Two events scared the living you-know-what out of the markets last week:

- 10-year Treasury yields hit 5%

- 30-year mortgage rates hit 8%

The last time either happened was July 2007 and August 2000, respectively.

There’s a good chance we’ll see a violent snapback in both over the next three-to-six months.

However, it won’t last.

We explained the heavy debt load weighing down the U.S. government in a previous issue of Wealth Whisperer.

Today, we’re taking that a step further.

We’ve uncovered new pieces to the puzzle, which have led us to make a bold prediction…

Rates will stay at these levels (or slightly higher) for the next decade.

We’ll explain why and also reveal how to position your portfolio.

Updated Government Debt Outlook

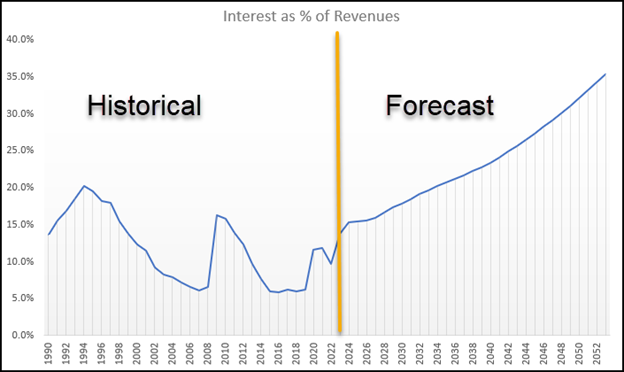

This year, government interest payments are expected to reach 13.8% of revenue.

While that’s higher than the 9.7% we paid last year, it’s not extraordinary.

However, look at the graph below, which maps out interest as a percentage of revenues, including historical data and forward estimates.

Source: Congressional Budget Office

Interest payments were historically low between 2000 and 2022 as a percentage of revenue.

Why?

Because the Fed kept interest rates well below the historical average.

Source: Federal Reserve (FRED)

It would be NORMAL for interest rates to sit where they are.

However, we need to think about supply and demand. Because, at the end of the day, that drives the price of Treasuries, which dictates the interest rates consumers pay.

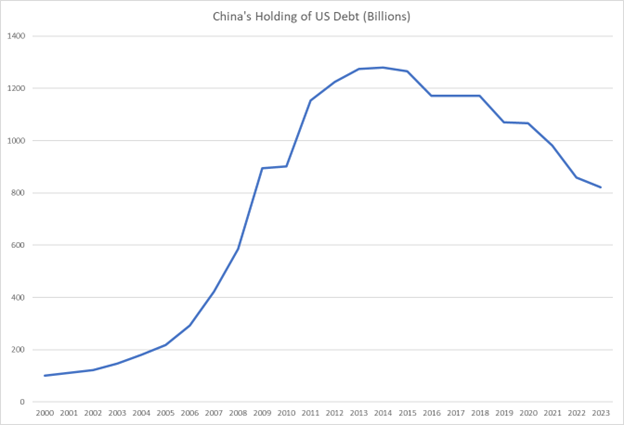

One of the largest debt buyers from 2000 to 2014 was China.

Their total holdings went from $101 billion in 2000 to $1,280 billion in 2014.

Today, that’s down to $822 billion.

Source: U.S. Treasury Dept.

With the Fed no longer adding to its balance sheet and China doing the same, U.S. debt faces a double whammy that isn’t likely to abate in the near future.

Let’s quickly remind ourselves why this is all happening.

A Look at Inflation

We’ve discussed the main reason behind inflation: housing.

There simply aren’t enough homes to satisfy demand, even with mortgage rates as high as they are.

The home building industry faces a skilled labor shortage that hasn’t improved. Instead, it has worsened as immigration becomes a greater threat to national security.

Coupled with higher energy prices and supply constraints, we’ll be lucky to see inflation drop below 3% this year.

We actually believe it will take well into 2025 before the situation improves. That’s when many of the reshoring projects will come online.

So, how do we position ourselves going forward?

Market Sectors Hurt

Normally, higher interest rates help banks.

Not this time.

Yes, banks do better with a steep interest rate curve, since they borrow at short-term rates and lend at long-term rates.

However, deposits amongst regional banks and even the larger institutions are continuing to drop.

What’s causing this?

Cash is moving out of the banks.

First, money market funds pay close to 5%. Their liquidity, combined with a high payout, is far more attractive than locking up your money in a certificate of deposit (CD).

Second, Baby Boomers are continuing to draw down on savings, removing cash from their accounts.

Third, inflation is forcing folks to put their money to work or watch their cash lose real value over time.

We don’t see this changing until inflation is under control and economic activity picks back up, especially home buying.

We’re also particularly bearish on small-cap technology companies and venture capital.

Low interest rates allowed unprofitable companies to buy growth until they were profitable.

Think about Uber and all the others who spent tons of money on marketing until they achieved the scale required to turn a profit.

Since cash was cheap, it was easy to fund these companies.

Now, investors want returns sooner.

That means even smaller, high-growth tech companies need to turn a profit sooner.

Most of them can’t.

So, we expect the playing field to thin out markedly over the next five years.

Market Sectors Helped

At the other end of the spectrum, we see a lot of reasons to like industrials.

While the sector generates lots of cash from operations, these companies typically reinvest heavily into capital equipment and projects.

We expect that calculus to change, with companies returning cash to shareholders instead of investing in growth.

That might not sound like a great long-term strategy, but in the short term, it should boost share prices.

Plus, the demand for industries like aerospace and defense remains so high that companies like Lockheed Martin (LMT) can squeeze more efficiencies out of current operations.

Similarly, consumer staples should do well.

These companies generate lots of cash and tend to see little revenue fluctuation.

With many repricing visible over the past month, several are trading at attractive multiples.

Whether you like consumer staples or industrials, the key is to look for companies that manage their debt to low levels.

Be Selective

Investors cannot be as diverse as they have been.

Higher interest rates will purge poor-performing companies from the system, making exchange-traded funds (ETFs) less attractive.

The key is to own a selection of high-quality stocks capable of weathering most market conditions.

And as it turns out, all you need is three.

Yep, a three-stock portfolio can perform so well that it beat the S&P 500 by 1,400% over a 20-year period.

Jim Woods calls this the Perfect Portfolio.

It’s an absolutely fascinating concept that is helping investors from all levels of experience and knowledge simplify, protect and grow their wealth.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)