America loves weight-loss drugs.

Here, I’m talking about the newest class of weight-loss drugs, the “GLP-1 drugs.” Indeed, the long-term impact of GLP-1 drugs has been a significant story in markets throughout 2023, but lately its had a bigger macro impact as expectations for this drug have resulted in substantial gains for specific large-cap pharmaceutical stocks and recent significant weakness in previously “safe” food stocks that’s contributed to the underperformance of the consumer staples sector in 2023.

The reason these GLP-1 drugs have had such a varied and broad impact on different parts of the market can be summed up by this statement: There are expectations that these GLP-1 drugs could result in substantially less food consumption across the country in the coming years. They literally could reduce the demand for food!

In a recent issue of our daily morning briefing Eagle Eye Opener, my “secret market insider” and I presented an analysis of the potential impact of these weight-loss drugs on different parts of the market, as they are becoming an increasingly popular topic amongst investors. Here, we explained 1) What GLP-1 drugs are (and what they do), 2) Why they’ve impacted markets and 3) How to gain exposure to them (and, for contrarians, what food and staples ETFs have underperformed because of GLP-1 drug concerns).

Let’s take a look at that analysis now, as it could turn skinny investor pockets fat!

What are GLP-1 drugs? The brand names of two of the most popular GLP-1 drugs are Ozempic and Wegovy (both produced by Novo Nordisk (NVO)). GLP-1 drugs were initially designed as a diabetes drug, as GLP-1 drugs stimulate the body to produce more insulin after someone has eaten. The extra insulin helps to reduce sugar levels and has proven very effective in controlling Type-2 diabetes. But along the way, users of the drugs noticed a side effect: They weren’t as hungry and lost weight. Studies have found that using GLP-1 drugs can lead to 10-15 pounds of weight loss. Given that, these now are being marketed as weight loss drugs and their popularity has exploded.

Why has this impacted markets? In short, because a lot of people are starting to use them. In the second quarter, sales of Ozempic rose more than 50% from a year ago (from $2.1 billion in 2022 to $3.2 billion), while Wegovy sales rose 30% from 2022 (to $1.1 billion). That’s having a direct impact on two of the biggest pharma stocks that have “first mover advantage” in this space.

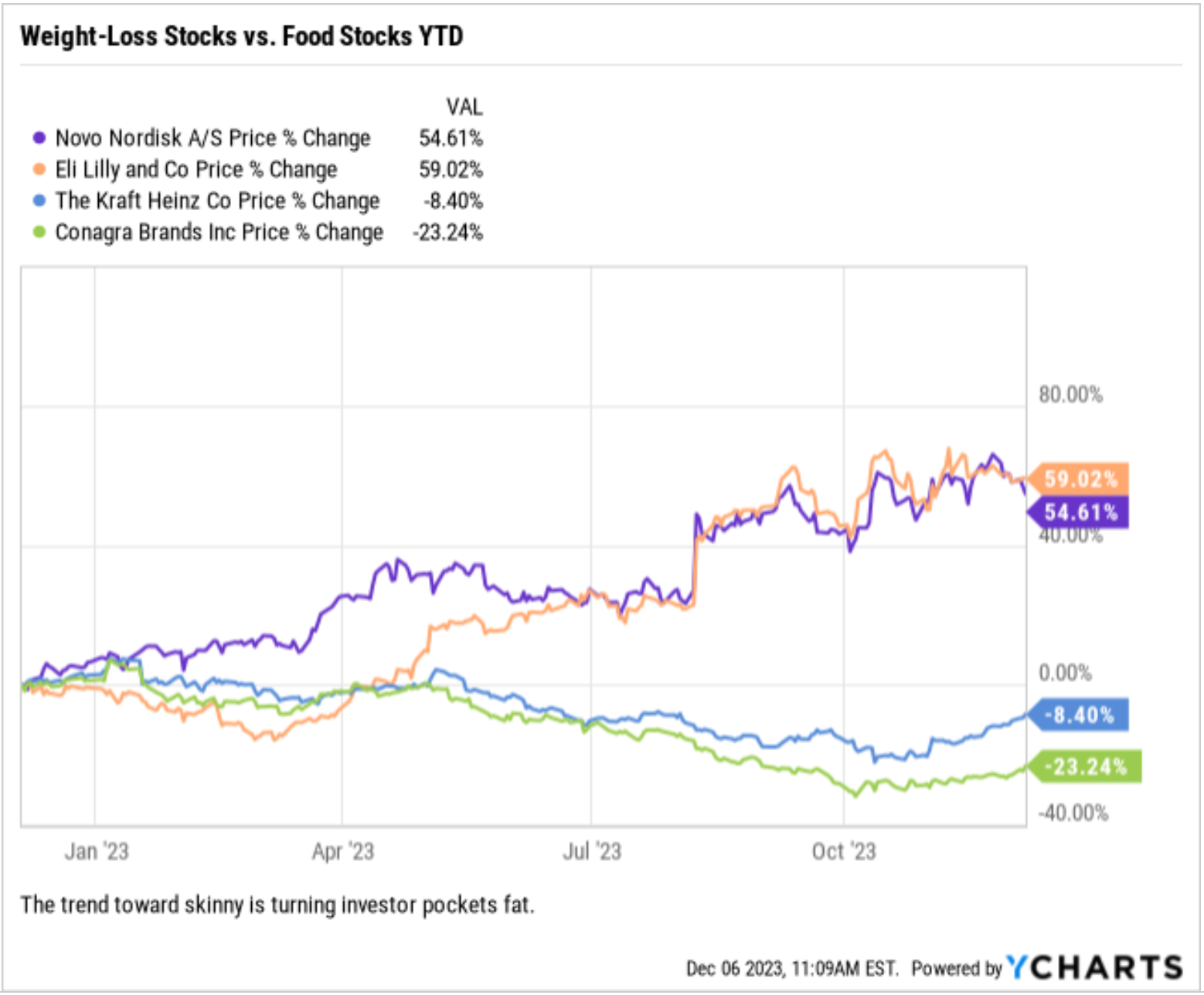

Novo Nordisk, who has two GLP-1 drugs (Ozempic and Wegovy), has risen 54.5% year to date (YTD). Eli Lilly (LLY), who manufactures Mounjaro, is up nearly 59% YTD (full disclosure, I am long both NVO and LLY in my newsletter advisory services). Conversely, pharma names that are not in this space have seen less-stellar returns. Merck (MRK) is down 5% YTD, while Pfizer (PFE) has collapsed 42%, in part due to collapsing Covid vaccine demand.

While certain pharma names have benefitted, a lot of processed food companies have seen their stocks fall sharply on concerns that, over the long term, widespread adoption of these GLP-1 drugs could structurally reduce demand for processed foods. Companies such as Kraft (KHC), Conagra (CAG) and Mondelez (MDLZ) have lagged the S&P 500, and in the cases of Kraft and Conagra, posted substantially negative returns (down 8.5% and 23% YTD, respectively). The reasoning here is clear: Estimates for GLP-1 drug usage forecast 25-50 million users by 2030.

If GLP-1 drugs reduce appetites by 10-20%, then the impact of aggregate food consumption will be in the low-single-digit-percent range (according to Bank of America). For the food companies, that’s evaporation of real and substantial demand. Being, it’s anecdotal and still early, but the risk here to food companies is real.

Finally, because food companies are a large part of consumer staples ETFs, their poor performance has negatively impacted the returns of the Consumer Staples Select Sector SPDR (XLP) and other consumer staples funds. XLP has declined 7.9% YTD, and while part of that has been the lack of a growth slowdown and higher yields that makes high dividend stocks less attractive, another part of this underperformance has been concerns about food demand. Food products account for 17% of XLP, while the impact of potentially reduced caloric demand can impact the grocers and the food-inclusive retailers.

The point being, food processors and large retailers with food exposure aren’t as big a weight on the market as tech, but they’re not unsubstantial, either. Meanwhile, those types of industries are heavily weighted in consumer staples ETFs and some dividend-focused ETFs. Bottom line, the evolution of these GLP-1 drugs and how they impact food demand is something all investors need to watch going forward.

So, what is the best way to get exposure to GLP-1 stocks, and what food stocks could be a contrarian opportunity?

For targeted GLP-1 exposure, obviously buying Novo Nordisk (NVO) and Eli Lilly (LLY) gets the job done as these two names are leaders in the space.

From an ETF standpoint, there are many pharmaceutical ETFs in the market today. The largest pharma ETF, the iShares U.S. Pharmaceuticals ETF (IHE), doesn’t have exposure to Novo Nordisk, which is a problem if the goal is GLP-1 exposure. Instead, the VanEck Pharmaceutical ETF (PPH) (here again, we are long PPH in my newsletter advisory services) is a better choice as Eli Lilly (LLY) is the largest holding (8.3%) while Novo Nordisk (NVO) is second at 6.5%.

Additionally (and presumably), most major pharma companies will invest in these GLP-1 drugs (PFE has a once-daily weight loss GLP-1 drug in development, as do most other major pharma companies) so we can expect other pharma names to release their versions in the coming year. Bottom line, PPH provides broad pharma exposure but also provides relatively large allocations to the two market leaders in the GLP-1 space.

Switching to the losers of the GLP-1 drug story (and for the contrarians out there), the case can easily be made that a lot of these longer-term forecasts about food demand destruction are overblown, and as such, there’s opportunity in the food names.

The Invesco Food and Beverage ETF (PBJ) has lagged the broader markets this year (down 5.7%), in part because of GLP-1 demand concerns. Some of the largest holdings in PBJ are the negative-exposed GLP-1 names, including Kraft Heinz (KHC) and Mondelez (MDLZ). PBJ trades at just 13.9X forward earnings and sports a yield of 2.41%. The point being, the underperformance has created value for those value-oriented types.

The anticipation of the impact of GLP-1 drugs has influenced specific stocks and sectors both positively and negatively, and that’s not likely to change. Given this potential and the topic in the popular lexicon, we think that understanding what GLP-1 drugs are and how they are impacting markets is important, especially for those interested in either side of this trade.

Did you like what you just read? Do you want this kind of analysis every morning before the market opens? If so, then you need to subscribe to the Eagle Eye Opener, today.

For just a skinny price, you can read about all kinds of ways to make your pockets fat!

***************************************************************

Just Say ‘Yes’

Move me on to any black square

Use me anytime you want

Just remember that the goal

Is for us all to capture all we want

Don’t surround yourself with yourself

Move on back two squares

Send an instant karma to me

Initial it with loving care

— Yes, “I’ve Seen All Good People”

Through references to chess, and specifically the movement of the Queen’s Bishop, prog-rock masters Yes wisely remind us that when we surround ourselves with those who think the same way we do, we can get trapped in a confirmation bias that stunts our ability to win the game. So, always try to take a couple of steps back and be sure you are grounded and fully aware of your circumstances. It’s only then that we can move forward toward our goal of capturing all we want.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

![[blue capsules spilling out of a bottle]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_89193115.jpg)