To hear more of my thoughts, watch this:

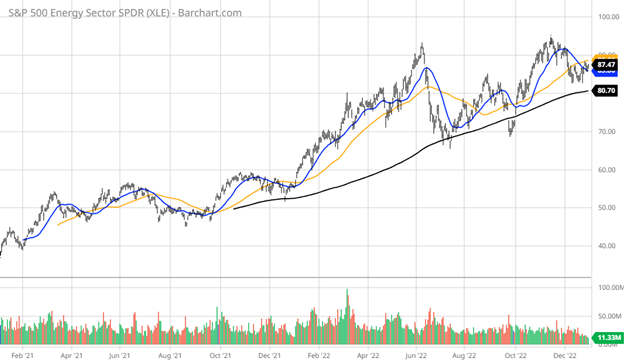

For 2022, the energy sector was the standout performer, as the major averages were broadly lower over the same period. The sanctions on Russian oil coupled with the economy rebounding from the pandemic and an anti-fossil fuel policy within the Biden administration provided a trifecta of catalysts for the energy patch, and man, it showed up in the form of energy companies reducing CapEx spending, initiating huge stock buybacks and hiking dividend payouts in both fixed and variable dividends.

The S&P 500 Energy Sector SPDR ETF (XLE) roared higher by 130% for the year, and closed the year on a constructive pull back that had most energy bulls looking for a continuation of the rally as 2023 got under way.

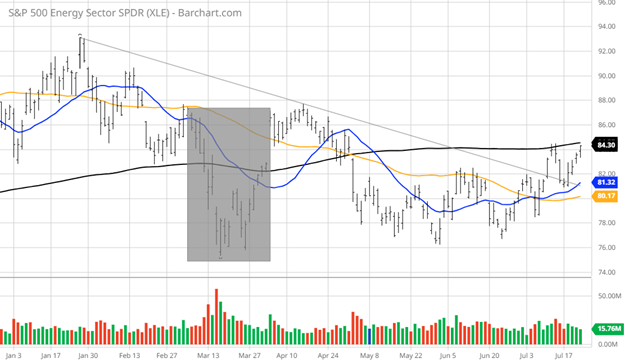

And for a little while, the bulls were right, as the energy sector rose by a little over 6% by the end of January. However, from that point on, energy stocks were deeply impacted in the month of March as recession fears swept over global markets, which is illustrated in the year-to-date chart below, showing a steep sell off. The dominant narrative was that the market would almost assuredly retest the October lows, which would represent a correction in the order of around 15% if using the S&P 500 as the benchmark.

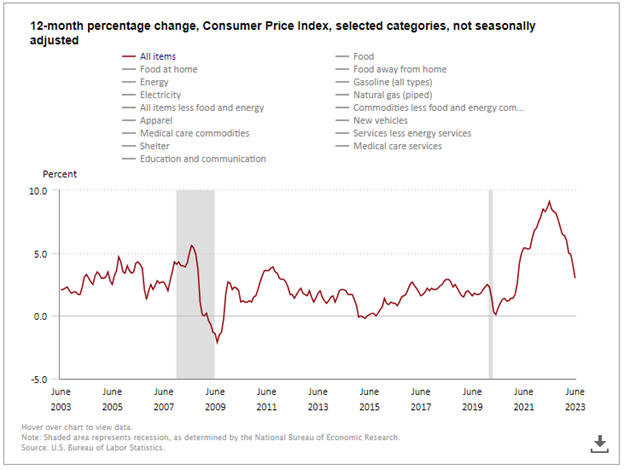

The 2022 rally in energy coincided with inflation spiking higher, along with the Fed desperately playing catch after its now-famous “inflation is transitory” policy statement went up in smoke when core inflation hit 9.1% in June 2022. Core CPI is now running at an annual pace of 3.0% as of June’s reading. A big contributor to the deceleration of month-over-month inflation can be attributed to oil and gas prices revisiting the March lows in June.

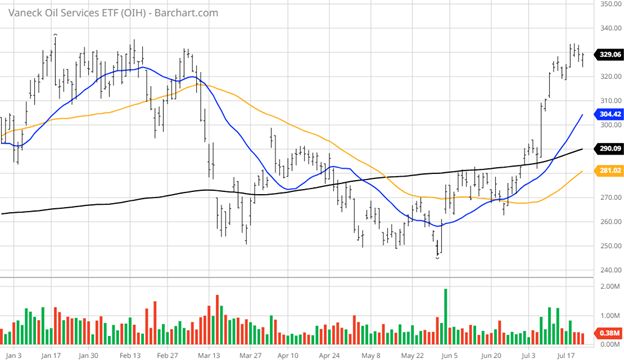

But that looks to change during the month of July, as shares of the XLE have clearly broken the downtrend line going back to January. Leading the fresh upside move have been the oil services stocks, those companies that support the oil and gas industry, including energy exploration, transport of petroleum and gas to refineries and the processing and delivery of energy assets to market. This subsector has seen a surge in prices over the past two weeks, trading up through its 200-day moving average like a hot knife through butter to challenge the previous 52-week high.

It’s a stunning move that has received little mention by the financial media with so much focus on all things artificial intelligence (AI). This breakout move by the oil services stocks historically foretells of a larger move about to take place within the broader sector at a time when talk of a weak China reopening has kept a lid on most of the major refiners and integrated oil and gas companies.

But there has been a sudden change in price action of the refiners in the past two weeks, with the leading names all posting very bullish moves higher. And while the biggest oil majors are still near the low end of their respective ranges, they too are now firming up in what could be a big reversal in the making, as investors grow more positive on the economy surviving the threat of recession.

It seems a majority of investors believe central bank interest rate hikes to fight inflation should keep a lid on global growth for the time being. And yet, there is clear evidence from recent price action that some investors are positioning for a rebound in energy stocks, lured by attractive valuations and signs the U.S. will continue to sidestep an economic downturn of any significant magnitude.

“We don’t have a recession as our base-case scenario in the U.S., so we think there is scope for the laggards to catch up,” said David Lefkowitz, senior equity strategist at UBS Wealth Management. “Energy is at the top of that list.” This month, UBS upgraded energy to “most preferred”, citing dwindling supply and signs that a U.S. recession, if it comes at all, may be less severe than expected.

Analysts at TD Securities said oil production cuts from Saudi Arabia and supply reductions from OPEC+ “are likely to more than offset the surplus accumulated in the first half of 2023,” lifting the price of U.S. West Texas Intermediate (WTI) to $90 per barrel. That’s 16% higher than where WTI currently trades at $77/bbl, which is already $10/bbl higher than where it was trading the last week of June.

So, just as no one is really looking to back up the truck in the energy sector, it’s a sudden development that I think has investors believing its more of an oversold bounce than a new and sustainable uptrend emerging. It’s hard to say, but leads one to ponder if we’ve seen the low in inflation this year as the CRB Commodity Index rose above 308, and is sitting at a fresh 2023 high amid a weaker dollar and higher food inputs.

From a Bloomberg note as of last Friday: “Agricultural commodities, which account for more than 40% of the index, resumed the upward trend after prices for cocoa, corn, soybeans and sugar increased on shortage fears. Also, the cost of wheat surged following Russia’s suspension of a shipping deal with one of the world’s biggest producers. WTI crude returned above $75 per barrel thanks to China’s pledge to roll out more policies, and natural gas soared above $2.7/MMBtu on expectations of stronger air conditioning demand.”

At present, there is only a 15% probability of a Fed rate increase at the Sept. 20 FOMC meeting. Based on what is now happening with energy and commodities, that number could easily start moving north of 50% if oil, natural gas and other commodity prices keep heading higher. With that said, it might be time to consider energy stocks trading at steep discounts from previous highs with big fixed and variable dividends.

P.S.My colleague, George Gilder, will be hosting a teleconference on July 26 at 2 p.m. EST — and you’re invited! The title of the conference is “How to Profit from the Next S&P500 Companies” and it is free. However, you have to register here to be able to attend. Don’t miss out!

P.P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)