Since its inception in 2009, Bitcoin has profoundly disrupted the foundations of financial markets.

The cryptocurrency market has evolved from a little-known digital asset to one that now serves as a new avenue for investors. Exchange-traded funds (ETFs), such as the Grayscale Bitcoin Trust (OTC: GBTC), offer investors a regulated and reportedly secure means to seize emerging opportunities with significant growth potential.

Bitcoin, a form of digital cryptocurrency, has weathered numerous tumultuous periods over the years. Following an initially sluggish start in 2011 that pushed the Bitcoin price to around $30, the currency experienced a significant year in 2013, witnessing gains of 6,600%. Another notable upturn occurred between 2017 and 2019, propelling the price to as high as $20,000. Simultaneously, there was a growing general public awareness of cryptocurrencies.

By November 2021, Bitcoin reached its all-time high, soaring to over $68,500. However, the trajectory shifted, and its value began to decline, dropping by approximately 30% due to China’s mandate to close Bitcoin mining operations, subsequently reducing the mining capacity as computers went offline. Concurrently, increased regulatory concerns emerged regarding crypto laws and regulations, fostering an atmosphere of fear, uncertainty and doubt about investing in these assets.

In 2022, rising inflation spurred by the global energy crisis and geopolitical turmoil stemming from Russia’s invasion of Ukraine, led to a decline in cryptocurrency prices, ushering in the onset of the “crypto winter” — a bearish period marked by sustained losses in the crypto markets. By June 2022, Bitcoin prices plummeted below $23,000 and continued to struggle following the abrupt collapse of the FTX crypto exchange, attributed to a liquidity crunch and allegations of fraud by Sam Bankman-Fried, the CEO of FTX, who was recently found guilty on all counts by a U.S. federal district court. The downfall of FTX triggered a significant crash, creating a ripple effect across the crypto markets. Other events such as the Terra Luna crash and varying microeconomic conditions in 2022, contributed to an overall loss of approximately 65% of Bitcoin’s market value in 2022. Investor confidence was severely impacted and exacerbated by widespread inflation and continual interest rate hikes. Consequently, the price of Bitcoin plunged below $20,000 by December 2022.

The crypto market is undergoing a notable shift, offering a new sense of optimism for investors. With a consistent rise in prices, the Bitcoin market is recuperating from the “crypto winter” and achieved a new high in February 2023. The interest shown by miners may indicate a bullish trend, as suggested by certain traders and analysts. Bitcoin’s future growth trajectory will significantly hinge on external factors such as sentiment, mining activities, money supply and the network effect, which is exhibited when a product’s value rises as more people use it. All those factors impact the price that investors are willing to pay for a cryptocurrency.

According to a November 2023 Forbes article, Bitcoin is showing a bearish trend. However, it is simultaneously offering hope of recovery, surging from a low of $31,000 to its current value of $34,457. This movement is somewhat impacted by inflation from the U.S. and U.K. economies, as the U.S. Federal Reserve has raised interest rates by 25-basis points in response. Despite optimistic projections for a potential rebound, Bitcoin’s current value remains nearly 50% lower than its all-time high. The upcoming 2024 Bitcoin halving event is anticipated as a potential catalyst for positive price momentum. This could prompt investors to consider options such as Grayscale Bitcoin Trust ETFs to diversify their portfolios and potentially increase their gains, aligning with other products offered by Grayscale.

Moreover, a recent Securities and Exchange Commission (SEC) ruling mandated a reevaluation of Grayscale’s bid to convert its GBTC trust into an ETF, favoring the trust in this decision. This crucial ruling paves the way for the first ETF to offer direct exposure to Bitcoin, enabling individuals with brokerage accounts to invest.

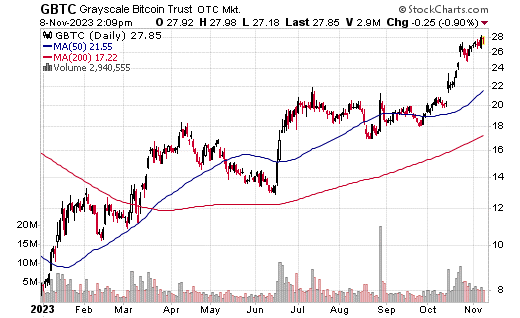

As of October 2023, this fund’s returns were up by 39.5% over the past month and up 239.0% year to date, according to Stock Rover, an investment research platform. As of November 7, 2023, the market price per share was $28.10. The fund has net assets of $21.77 billion under management and an expense ratio of 2.00%.

Source: StockCharts.com

Bitcoin’s potential to hit $100,000 by 2023 remains debated among experts (including myself, who think this prediction is ridiculous) due to its recent impressive rally and gains, though some suggest this milestone might take longer, potentially a decade. Conversely, certain investors and institutions hold a bearish outlook, predicting a potential crash in Bitcoin’s value, citing reasons such as energy costs, strict monetary policies and market uncertainty that could deter traders and drive its value downward.

Notwithstanding this, funds such as GBTC, managed by Grayscale, one of the world’s largest cryptocurrency asset managers, offer an intriguing investment avenue for those seeking to diversify their portfolios within the resurgent crypto market. Nevertheless, investors in this ETF should remain attentive to public sentiment that could affect the fund, along with factors like inflation, microeconomic conditions and other variables. It is essential for investors to thoroughly evaluate each fund’s investment objectives, risk factors, fees and expenses before making any investment decisions.

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)