Three bank stocks to buy when Fed-fueled financial fears fade feature companies that could surge when current shareholder selling subsides.

Bargain-minded investors may want to watch the three bank stocks to buy when Fed-fanned shareholder selling stops. The Federal Reserve is expected to raise rates on Wednesday, May 3, for the 10th time in a row as it seeks to keep fighting inflation.

The Federal Open Market Committee, the U.S. central bank’s monetary policy-setting body, began its series of nine consecutive rate hikes on March 17, 2022, moving the Federal Funds rate from 0-.25% to 4.75-5% on March 2, 2023. Many prognosticators are predicting a 10th straight rise in rates on May 3 but the fallout has exposed risk management missteps that led to the failure of Silicon Valley Bank, of Santa Clara, California, on March 10, and Signature Bank, of New York, on March 12.

Three Bank Stocks to Buy When Fed-fueled Financial Fears Fizzle out

A new shockwave occurred on Monday, May 1, when JPMorgan Chase (NYSE: JPM) announced it would pay $10.6 billion to acquire most of the assets of San Francisco’s First Republic Bank (NYSE: FRC) after regulators seized the lender as it became the biggest U.S. bank failure since the collapse of Washington Mutual during the 2008 financial crisis. The downfall of First Republic left shareholders with worthless stock.

“First Republic shares sold for over $200 a share in November 2021,” wrote Mark Skousen, PhD, to subscribers of his Forecasts & Strategies investment newsletter on Monday, May 1.

Mark Skousen co-heads Fast Money Alert.

Last Friday, April 28, First Republic shares traded for around $3, before they sank to zero on Monday, May 1, Skousen commented. The bank had a rising dividend policy and turned a $269 million profit in the first quarter of 2023. However, half its depositors withdrew their money, he added.

“This goes to show you how fast a financial institution can fail when there’s a run on the bank,” Skousen counseled.

Three Bank Stocks to Buy Even as Fed-fueled Failures Multiple

Even though JPMorgan Chase Chief Executive Officer Jamie Dimon predicted the current banking crisis had ended with his company’s takeover of failing First Republic, Skousen expressed his doubts. There is never just “only one cockroach,” wrote Skousen, citing a Wall Street saying.

A sell-off in regional banks followed on Tuesday, May 2, when PacWest Bancorp (NASDAQ: PACW), of Beverly Hills, California, plunged 27.78%; Western Alliance Bancorp (NASDAQ; WAL), of Phoenix, Arizona, fell 15.12%; and Dallas-based Comerica Bank cratered 12.42%.

The three bank stocks to buy when the Fed seems ready to halt its rate hikes appear capable of overcoming the dual risks of high inflation and a potential recession. Bigger bank stocks should be better positioned than smaller regional banks to withstand current economic headwinds due to tighter regulatory scrutiny.

The 3,800 floor in the S&P should hold for now, but may be followed by a rally to 4,100-4,200, according to BofA Global Research. Investors currently prefer large caps over small caps, with quality trumping junk bonds, as a recent shift of deposits from banks occurred at the fastest pace since Russia’s invasion of Ukraine, BofA added.

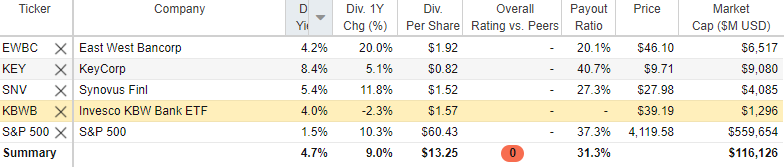

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

Three Bank Stocks to Buy Are Affected by Industry Struggles

In the Fed’s recent monthly report, the U.S. central bank announced that “loans to commercial banks” jumped to $345.5 billion in March. The Fed’s Discount Window was “wide open,” with the Fed making more short-term loans to banks than it did in the financial crisis of 2008, said Mark Skousen, who co-heads the Fast Money Alert trading service with seasoned investor Jim Woods.

Bank deposits, which free-market economist Skousen equated to the money supply, fell 2.5% as depositors withdrew billions of dollars from their bank accounts. If the trend continues, the United States will face a “major credit crunch,” he added.

Skousen wrote in his monthly Forecasts & Strategies newsletter that he laughed upon reading the headline of a Federal Reserve monthly report: “The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible and stable financial and monetary system.”

Fed policy is anything but stable, Skousen opined.

“While the Biden administration continues to spend money like water, the Fed has imposed a tight money policy, which is likely to create an inflationary recession this year,” Skousen wrote in Forecasts & Strategies.

Three Bank Stocks to Buy Entice Skousen’s Attention

Even though investing in banks right now is risky, Skousen notched a profit of nearly 8% in just 43 days during 2021 by recommending shares of Signature Bank in Fast Money Alert. Skousen also has recommended banking stocks and call options in his Home Run Trader advisory service.

In Home Run Trader, Skousen recommended US Bancorp (NYSE: USB) to produce a 3.22% gain during 2007. The next year, Skousen recommended buying Bank of Montreal (NYSE: BMO), finishing with a 10.43% profit, before offering another bullish call in 2012 when he recommended Westpac Banking Corp. (NYSE WBK) before it climbed 13.92%.

Jim Woods, who heads the Bullseye Stock Trader advisory service, while partnering with Skousen in Fast Money Alert, recommends both stocks and options, and he has shown keen interest in banking stocks.

Jim Woods heads Bullseye Stock Trader.

Woods wrote in his May 2023 Successful Investing newsletter that banks and the financial sector had free money through minimal interest rates for more than a decade. Then, the Fed jacked up rates within about 10 months to levels not seen since the 1990s. The resulting financial stress contributed to the failure of Silicon Valley Bank and others, he added.

Three Bank Stocks to Buy Face Weakening Macroeconomic Conditions

The broad macroeconomic picture shows signs of weakness, with employment indicators deteriorating on a year-over-year and sequential basis in recent weeks, BofA reported. Despite rate increases, the unemployment rate in March of 3.5% was down 10 basis points, or 0.10%, from February.

As wage growth eases, the Fed will continue to consider relatively strong unemployment levels and the price indices in setting future rate hikes. While there have been signs of prices cooling, BofA Global Research is less optimistic for a soft landing and expects a mild recession to begin in second-half 2023.

Adjusted retail and food sales, along with credit card balances, are up on a year-over-year basis, as consumers keep spending amid high inflation. Plus, the mortgage backdrop has become progressively more difficult, and higher interest rates are leading to lower originations overall amid worsening affordability, BofA wrote.

Federal Reserve’s Supervision and Regulation Must Be Enhanced After Failures

The Federal Reserve’s supervision and regulation must be strengthened in the wake of the Silicon Valley Bank (SVB) failure on March 10, said Michael Barr, the Federal Reserve System’s vice chairman for supervision. After the Federal Reserve’s review of its supervision and regulation of Silicon Valley Bank, Barr said upon release of the report on April 28 that the failure stemmed from “a textbook case” of management missteps by the bank, whose senior leadership mismanaged basic interest rate and liquidity risk.

“Its board of directors failed to oversee senior leadership and hold them accountable,” Barr said. “And Federal Reserve supervisors failed to take forceful enough action, as detailed in the report. Our banking system is sound and resilient, with strong capital and liquidity. And in some respects, SVB was an outlier because of the extent of its highly concentrated business.”

This report is meant to serve as a self-assessment that takes an “unflinching look” at the conditions that led to the bank’s failure, including the role of Federal Reserve supervision and regulation, Barr said. Individuals not involved in the Silicon Valley Bank’s supervision conducted the review, which Barr said he oversaw.

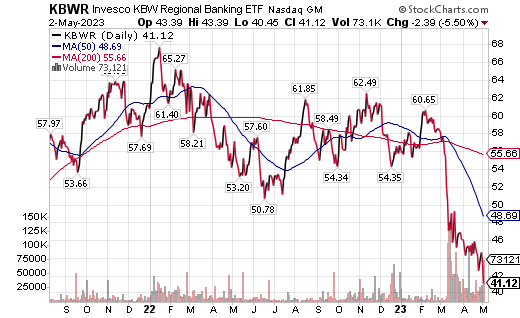

Pension Fund Chairman Suggests an ETF Rather than Three Bank Stocks to Buy

Investors interested in a diversified portfolio of regional and smaller banks should consider the exchange-traded fund (ETF) Invesco KBW Regional Banking (KBWR), said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter. It was up 36.09% in 2021, down 7.25% in 2022, and is down 27.24% so far in 2023. Its recent yield was 4.0%.

Bob Carlson, head of Retirement Watch, meets with Paul Dykewicz

The fund tracks the KBW Nasdaq Regional Banking Index, which is designed to mirror the performance of U.S. regional banking and thrift companies that are publicly traded.

KBWR has 50 positions with 30% of the fund in the 10 largest holdings.

Chart courtesy of www.stockcharts.com

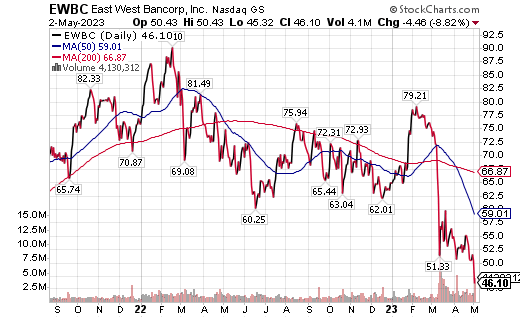

Three Bank Stocks to Buy Include One Favored by Money Manager

East West Bancorp, Inc. (NASDAQ: EWBC), of Pasadena, California, is a regional bank stock ripe for investors to buy after its recent price drop, said Michelle Connell, who heads the Dallas-based Portia Capital Management. A key reason to own EWBC shares is its 4.2% dividend yield that pays shareholders to remain patient for the financial sector to recover.

Michelle Connell heads Portia Capital Management.

The bank’s stock has fallen along with its banking peers, Connell added. Year to date, East West Bancorp, the holding company of East West Bank, is down 28.59%, Connell said. In the last 12 months, it’s slid 34.73%, while slipping 8.82% on Tuesday, May 2, she continued.

“However, the Bank had strong earnings when it reported on April 20,” Connell opined. East West Bank beat analysts’ consensus earnings estimates. Connell added.

Since April 20, at least four analysts have reiterated their overweight status on the stock and increased their long-term price targets,” Connell told me.

“The bank is interesting because not only do its 120 branches serve the East and West coasts and some mid-American cities, but the banking company also has branches in China.

Chart courtesy of www.stockcharts.com

East West Bancorp Leads Three Bank Stocks to Buy

East West Bancorp has labeled itself as a “financial bridge” between the United States and China,” Connell said. Plus, East West Bancorp is “strong fundamentally,” Connell continued.

Currently, the bank has only 5% of its lending with venture capital organizations, Connell continued. East West Bancorp further has a $64 billion balance sheet, with $28 billion in unused borrowing facilities, Connell indicated.

One point of caution for all regional banks, including East West Bankcorp, is that it has exposure to commercial real estate, Connell counseled. The banking company’s dividend has grown 17% on an annualized basis, she added.

“The stock is very cheap,” Connell told me. “Its current price-to-earnings (P/E) ratio is six, while its five-year average P/E ratio is 12.”

East West Bancorp Could Climb 25% or More in Next 12-18 Months

East West Bancorp’s upside during the next 12 to 18 month is 25% or greater, Connell said. She recommended dollar cost-averaging with this stock, as well as adding one or two more strong regional banks to one’s buy list.

East West Bancorp, Inc. reported first-quarter 2023 net income of $322.4 million, or $2.27 per diluted share, up from $237.7 million, or $1.66 per diluted share, in first-quarter 2022. Year-over-year, earnings per share increased 37%, while total loans reached a record $48.9 billion as of March 31, 2023.

“East West’s ability to consistently generate industry-leading profitability while maintaining above peer capital ratios are strengths in any business cycle,” stated Dominic Ng, its chairman and CEO. “East West continued to deliver in the first quarter, despite the banking industry and market disruption that occurred in mid-March.”

For the first quarter of 2023, the bank earned “industry-leading returns” of 2.0% on average assets and 22.9% on average tangible common equity, Ng continued.

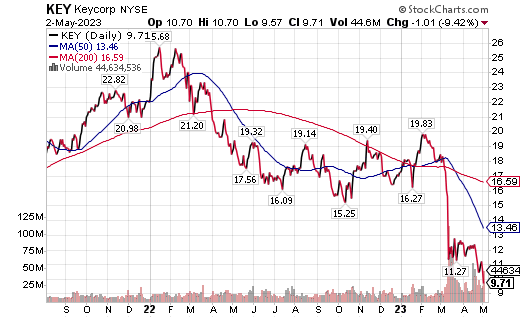

KeyCorp Makes List of Three Bank Stocks to Buy

Cleveland-based Keycorp (NYSE: KEY), with a market capitalization of nearly $17.9 billion, received a buy rating from BofA Global Research in late February. However, it plunged 9.42% on Tuesday, May 2.

The bank’s management is investing in growing sectors such as health care, technology, renewable energy and affordable housing. So far, its leaders report staying on track to achieve a goal of organically growing its customer base 20% by 2025.

As for a price objective, BofA wrote in late February that it viewed $20 as realistic, even after factoring in recession risk. KEY’s risks include a prolonged low interest rate environment, greater-than-expected expenses and any inability to maximize balance sheet efficiency.

Chart courtesy of www.stockcharts.com

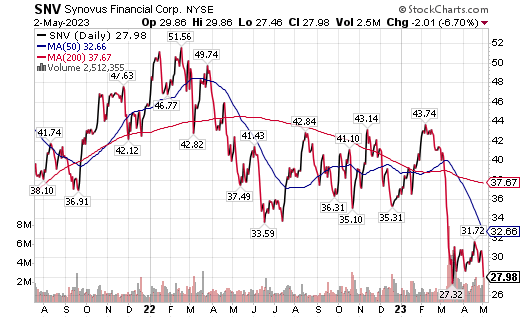

SNV Snags Spot among Three Bank Stocks to Buy

Synovus Financial Corp. (NYSE: SNV), of Columbus, Georgia, has a $6.3 billion market capitalization and gained a buy rating from BoA in a research report from late February. The investment bank placed a $43 price objective on SNV at the time.

Of course, the banking sector has suffered since then amid high inflation and increased rates, so investors need to be cautious. Risks faced by SNV include potentially slowing economic growth, as well as a possible reduced takeout price compared to $40 price range where the stock had been trading in February.

Outperformance could come from a quicker-than-expected pickup in overall economic activity or the bank becoming an acquisition target above BofA’s price objective for SNV. Overall, the bank’s management expressed cautious optimism for its outlook and indicated to BofA in February that it had not needed to adjust its underwriting guidelines.

Chart courtesy of www.stockcharts.com

CDC Sees Rising Vaccinations Against New Bivalent Variant of COVID-19

The U.S. Centers for Disease Control and Prevention (CDC) reported at least one vaccination against COVID-19 and its bivalent variant has been given to 270,047,396 people, or 81.3%, of the U.S. population, as of April 26. Those who have completed the primary COVID-19 doses totaled 230,533,196 of the U.S. population, or 69.4%, according to the agency.

Also as of April 26, the United States had given a bivalent COVID-19 booster to 52,331,682 people who are age 18 and up, equaling 20.3% of America’s population. Medical studies have shown vaccinations help keep people healthy and reduce the morbidity from contracting COVID, potentially boosting confidence of consumers to shop at stores, travel and otherwise spend money.

The three bank stocks to buy seem to be positioned to survive the current bank industry fallout and recover along with the rest of the financial services sector. Despite the possibility of further financial institution failures, these three bank stocks seem less vulnerable than industry peers, according to buy ratings and analysis of BofA in its publicly distributed research report in February.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)