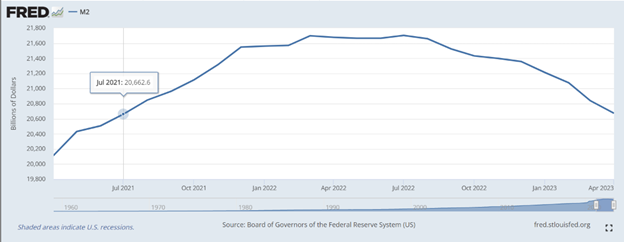

Investors will be in a period of macro-economic volatility for a while. There is no question in my mind that the headwinds the market faces at the mid-point of 2023 will either remain or be more stiff as the year progresses. Those headwinds include a continuation of quantitative tightening by the Fed (shrinking of M2 money supply), inflation that borders on producing stagflation, a stubbornly unaffordable housing market for first-time and move-up buyers due to short supply, balance sheet stresses at regional banks that restrict lending to consumers and businesses alike, household debt that sets new monthly records and all things geo-political at risk of going awry. U.S. diplomacy is losing credibility around the globe.

The Fed is on a dual mission of raising rates to somehow curb hiring and slow wage growth, while also reducing the velocity of money that was created from all the stimulus born out of overzealous Fed easing and Congressional spending. In what is an oxymoronic scenario, Congress has kept on spending with the passage of the Inflation Reduction Act ($370 billion), the CHIPS Act ($280 billion) and the raising of the debt ceiling ($2.5 trillion) while the Fed has been trying to reduce its balance sheet before having to inject massive emergency funds to thwart systemic chaos within the regional bank sector. This situation is far from over.

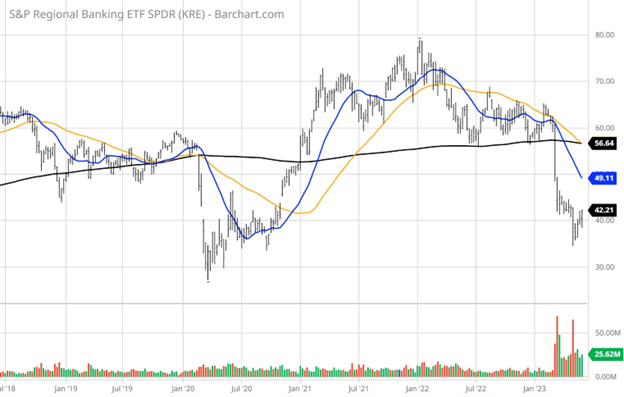

The S&P Regional Bank Sector ETF SPDR (KRE) has shed nearly 50% of its value since January 2022. Another rate hike or two will only exacerbate further deposit outflows to higher-yielding money markets, not to mention the stresses within corporate office property loans that are just starting to unfold. This past week, JPMorgan Chase & Co. CEO Jamie Dimon said that markets should brace for 6% or even 7% interest rates. The longest-tenured CEO of the major money center banks now warns that the banking system could take a big hit from commercial real estate loans.

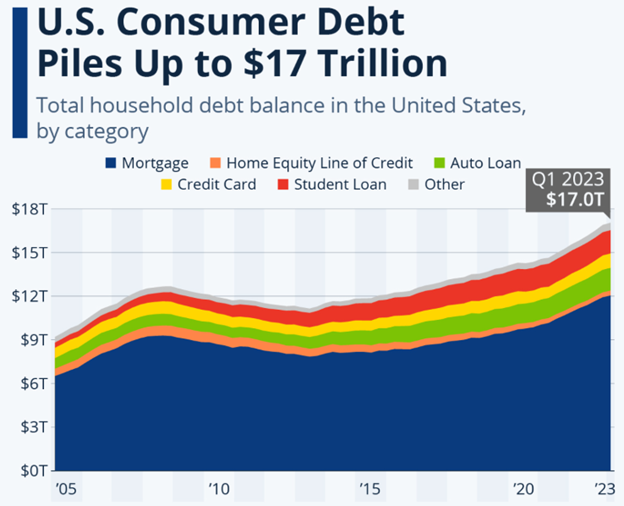

On May 23, the Federal Reserve Bank of New York’s Center for Microeconomic Data issued its Quarterly Report on Household Debt and Credit. The report shows an increase in total household debt in the first quarter of 2023, increasing by $148 billion (0.9%) to $17.05 trillion. Balances now stand $2.9 trillion higher than at the end of 2019, before the pandemic recession. The share of current debt becoming delinquent increased for most debt types, and represents a troubling trend for an economy where roughly 70% of GDP is dependent upon consumer spending.

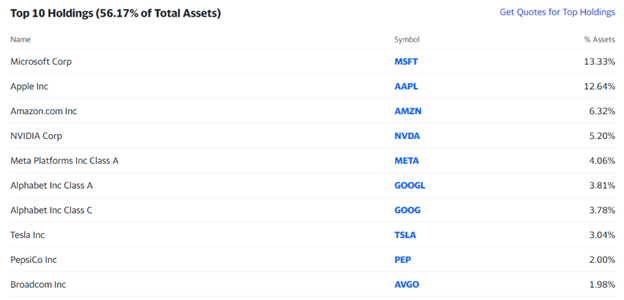

Index funds have proven to be a good bet in years past. However, only two of the 11 market sectors are trading in a sustainable bullish pattern — technology and communication services. Consumer discretion and industrials are trading in neutral patterns. Consumer staples, materials, real estate, energy, financials and utilities have lagged or have turned lower. Market leadership is narrower now than when the year began. Just nine stocks account for about 56% of the Nasdaq 100 (QQQ) — shown in the table below — and for roughly 28% of the S&P 500.

www.yahoofinance.com

There are two plausible scenarios that will likely unfold as the year progresses. Either the economy will experience a period of immaculate deflation, that produces slowing growth without a recession, or global macro-economic conditions will deteriorate outside the United States, which in turn will start to impact sales and earnings growth of those nine mega-caps and the multi-national companies that anchor the major averages. Without the epiphany surrounding the radically sudden disruptive technological advances of artificial intelligence (AI), it is my view the S&P would be retesting the October lows — as many, very smart, chief market strategists have been calling for since January.

The rising tide within the Magnificent Seven (Microsoft, Nvidia, Alphabet, Apple, Meta, Tesla and Amazon) has provided the much-needed fund manager bid that has altered the course of an otherwise soft first-quarter reporting season and cautious outlook by most premier blue-chip companies, leading to a bifurcated market of a few big winners and multitudes of lagging stocks that are in well-defined technical downtrends.

Last Friday’s big rally showed, for the first time, a genuine broadening out of sector participation. History has shown that about two-thirds of the time, breadth catches up with price and not the other way around. Hence, regardless of what the Fed might do with rates, there was clear rotation from the mega-tech-led rally to that of other sector leaders.

This is where the quantitative bulls perform price discovery of stocks that are inherently cheap to historical valuation. Price to fundamentals is king in the business of stock selection — where the cheap tend to outperform the expensive when the market begins to broaden out. With that said, great companies trading at steep discounts are down for similar reasons — they lack a near-term visible catalyst that suggests good things are about to happen. Even a great stock in a lagging sector may well struggle to outperform because of outgoing fund flows in sector exchange-traded funds (ETFs) and mutual funds.

Instead, the practice of trend following is extremely beneficial to identifying where the sky is blue for a sector and stocks within those sectors that are under heavy accumulation.

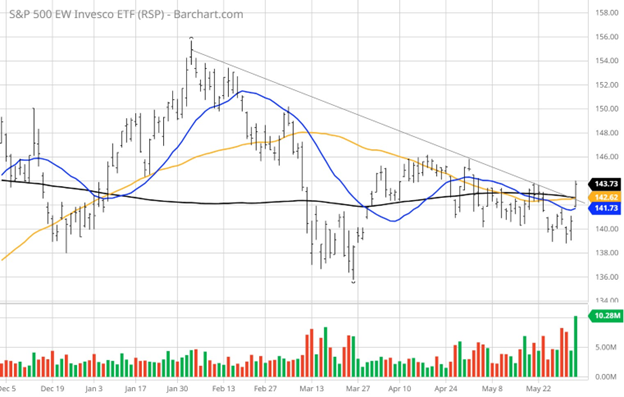

Friday’s rally had the SPDR S&P 500 ETF Trust (SPY) higher by 1.45%, where the top nine holdings account for 27% of total assets, whereas the Invesco SPDR Equal Weight ETF (RSP) rose by 1.81% on the biggest spike in volume in six months, reflecting participation from the other nine sectors that have yet to fully get involved. Given the large macro issues noted within that should have kept a lid on the market, there is a clear and present upside breakout underway that must have cash rich investors wondering what the hell am I missing. Just maybe, the market has priced in all the bad news. Go figure.

P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)