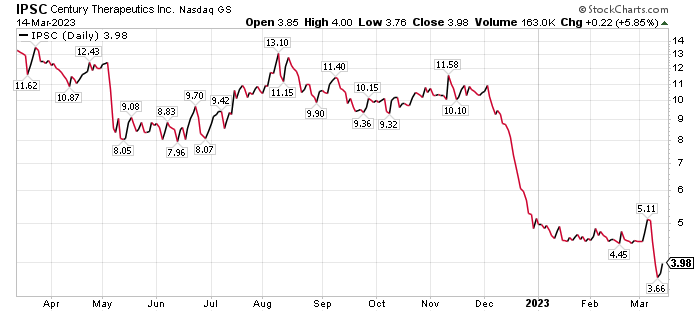

Four-Cap Pharmaceutical Stocks to Buy Encompass Century Therapeutics

Founded in 2018, Philadelphia-based Century Therapeutics Inc. (NASDAQ: IPSC) is a clinical-stage biotechnology company developing induced pluripotent stem cell (iPSC)-derived cell therapies in immuno-oncology. The company is a so-called early-stage pipeline Smid (small- and mid-cap stocks), is rated a “buy” and has received a $28 price objective from BofA Global Research.

The BofA placed a probability-adjusted net present value (NPV) on the product pipeline of Century Therapeutics. BofA has forecast revenue for the company through 2038, assuming a -5% to -10% terminal growth rate and a 14-15% weighted average cost of capital (WACC) for each pipeline program based on its stage of development.

Treatment of bladder and kidney cancers are included in BofA’s estimated platform/ pipeline value for the stock of $8/share. Based on comparison to the value of other early-stage technology platforms, including cell therapies and broadly applicable oncology platforms, BofA estimates a $500 million platform value of $8 per share. BofA also values the company’s cash position at $6 per share.

Potential downside risks for Century Therapeutics are a failure of its clinical trials, less commercial uptake than anticipated and better-than-expected progress of competitive programs.

Chart courtesy of www.stockinvestor.com

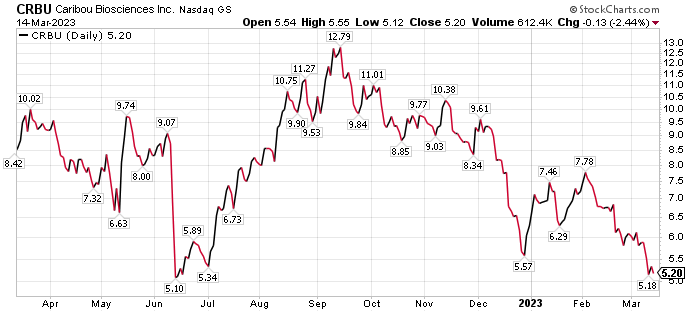

Caribou Biosciences Belongs Among Four-Cap Pharmaceutical Stocks to Buy

Caribou Biosciences Inc. (NASDAQ:CRBU), a clinical-stage CRISPR genome-editing biopharmaceutical company headquartered in Berkeley, California, describes itself as a developer of transformative therapies for patients who have devastating diseases. The company is advancing a pipeline of off-the-shelf cell therapies from its CAR-T and CAR-NK platforms as treatments for patients with hematologic malignancies and solid tumors.

The genome-editing platform of Caribou Biosciences includes its proprietary Cas12a chRDNA technology, enabling superior precision to develop cell therapies that are intended to potentially improve antitumor activity. CRISPR genome editing uses modular biological tools to make DNA changes in living cells. There are two basic components of Class 2 CRISPR systems: the nuclease protein that cuts DNA and the RNA molecule that guide the nuclease to generate a site-specific, double-stranded break, leading to an edit at the targeted genomic site.

CRISPR systems can edit unintended genomic sites in a process known as off-target editing that may lead to harmful effects on cellular function and phenotype. In response to this challenge, Caribou has developed CRISPR hybrid RNA-DNA guides (chRDNAs) that direct substantially more precise genome editing compared to all-RNA guides.

Caribou Biosciences received a $27 per share price objective from BofA Global Research, based on a probability adjusted net present value (NPV) of treatments in its pipeline, its partnership and its cash position.

Downside risks that could cause Caribou Biosciences to fall short of that price objective include initial clinical data for pipeline programs failing to show a meaningful benefit in patients; pipeline therapies fail to differentiate from similar competing products; and a regulatory and reimbursement environment that weighs on commercial economics. In addition, patent litigation could invalidate or otherwise undermine the intellectual property (IP) portfolio and funding may be insufficient to move forward pipeline aspirations or manufacturing buildout.

Chart courtesy of www.stockinvestor.com

Five Mid-Cap Pharmaceutical Investments to Purchase Include Rising Small Cap

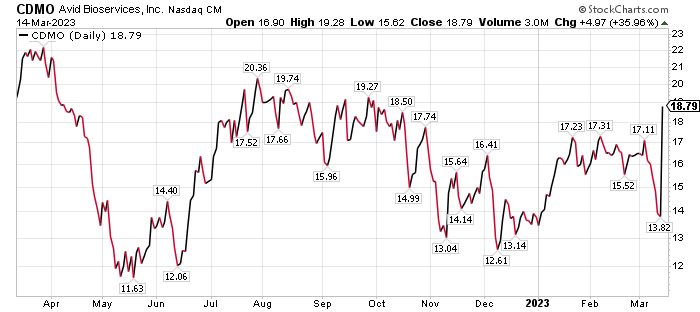

Tustin, California-based Avid Bioservices (NASDAQ: CDMO), with a market cap of $1.01 billion, is a contract development and manufacturing organization, or a CDMO. It explains why the company’s leaders picked CDMO as the stock’s ticker symbol, said Michelle Connell, head of Dallas-based Portia Capital Management.

Avid provides manufacturing facilities to other biotech companies, since the industry is constrained and is short on capacity. To address the problem, Avid is in the process of more than doubling its capacity, Connell continued.

Michelle Connell leads Dallas-based Portia Capital Management.

A reason Connell said she prefers CDMO to other biotech companies is that it is not developing pharmaceuticals and thereby is not dependent on Food and Drug Administration (FDA) approval, Connell counseled. Biotech companies that are dependent upon FDA approval are binary, either winning or losing, she added.

“Thus, there can be huge risk owning one or two pure biotech plays,” Connell said.

Connell pointed out that, unlike many biotech plays, Avid is profitable in terms of net income and cash flow. Even though the stock is not big enough yet to rank at the low end of the mid-cap category, Connell said she likes it well enough to rate the rising small cap as her top choice in both groups.

“Its operating cash flow has been positive for the past three years,” Connell said.

Like most biotechnology stocks, Avid had negative performance in 2022 but the stock has jumped 36.46% so far this year through March 14.

Since the company still is cheap on a price-to-earnings as well as price-to-sales basis, Connell projected the stock is posed for further double-digit-percentage upside in the next 12 months.

Chart courtesy of www.stockcharts.com

Avid Biosciences Reported Favorable Financial Results

The company is reiterating full 2023 fiscal year revenue guidance of between $145 million and $150 million. It reported revenues for its third quarter of fiscal 2023, at $38.0 million, representing a 21% increase compared to $31.5 million recorded in the same period the previous year.

For the first nine months of fiscal 2023, ended January 31, 2023, revenues were $109.5 million, a 24% increase compared to $88.4 million in the prior year period. For both the quarter and the year-to-date periods, the rise in revenues primarily can be attributed to jumps in manufacturing runs, process development services for new customers and revenue recognized in the current year period for changes under a contract where uncertainties were resolved.

Revenue and increased capacity utilization are having a positive impact on margins, the company reported. During the third quarter of fiscal 2023, Avid Biosciences signed $67 million in new business to mark its strongest quarter in company’s history, excluding Covid-related business. Given the demand, and its backlog hitting a new high, its management said timing could not be better for Avid to complete its mammalian cell facilities expansion that will provide new capacity.

The Myford South expansion has been turned over to operations and is now complete. The first customer is scheduled to start manufacture next month. In addition, new process development capabilities will be operational in a few weeks.

Micro-Cap Pharmaceutical Stocks Offer Another Way to Invest in the Industry

Another way to invest in biopharmaceuticals is through micro-cap stocks. That is the niche of futurist George Gilder’s Moonshots advisory service, which intentionally limits its circulation to enhance its exclusivity. The Moonshots track record has been sterling as an outperforming advisory service that may have a new pharmaceutical pick soon after Gilder and Senior Analyst Richard Vigilante recently returned from a trip to Israel to conduct due diligence on prospective investments.

Investors interested in micro-cap alternatives may appreciate knowing Moonshots’ portfolio companies jumped an average of 84%, double the gains of the NASDAQ, from July 2019 to February 2023, counting only closed positions. I am further feedback from globe-trotting Gilder and his team as they seek companies developing the kinds of new paradigms that investors crave.

Russia Downs U.S. Surveillance Drone Above International Waters Near Ukraine

A Russian warplane struck a U.S. surveillance drone above the Black Sea near Ukraine on Tuesday, March 14, hitting the drone’s propeller and causing its American operators to bring it down in international waters, the Pentagon reported. Until that incident, Russia and the United States had managed to avoid a direct confrontation despite the war in Ukraine.

Pentagon officials said the unarmed Reaper drone was on a routine reconnaissance mission when two Russian Su-27 fighter jets approached it about 75 miles southwest of Ukraine’s Crimean Peninsula, an area Russia has used to launching strikes against Ukraine. The midair clash is the first known direct contact between the Russian and American militaries since the war in Ukraine started last Feb. 24.

Johns Hopkins Stops Round-the-Clock Updates of COVID Cases and Death

Worldwide COVID-19 deaths rose to 6,881,955 people, with total cases of 676,609,955, Johns Hopkins University reported on March 10, its last day of collecting data about the pandemic after three years of round-the-clock tracking. COVID-19 cases in the United States reached 103,804,263, while deaths hit 1,123,836 as of March 10, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America ranked as the country with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,650,596 people, or 81.2% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of March 8. People who have completed the primary COVID-19 doses totaled 230,142,115 of the U.S. population, or 69.3%, according to the CDC. The United States has given a bivalent COVID-19 booster to 50,821,425 people who are age 18 and up, equaling 19.7% as of March 8.

The four small-cap pharmaceutical stocks to buy provide growth potential despite the failure of two big U.S. banks, Russia’s downing of a U.S. surveillance drone, inflation and recession risk. The four small-cap pharmaceutical stocks may interest investors seeking exposure to drug companies that have a key role in the health care system.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. He is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

![[gold pill]](https://www.stockinvestor.com/wp-content/uploads/3022618543_9ab124cc98_b.jpg)