Three ways to invest in Central Asia’s IT Boom amid rapid digital technology development.

Three ways to invest in Central Asia’s IT boom open a path to a region that historically has served as a significant crossroads of civilizations, bridging the gap between the East and the West.

While intellectual technology (IT) incurred a setback during the Soviet era, things are changing now. Having a young and exponentially growing population of over 78 million people, Central Asia, comprised of five former Soviet republics — Kazakhstan, Kyrgyzstan, Turkmenistan, Tajikistan and Uzbekistan — is seeking to become a global tech force.

For the past twenty years, Central Asia’s aggregate gross domestic product (GDP) has increased fourfold in real terms. A 2022 report from the Eurasian Development Bank (EDB) indicated that Central Asia is a region with high development potential in the upcoming years, with its aggregate GDP now standing at about $347 billion.

Three ways to invest in Central Asia’s IT boom: Kazakhstan and Uzbekistan

Kazakhstan is the leading economy in the region, growing from $18.3 billion in 2000 to $197.1 billion in 2021, followed by Uzbekistan, whose economic reforms are responsible for a long-term significant economic growth of $52 billion (from 2000 till 2021). Kyrgyzstan is seeking to tap its economic potential by using hydroelectric power, Tajikistan is planning to use the potential of its comparatively young demographic to fuel economic development and Turkmenistan is aiming for increased growth by diversifying its economy.

Moreover, as of fall 2023, World Bank predictions forecast the region’s GDP strengthening to 4.8% by year-end 2023 and maintaining an average of 4.7% in the next couple of years. One area driving economic growth is the potential for Central Asia to establish itself as a robust digital market, propelled by the exponential increase in internet users across the region.

“With Uzbekistan’s government providing tax benefits to businesses, the country might be creating an even better climate for economic development than the established market,” said Sherzod Shermatov, the Minister of Digital Technologies of Uzbekistan.

“This is the main message,” Shermatov said. “We want to help you grow your business with us.”

Three Ways to Invest in Central Asia’s IT Boom: Digital Silk Road

The ancient Silk Road is now becoming a digital one in the present day. At the recent ICT Week Startup Summit, 2023 held in Tashkent, Uzbekistan, leaders from Uzbekistan, Kyrgyzstan and Kazakhstan convened to discuss the IT transformation during the “Central Asia’s Emerging Digital Market” panel discussion. Highlighting the recent World Bank report, the discussion’s moderator, Vladimir Norov, co-founder and chairman of the Central Asia Association of Artificial Intelligence, emphasized the role of the COVID-19 pandemic and ongoing military attacks by Russia’s forces in Ukraine. These factors have spurred increased investment and engagement by foreign companies to foster expanded development in the region.

“When you talk to the attractiveness for foreign investors, we don’t talk about Uzbekistan, Kazakhstan, Kyrgyzstan, Kazakhstan, we are talking about the full region; it’s the Central Asia region,” said Abdulahad Kuchkarov, first deputy director of the IT Park Uzbekistan, during the panel.

Two countries, Kazakhstan and Uzbekistan, have been particularly at the forefront of the digital transformation of Central Asia. A report by the Asian Development Bank in 2022 identified six main sectors that would benefit from digital advances, while boosting regional cooperation: health care, education, agriculture, finance, trade and tourism.

However, despite the growing regional cooperation, a lack of capital investment remains a challenge for the countries. Nonetheless, according to the Uzbekistan Institute of Macroeconomic and Regional Studies, regional cooperation increased 1.3 times over five years (2017-2021). These sustained joint investment efforts triggered regional growth and resulted in enhanced investment flows.

Three Ways to Invest in Central Asia’s IT boom: 5%-Plus GDP

Moreover, the European Bank for Reconstruction and Development (EBRD) in its latest Regional Economic Prospects (REP) reported forecasts of 5.7% GDP growth in Central Asia in 2023, with annual growth of 5.9% in 2024. This growth is primarily driven by international trade, China’s economic reopening and increased government spending.

The strong focus on regional cooperation is expected to offer more investment opportunities in the future, allowing investment in international stocks and local stock exchanges to capitalize on Central Asia’s burgeoning IT boom amid growing digital technology developments.

Here are the three ways to invest in Central Asia’s IT boom amid rapid digital technology development.

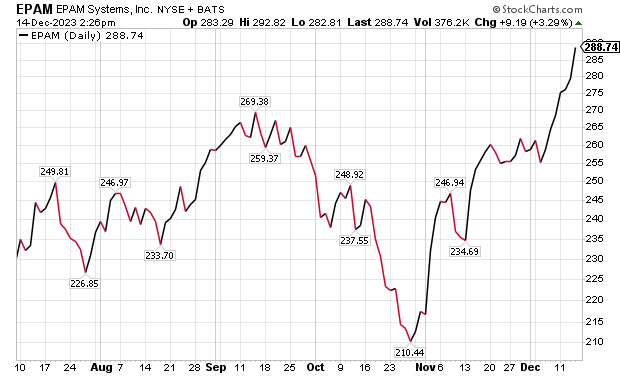

First of Three Ways to Invest in Central Asia’s IT Boom: EPAM Systems Inc.

The first way of investing in the region is through EPAM Systems Inc. (NYSE: EPAM), which is establishing a growing presence in the Central Asian market.

EPAM Systems Inc., founded in 1993 and headquartered in Newtown, Pennsylvania, provides digital software product development and platform engineering services worldwide in over 50 countries with 55,600+ clients.

Within the scope of information technology, these services specifically include Software Product Development, Custom Application Development, Application Testing, Enterprise Application Platforms, Application Maintenance, and Support and Infrastructure Management. These services are primarily offered as solutions in financial services, travel and consumer, software and high technology, life sciences and health care. The overall focus is on innovative and scalable software solutions.

The company operates in three central regions: the Americas, Europe, the Middle East and Africa (EMEA) and Asia-Pacific (APAC). Within EMEA, EPAM Systems has offices in Uzbekistan (Tashkent) and Kazakhstan (Almaty, Astana and Karaganda). Moreover, EPAM Systems employs 59,300 people and has amassed a total revenue of $4.84 million in the past 12 months.

Three Ways to Invest in Central Asia’s IT Boom: Undervalued Stock

EPAM Systems, a global digital transformation services and product engineering company, looks to be an undervalued stock with a market capitalization of $15.875 billion, as of December 2023. Meanwhile, the price-to-earnings (P/E) ratio) is at 34.26, with a 52-week range of $197.99 – $385.96 (Yahoo Finance). As for EPAM’s profitability, the Stock Rover financial service estimates five-year earnings per share (EPS) growth of 4.9%, as well as 4.3% sales growth in the next year. That makes the stock a good buy at the moment.

The third-quarter earnings report released on Nov. 2, 2023, showed better-than-expected results. Despite the decline in revenue by 6.1% year-over-year, the company recorded an increase in revenues from the EMEA region by 1.8% year over year.

The overall rating of the stock vs. its peers, according to Stock Rover, is 98/100, with valuation (89), efficiency (92) and financial strength (96) scoring exceptionally high. The stock received lower ratings of 53 out of 100 for growth and 79 of 100 for momentum.

The year-to-date (YTD) S&P 500 returns on the stock showed 21.7%, as of December 12, 2023. Out of 15 analysts who track EPAM Systems, Stock Rover reported that seven called the stock a strong buy, while six rated it as a hold, making the consensus analyst rating a buy.

EPAM Systems Inc. competes with other companies like Virginia-based Dxc Technology Company (NYSE: DXC), New York-based Kyndryl Holdings Inc. (NYSE: KD), and Virginia-based CACI International Inc. (NYSE: CACI).

On Oct. 31, 2023, EPAM signed a strategic collaboration agreement with Amazon Web Services (AWS) to expand its club engineering capabilities and help its clients scale up cloud-native development to find solutions to business challenges using artificial intelligence (AI).

Source: StockCharts.com

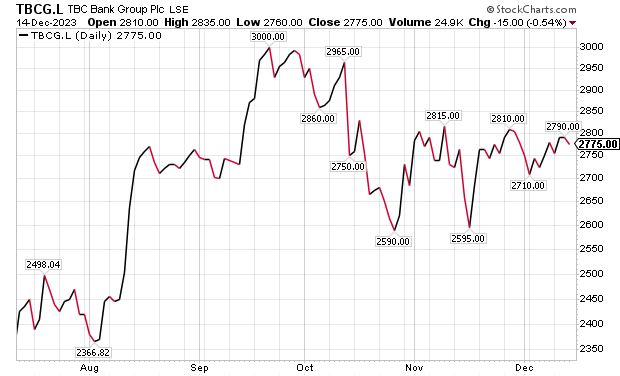

Second of Three Ways to Invest in Central Asia’s IT Boom: TBC Bank

The second way of investing in the region is through TBC Bank, which is traded on the London Stock Exchange and is establishing a growing presence in the Central Asian market.

TBC Bank Group PLC (LSE: TBCG.L), a London-based banking group founded in 1992 and previously headquartered in Tbilisi, Georgia, provides banking, leasing, brokerage, insurance and card processing services to individual and corporate customers in Georgia, Azerbaijan and Uzbekistan.

The company operates in many segments, including corporate, micro, small and medium enterprises, corporate centers and others, with retail making most of the company’s revenues. Additionally, TBC Bank is also a provider of internet, mobile, remote, SMS banking and wallet-related services.

The company employs approximately 10,700 employees worldwide and has a market capitalization of $1.548 billion with a P/E ratio of 5.01, as of December 2023 (Yahoo Finance). The total sales of the company reached $965 million over the past 12 months. The stock’s 52-week range spanned $2,055.00 – $3,095.00, as of December 12, 2023 (Yahoo Finance).

According to Stock Rover, the stock seems promising in growth, scoring 95/100 with sales five-year average rising 18.9%. The stock is also profitable, given its score of 85/100 with a net margin of 44.0%. Furthermore, the dividend yield of this stock is 8.1%.

According to Simply Wall St, the company currently is trading 40.6% below its estimated fair value and its earnings are forecast to grow 16.03% per year, after gaining 23% during the past five years.

The main competitors of the company are Japan-based Yamaguchi Financial Group Inc. (OTC: YFGSF), Cyprus-based Bank of Cyprus Holdings Public Limited Company (OTC: BKCYF) and Indonesia-based PT BankBTPN Tbk (OTC: BTPNF). As far as its price-to-earnings ratio vs. peers, TBC Bank appears to be a good value. TBC Bank has a P/E ratio of 4.8x, compared to its peers who average 7.7x.

TBC Bank has made a significant impact in Central Asia in recent years. In Uzbekistan, it has attracted $28.1 million in capital from shareholders. This investment was created with the European Bank for Reconstruction and Development (EBRD), the International Finance Corporation (IFC) and TBC Bank Group PLC. The investment was directed towards TBC Bank Uzbekistan (TBC UZ), aimed at bolstering TBC UZ’s position in the local banking market and contributing to the digitalization of the country’s banking sector.

The bank also started investing in Uzbekistan’s IT sector, which has been booming over the past seven years. For instance, it acquired a 51% stake in Payme, a payment service provider, for $5.5 million, making it the most significant investment in IT companies in Uzbekistan. More recently, TBC Bank launched a feature to enable accepting international online transfers, according to spot.uz. These are just a few examples of how the bank expands its regional reach and operations.

Source: StockCharts.com

Third of Three Ways to Invest in Central Asia’s IT Boom: Open a Brokerage Account

The third way to invest in the region is by opening a brokerage account, allowing investors to buy shares on the local Uzbek stock exchange and other regional stock exchanges.

Uzbek Commodity Exchange (UzEx), located in the capital of Tashkent, Uzbekistan, is the biggest trading platform in the Central Asia region. It has an extensive trade infrastructure of 13 branches in various regional centers with more than 100 trading platforms and 7,000 brokerages providing stock services for global investors.

“Privatization is happening both through the public markets via IPOs and through strategic sales,” said Quinn Martin, president of the New York-based Bluestone Investment Bank that focuses on Central Asia.

However, the Uzbekistan government recently abandoned its proposed plan of selling 2% of state-owned companies through initial public offerings (IPOs). Under that plan, Uzbekistan intended to offer investors a chance to buy up to 2% of the shares in companies that the government planned to privatize through a public auction on a local stock exchange. An IPO of Uzbekneftegaz, an integrated natural gas and liquid hydrocarbons producer in the Central Asian nation, and 39 other state-owned enterprises were approved in a March 24 decree by the President of Uzbekistan, but the innovative idea later was dropped.

Such a privatization could have led to complications, since offering just 2% of selected state-owned companies in IPOs may have caused those shares to become highly illiquid in the secondary market. A small local public offering may have inadvertently set a low benchmark price and hurt the prospects of a larger international listing in the future.

American investors can gain exposure to Uzbekistan by investing in Asia Frontier Capital’s Uzbekistan Fund (AFC Uzbekistan Fund), managed by its Chief Investment Officer Scott Osheroff, which has delivered 78.52% growth since its inception in 2019. Direct trading for foreign investors can be done by opening a Uzbek brokerage account with a locally licensed investment bank like Bluestone and others.

The AFC Uzbekistan Fund’s strategy is to offer high returns for investors from growth in the equities market. In the long term, the fund wants to capture value in listed growth companies in 5-7 years to achieve capital appreciation. The goal is to focus on private companies and government privatizations.

Third of Three Ways to Invest in Central Asia’s IT Boom: CONCLUSION

Central Asia is experiencing remarkable growth. Just a few years ago, this region remained largely unknown to the world, but it now aims to establish itself as a central hub for digitalization and technology in the future. Factors such as exponential demographic growth, an intensified focus on English education, growing opportunities in private education, and a surging IT outsourcing sector contribute to the region’s potential as a highly attractive investment destination.

“The demographics are mind-blowing,” Martin said. “More babies were born here last year than in the UK, Ireland, Norway, Sweden, Finland and Denmark combined. The word is out that everyone needs to learn English. The opportunities in private education are immense.”

Amid escalating global investments, the former Silk Road countries are actively working to attract more investors from the region and abroad. They are forging partnerships and offering opportunities on both local and international stock exchanges in a bid to enhance their appeal and foster increased investment.

“Uzbekistan is in the early days of a 10- or 20-year boom cycle,” Martin said. “Buckle up.”

Three ways to invest and profit from Central Asia’s IT boom include EPAM Systems, TBC Bank and opening a local brokerage account.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)