What’s the reason for the big decline in stocks of late?

While a lot of pundits have offered explanations such as the rising dollar, recession fears, high oil prices and “higher-for-longer” monetary policy, the real reason is simple… rising Treasury bond yields.

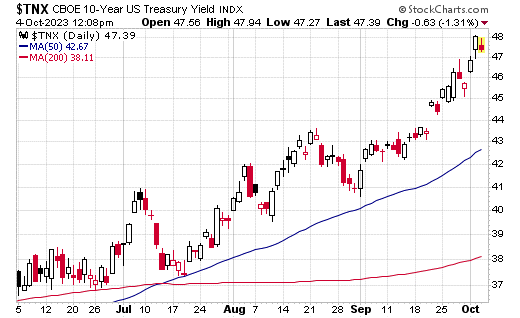

And here, I am not just talking about a modest rise. Rather, bond yields are now at their highest levels in 16 years, and we could soon be approaching a benchmark 10-year Treasury note yield with a “5” handle — ouch!

Yet, a critical question here remains, and that is… Why are bond yields still rising?

The answer is neither simple nor obvious, which is why a thoughtful treatment of this issue is something required at this juncture. And to provide just such as treatment, I am going to show you what we wrote today in the daily market briefing, Eagle Eye Opener.

The Eagle Eye Opener is a collaboration between myself and my “secret market insider,” a man who provides actionable intelligence to the biggest Wall Street brokerage firms at a very high cost — intelligence of the sort you are about to read here, with my compliments.

So, again, why are yields rising? Here’s what we wrote this morning…

The rise in Treasury yields once again hit stocks as the 10-year yield rose through 4.70% for the first time since April 2007, and that continued move higher weighed on stocks. For reference, the 10-year yield was 4.18% just one month ago, and the rise in yields has gained steam lately and that is pressuring stocks.

But as always in markets, the key question to ask is: Why are yields rising?

There are three typical causes of higher yields: Rising inflation expectations, surging growth expectations and fears of a hawkish Fed. I want to investigate each of these to see if they are behind this acceleration higher in yields.

Potential Cause 1: Rising inflation expectations. Inflation expectations can drive long-term Treasury yields. When inflation expectations are rising sharply, that can push yields on longer-dated Treasuries higher as investors demand more long-term interest to offset potentially longer-term inflation. Inflation expectations rising sharply? No, they are not.

The five-year TIPS/Treasuries inflation breakevens have moved up over the past month, but barely so as they’ve risen from 2.17% on Sept. 1 to 2.22% as of Sept. 29. The recent high was 2.30% a few weeks ago, but these breakevens are well off the 3.57% peak in March 2022. Is inflation responsible for surging yields? No. Inflation expectations have not materially changed and are not fueling this rise in yields.

Potential Cause 2: Surging economic growth. Growth is the other factor that can influence longer-term Treasury yields, as higher growth can mean more inflation and investors demand higher longer-term yields to offset that risk. Point being, higher growth = higher yields. Are growth expectations accelerating? No, not meaningfully.

Looking at the Atlanta Fed’s GDP now, they are anticipating a sharp increase in gross domestic product (GDP) from 2.10% in Q2 to the current estimate of 4.9% for Q3. That’s a definite increase. But that growth expectation has been steadily declining from a high of just under 6% quarterly growth, so it’s not like growth expectations have spiked higher recently. Meanwhile, Wall Street analysts’ GDP estimates have risen to just under 3% recently, but that’s not the type of growth that would justify a 70-bps increase in the 10-year yield. Is growth responsible for surging yields? No. Growth expectations have risen from Q2, but that hasn’t happened recently and growth isn’t strong enough to justify this type of move higher in yields.

Source: StockCharts.com

Potential Cause 3: Hawkish Fed expectations. If the market truly believes the Fed will be “higher for longer,” that could push both short- and long-term yields higher. So, are Fed expectations getting materially more hawkish? No, not substantially so.

According to fed fund futures, there is currently a 53.6% probability the Fed does not hike rates between now and year-end. A month ago, the probability was 51.9% (so no change). Looking towards 2024, there has been a shift in market expectations. Currently, the market expects between 50-75 basis points of rate cuts from the Fed in 2024. A month ago, the market expected between 100-125 basis points of cuts in 2024. That’s a 50-basis-point change in expectations. Are Fed expectations responsible for rising yields? Partially. The market starting to believe the Fed will stay higher for longer has likely contributed to the yield rally, but it can’t account for the recent acceleration or size.

If the “usual suspects” aren’t doing it, what is? First, sentiment and speculation. CBOT U.S. Treasury short positions are just off the spike highs of the year, and we can tell by the reaction in bonds to “second tier” economic data and Fed/important financial people speak. Point being, JPMorgan CEO Jamie Dimon said it’s possible that Fed funds goes to 7% (a lot is possible) while some Fed officials have called for multiple additional Fed rate hikes (but the median dots still show just one between now and year-end, and that’s barely so). Point being, there’s clear downward momentum in Treasuries, and just like momentum can push stocks higher or lower than fundamentals justify, so too can it happen in bonds, and sentiment and momentum are major contributors to this past month’s drop in bonds.

Second, U.S. governmental dysfunction matters. For those of a certain age, this will ring a bell: It looks like the “bond vigilantes” have returned (at least in part). Bond vigilantes was a classic Wall Street term for bond investors who would sell Treasuries and send yields higher to voice disapproval over U.S. fiscal policy. They were popular and prevalent in the 1970s, ’80s and early ’90s, but were considered “extinct” by some on Wall Street after they failed to appear over the past 20 years. Well, they’re back!

Dysfunction in Congress is starting to matter, because markets want the government to address the long-term fiscal path of the country. To be clear, this isn’t a big enough reason to push Treasuries lower/yields higher by itself, but combine it with hawkish Fed fears and momentum, and we’ve got ourselves a solid drop in Treasuries, and that is why we are seeing bonds drop and yields spike.

What makes it stop? Disappointing economic data that reminds investors a growth slowdown is still possible. As we’ve covered, none of the long-term drivers of yields have changed much. Neither growth nor inflation are surging. That’s an important positive, and it strongly implies this spike in yields will be temporary because growth and inflation determine longer-term yields, regardless of what we’re seeing now.

That means for this spike in yields to stop, we need to see economic data that underwhelms and makes investors think a slowdown could occur. And given how oversold the 10-year Treasury is right now, any sort of disappointing economic data could easily cause a 20-basis-points decline in yields, if not more. Until then, momentum and general anxiety about the Fed and U.S. fiscal policy will push yields higher, and until they stop rising, we can expect continued volatile stock prices.

If you would like to get this kind of deep analysis on the economy, stocks, bonds and anything that makes the market move, each trading day 8 a.m. Eastern time, then I invite you to check out my Eagle Eye Opener, right now. I suspect it will be the best decision you make today!

***************************************************************

My Favorite Buffett Wisdom

“The stock market is a device to transfer money from the impatient to the patient.”

–Warren Buffett

The virtue of patience isn’t stressed enough when it comes to money. But think about it. Aren’t some of your biggest investing successes the ones that you’ve owned for a very long time? Sure, we can trade stocks and options to take advantage of tactical trends; however, when it comes to wealth building, there is no substitute for patience.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods