Now, in a manner with which my readers have grown accustomed, I will not beat around the bush about Bitcoin.

There is thrum of excitement within the markets, and it is related to the potential approval for a U.S.-based spot Bitcoin exchange-traded fund: ProShares Bitcoin Strategy ETF (BITO). While the Securities and Exchange Commission (SEC) has not yet signed off on approval of this ETF, experts have reported the approval may come early in 2024.

Bryan Armour, director of passive strategies research for North America at Morningstar, commented, “For ETF investors, this would be the best product on the market.”

But, why the excitement? Well, on the back of BlackRock’s first steps toward an ether ETF, the price of bitcoin hit an 18-month high, soaring to $37,970. Further, the price of bitcoin has more than doubled since the start of 2023.

With the price of bitcoin raging higher, a spot Bitcoin ETF does sound appealing, as this fund would allow investors to invest directly into the digital asset. Currently, investors have only the option to buy bitcoin futures ETFs.

However, as Benjamin Franklin wrote, “…in this world nothing can be said to be certain, except death and taxes.” And this relates not only to the approval of the spot Bitcoin ETF, but the success of such direct investing for many investors.

This brings us to today’s ETF — ProShares Bitcoin Strategy ETF (BITO). While this is a futures fund, it is a tried and true one. And with such a flurry of excitement surrounding something so new, I want to bring us back to the now.

BITO is the world’s largest and first U.S.-based Bitcoin-linked ETF. And while the fund does not invest directly in Bitcoin, it invests in cash-settled, front-month bitcoin futures, which are traded on commodity exchanges registered with the Commodity Futures Trading Commission (CFTC), such as the CME Futures Exchange.

The value of the bitcoin futures is determined by the CME Group and Crypto Facilities Bitcoin Reference Rate (CME CF BRR), which aggregates bitcoin trading activity across major global bitcoin spot trading venues during a one-hour window.

As a matron of the Bitcoin universe, BITO has closely tracked the performance of the spot bitcoin since its inception. Moreover, this fund can be held through a brokerage account with no need for a cryptocurrency exchange account.

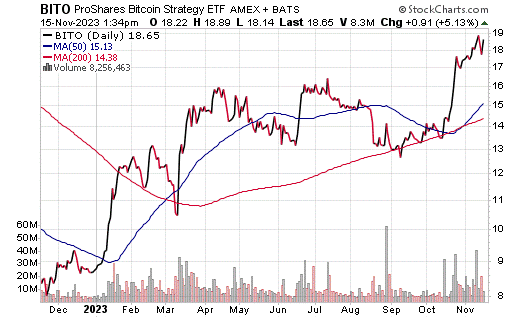

BITO has net assets of $1.09 billion and assets under management of $1.07 billion. Moreover, the fund is trading at the high-end of its 52-week range, which is $19.23, and it is currently trading at $18.33 and climbing. As of the market’s Nov. 15 open, the fund has already climbed 3.27%. Looking at the chart below, it is apparent that BITO is finishing the year strongly, as its price is piggybacking off the aforementioned market excitement.

Chart courtesy of www.Stockcharts.com

Overall, the market may love the idea of investing in the digital currency itself, but Bitcoin has had its shares of ups and downs, and that means more volatility. With BITO, investors are exposed to the crypto world, but with a cushion.

As I mentioned, and as Ben Franklin did before me, certainties are rare in this world and certainly not in the stock market. So, let me leave you with one last thought, from a philosopher of science.

A philosopher who greatly believed that observation and inductive reasoning are an integral part of our scientific understanding — Sir Francis Bacon, who wrote, “If a man will begin with certainties, he shall end in doubts; but if he will be content to begin with doubts, he shall end in certainties.”

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)