One of the sectors of the market that has caught the eye of many investors is the housing market. After a fall in housing prices across the board in 2022, home prices are rising again, largely due to a shortage of available homes, higher mortgage rates and the persistence of higher inflation. As an example, Forbes recently reported that, in my home state of California, the median sales price of homes across the state decreased across the board from 2022 to 2023. Since then, price trajectories have become more mixed, seeing rises in Los Angeles but falls in the Bay Area.

While some market analysts have predicted a renewed interest in real estate investment trusts (REITs) as a result of the present state of the housing market. Others disagree and point out that REITs are heavily weighted towards commercial real estate, which is currently in trouble. As evidence of this, you merely need to look at the myriad reports of downtown office buildings sitting empty and unused.

So, I want to discuss a specific exchange-traded fund (ETF) that is closely linked to the home building and construction market but is not a REIT.

The Invesco Dynamic Building & Construction ETF (NYSEARCA: PKB) aims to track the performance of an index composed of companies in the building and construction industry. To do so, the fund’s managers use a list of criteria to evaluate prospective companies, including price momentum, earnings momentum, value and management action. The result produces a basket of 30 companies, most of which provided construction and engineering services for residential or commercial properties across the United States. However, the fund’s managers are also willing to consider companies that produce materials used in home improvement and construction.

The selected 30 stocks are placed by weight into groups, organized by market capitalization and then weighted equally within each group. This methodology, coupled with the fact that top-ranked large stocks are weighted at 40% of the index and top-ranked small stocks are given a weight of 60%, produces a noticeable slant towards small-cap stocks.

Top holdings in the portfolio include PulteGroup Inc. (NYSE: PHM), Lennar Corporation Class A (NYSE: LEN), D.R. Horton Inc. (NYSE: DHI), Trane Technologies plc (NYSE: TT), Martin Marietta Materials, Inc. (NYSE: MLM), Vulcan Materials Company (NYSE: VMC), NVR, Inc. (NYSE: NVR) and Tractor Supply Company (NASDAQ: TSCO).

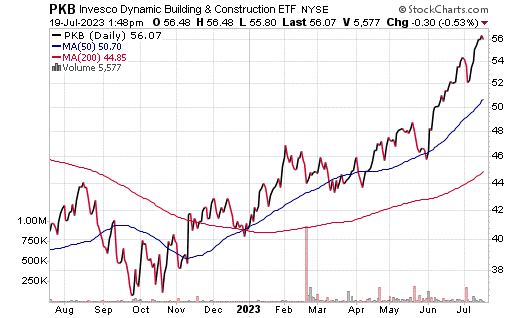

Year to date, this fund has seen a total return of 38.5%. This ETF has total net assets of $250 million and an expense ratio of 0.62%.

The real estate sector, like all market sectors, is subject to fluctuations depending on factors such as economic conditions, interest rates and government actions can all affect the trajectory of the housing market. So, investors should be aware of the risks associated with investing in such a fund and always do their due diligence before adding any stock or fund to their portfolio.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)