With bullish sentiment for cryptocurrency settled in for the time being, I want to examine an opportunity that could lead to profits if Bitcoin pulls back again.

While the Bitcoin market has seen a substantial upswing this year, the cryptocurrency is still in its early stages, with influencing factors such as supply and demand, government regulation and popular media and investor sentiment contributing to its characteristic volatility. Let me introduce you to ProShares Short Bitcoin Strategy ETF (BITI), offering investors a way to profit if Bitcoin retreats.

For investors wanting exposure to Bitcoin’s fortunes without having to invest directly, the current offering of exchange-traded funds (ETFs) provides an easy entry point. Traditional ETFs don’t require cryptocurrency exchange accounts or “wallets,” allowing investors to bypass crypto exchange restrictions and costs, as well as to use traditional brokerage accounts for exposure to the digital asset.

And for investors anticipating the other side of Bitcoin’s upswing, there are inverse, or short strategy ETFs, such as ProShares Short Bitcoin Strategy ETF (BITI). Consider this ETF another investing tool to use in just the right circumstances when Bitcoin falters.

As a sibling fund to ProShares Bitcoin Strategy ETF (BITO), BITI does not short Bitcoin directly. It gains short exposure to Bitcoin through cash-settled, front-month and back-month bitcoin futures contracts traded on commodity exchanges registered with the Commodity Futures Trading Commission (CFTC). The fund’s goal is to achieve the inverse of the daily performance of the S&P CME Bitcoin Futures Index.

In other words, the fund’s investing strategy is to bet on a decline in bitcoin futures — since a drop in bitcoin futures contracts should cause BITI to rise. The fund rebalances its portfolio each day.

BITI is the first short bitcoin strategy ETF in the United States, and currently the only ETF approved by the Securities and Exchange Commission (SEC) that trades the inverse of Bitcoin’s daily performance. BITI is significantly smaller than its sibling BITO, with $75.39 million in assets under management and an expense ratio of 0.95%.

Like BITO’s introduction just before the peak of Bitcoin in 2021, BITI was introduced by ProShares in June 2022, after Bitcoin dropped from the year’s high at $46,820 in March 2022 to $21,027 in June. The fund had a strong reception, with over 870,000 shares traded on its second day.

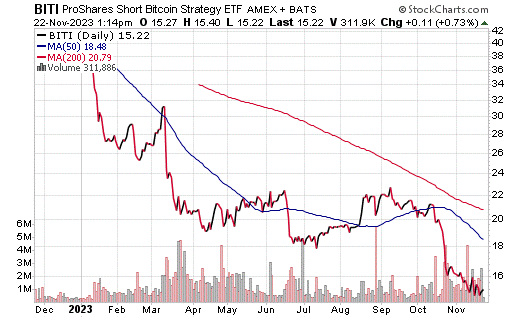

But given that it trades the inverse of Bitcoin, BITI is now just barely up from its lowest point since the fund’s launch.

With the sudden recovery of Bitcoin after its steep fall in 2022, the upcoming Bitcoin “halving” expected in April 2024 and the possible SEC approval of spot bitcoin ETFs early next year, BITI may be useful for investors who believe bitcoin is now overbought.

As excitement in the market surrounding Bitcoin has driven the price significantly up in recent months, BITI is down 20.77% over the past month, 30.81% in the past three months and 61.35% for the year to date.

Source: StockCharts.com

Despite what some have called a mistimed launch with BITI now near a record low, the fund may still prove a useful tool for investors who believe Bitcoin’s rally to be a short squeeze. BITI also may appeal to those who want to hedge their risk. Whether Bitcoin will continue to push higher as some experts anticipate, and some investors hope, or see another plunge, time will tell.

As always, investors should do their due diligence before adding any stock, fund or ETF to their portfolio. Inverse ETFs compound losses in volatile, upward-trending markets, posing risks if the market turns unfavorably.

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)