“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.” — Warren Buffett

Charlie Munger, Vice Chairman of Berkshire Hathaway and Warren Buffett’s sidekick for more five decades, died this week at the age of 99. He was hoping to celebrate his 100th birthday on January 1, 2024.

Munger was always a delight to listen to at the annual Berkshire Hathaway shareholder meetings in Omaha. My son, Todd, and I attended the 50th anniversary meeting in 2015.

I quote Munger nine times in “The Maxims of Wall Street,” but one quote stands out as the key formula that made Warren Buffett’s investment company the No. 1 most successful money manager in the world:

“A great business at a fair price is superior to a fair business at a great price.” (p. 37)

When Munger offered that advice, Buffett was using a different formula — focusing on struggling companies that were selling at a bargain price compared to their book or net value. Such an undervalued stock can be compared to a discarded cigar butt, which has one more puff left.

In his 1989 shareholder report, Buffett called it his “cigar butt” technique. He made his first million using this approach, but after talking to Charlie Munger, decided there was a better way.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” he said. “Charlie understood this early: I was a slow learner. But now, when buying companies or common stocks, we look for first-class businesses accompanied by first-class managements.”

Indeed, that is the case when you look at Berkshire Hathaway’s portfolio, including Apple, Amazon, Coca Cola, Bank of America, Chevron, Visa, MasterCard and the privately held GEICO.

Why Buy-and-Hold and Dollar-Cost Averaging Work

When you’re a long-term investor, Menger’s advice makes sense. You want to be invested in well-managed companies that can’t help but grow over time.

Buffett states, “Charlie Munger and I have not learned how to solve difficult business problems. What we have learned is to avoid them.” (“Maxims of Wall Street,” p. 166)

J. Paul Getty, America’s first billionaire, adopted the same formula years earlier. He warned, “It is surprising that so many investors buy stocks in dying industries and ignore tempting opportunities to buy into companies that cannot help but burgeon as time goes on.” (p. 117)

For long-term investors, he advises, “The seasoned investor buys his quality stocks when they are priced low, holds them for the long-pull rise and takes in-between dips and slumps in his stride.” (p. 16)

Buffett and Munger: Strange Bedfellows in Politics

Another interesting feature of the Buffett — Munger relationship was that Buffett was a life-long Democrat while Munger was a long-time Republican. Working together resulted in more pragmatic attitudes toward the role of government in our society. I was glad to see Munger come out in favor of Singapore’s Medisave program as an alternative to Obamacare. Singapore’s healthcare program uses market techniques such as health savings accounts to keep the cost of medical expenses down while maintaining quality control. As a result, Singapore spends only 5% of its GDP on healthcare, while the United States spends 18%. Meanwhile, Singapore citizens live longer on average than Americans.

Some Other Great Munger Quotes

Here are a few other great Munger quotes from the Maxims:

“To be a successful investor you must draw from many disciplines.” (p. 68)

Note: We underestimate the value of a good liberal arts education. The great thing about investing in individual stocks is that it forces you to learn a lot about how the world works. Warren Buffett resisted investing in technology stocks because he said he knew finance (banking, insurance, etc.) but not technology. As a result, he missed out on beating the market until he finally invested in Apple (now his largest position).

“No pilot, no matter how great his talent or experience, fails to use his checklist.” (p. 71)

Note: You can’t be a successful investor without a sound plan of action. Set it up and then follow it. Most investors lack a consistent program of successful investing.

“In my whole life, I have known no wise people who didn’t read all the time — none, zero.” (p. 118)

Note: As I tell my Chapman students, most young people look, but they don’t read anymore. If you want to make a difference in life, start reading regularly.

Last, but not least:

“Trying to minimize taxes too much is one of the great causes of really dumb mistakes in investing.” (p. 146)

Note: I can’t tell how much money I’ve lost over the years investing in tax shelters. I would have been better off ignoring the tax consequences and focused on the investment itself.

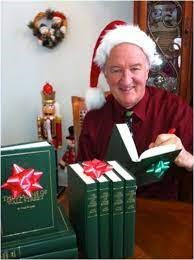

You can see why I encourage all my readers and subscribers to read regularly from “The Maxims of Wall Street,” now in its 10th edition. As Dennis Gartman wrote to me, “It’s amazing the depth of wisdom one can find in just one or two lines from your book. I have it on my desk and refer to it daily.”

‘Best holiday gift for my clients!’

What better gift to give your friends, relatives, clients and your favorite stockbroker than the new 10th edition of “The Maxims of Wall Street.” I autograph and number each copy.

I’ve added some 20 new quotes to the new edition, including the following:

“Forecast a number or a date, but never both.” — Jason Zweig, Wall Street Journal

“The first rule of racing is to break off the rearview mirror.” — Italian race car driver

“Scared money don’t make money.” — Billy Napier, football coach

“The most important quality for an investor is temperament, not intellect.” — Warren Buffett

“Never bet on the end of the world. It only comes once, which is pretty long odds.” — Arthur Cashin, New York Stock Exchange floor manager

“Charts are great for predicting the past.” — Peter Lynch

“There are two kinds of people who lose money: those who know nothing and those who know everything” — Henry Kaufman (“Dr. Doom”)

“If you mix your politics with your investment decisions, you’re making a big mistake.” — Warren Buffett

“The buyer needs one hundred eyes, the seller not one.” — George Herbert

“Efficient markets exist only in the textbooks.” — Warren Buffett

“Success is never final, and failure is not always fatal. It is courage that counts.” — Sam Rayburn

“Maxims” has been endorsed by Warren Buffett, Jack Bogle, Kim Githler, Alex Green, and Bert Dohmen and reviewed favorably by Barron’s.

It makes an ideal gift during the holidays for family, friends, clients and your favorite stockbroker or money manager. As Rodolfo Milani states, “I find them to be ideal gifts for my best clients.”

‘Maxims’ at a Super Discount

Despite rising inflation and shipping costs, I’ve managed to keep the price of the new 10th edition to only $21 for the first copy, and only $11 for all additional copies. And if you order an entire box (32 copies), the cost is only $327 (around $10 each).

I pay all shipping costs if mailed to any of the 50 states. Plus, I autograph and number each copy. A real keepsake!

To order your copies, go to www.skousenbooks.com.

Do You Live in Central Florida?

FREE LECTURE — University Club of Winter Park, Florida, Monday, Dec. 4: This coming Monday, I’ll be speaking on “It All Started with Adam: Would Adam Smith, the founder of free-market capitalism, be happy or distraught if he returned today for his 300th birthday?” The answer may surprise you. The University Club is located at 841 N. Park Ave. in Winter Park. Refreshments at 3:30 p.m., lecture at 4 p.m. This lecture is open to the public, without charge. Please join me and say hello.

You Nailed it!

Don’t Miss Tonight’s California Versus Florida Debate

“By the collision of different sentiments, sparks of truth strike out, and political light is obtained.” — Benjamin Franklin

I hope you will all watch the special debate tonight between the Florida governor Ron DeSantis and California governor Gavin Newsom from 9 p.m. — 10: 30 p.m. ET on Fox News, hosted by Sean Hannity.

It is rare today to see a civil debate on the cable news networks, but somehow Sean Hannity has pulled it off.

Tonight’s debate will be especially worth watching because both governors are potential future presidents of the United States.

The political philosophy between the two governors couldn’t be more different. I know, because my wife and I have homes in both states, and we can see the difference. We teach at Chapman University in California from January to mid-May, and we reside in Florida during the summer and fall.

There are some similarities. Our homes are located in Orange County, California, and Orange County, Florida. There’s Disneyland in Anaheim and Disney World in Orlando. Both are famous for warm sunny days, although California has dry heat and Florida has its humidity. And both have fabulous beaches, although California’s oceanside is cold and Florida’s is at least 20 degrees warmer.

There are big differences between the two populous states in terms of taxes, business environment, crime, homelessness and culture, and I suspect that’s where the big debate will be and why people are leaving California and moving to Florida.

I’ll have a full report on the debate in my Monday hotline. Stay tuned.

Good investing, AEIOU,

![]()

Mark Skousen

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)