As we wind down 2023, let’s look at those exchange-traded funds (ETFs) that haven’t quite hit the high notes.

In this analysis, we’ll dive into the realm of dividend ETFs that could potentially rebound as flight-to-safety plays, if there is a recession next year. If you’re up for braving a bit of risk in the coming year, consider taking the leap and investing.

Despite their underwhelming performance, dividend growth funds have become the go-to strategy for long-term investors seeking a steady income flow. These ETFs will not only infuse a portfolio with cash, but also offer a chance for investors to diversify.

One ETF that caught my eye is the Invesco High Yield Equity Dividend Achievers ETF (PEY). This smart-beta index fund selects 50 of the highest-yielding dividend stocks from the NASDAQ U.S. Broad Dividend Achievers Index. With a decade-plus track record of raising dividends, this ETF is worth considering. Even if it may lag during strong markets, it performs extraordinarily well during periods of low and negative equity returns.

What makes dividend funds like PEY even more attractive to investors is the fact that it pays dividends monthly and has continually increased its income contributions in the past 10 years. Having invested at least 90% of its total assets in stocks with dividend increases ensures consistent growth.

Not all dividend stocks qualify for PEY. To earn a spot in this ETF, companies must have a solid track record — boosting their annual regular cash dividend payments for the last 10 consecutive calendar or fiscal years. Additionally, companies must meet a minimum market capitalization mark of $1 billion to be eligible for inclusion. The index is reconstituted annually and rebalanced quarterly on a rigorous schedule.

PEY boasts a diverse portfolio, allocating to various sectors, including financials, utilities, consumer staples, materials, communications services, consumer discretionary, industrials, energy, information technology, real estate and health care. There is something for everyone in this diverse mix, so why not consider investing?

Geographically speaking, this ETF seems to provide an interesting opportunity for investors, with a total of 97.87% of holdings based in the United States and the remaining holdings based in Switzerland (2.13%).

However, it is important to stay vigilant of the risks involved with investing in dividend ETFs like PEY. One risk is the possibility of a negative return.

Top holdings in the portfolio include Verizon Communications (NYSE: VZ), Altria Group Inc. (NYSE: MO), Universal Corp (NYSE: UVV), KeyCorp (NYSE: KEY), The Scotts Miracle Gro Co. Class A (NYSE: SMG), Northwest Bancshares Inc. (NASDAQ: NWBI), Truist Financial Corp. (NYSE: TFC), Lincoln National Corp. (NYSE: LNC), Walgreens Boots Alliance Inc. (NASDAQ: WBA) and Sandy Spring Bancorp Inc. (NASDAQ: SASR). These constitute 28.49% of total assets according to Yahoo Finance. Overall, there is a total of 50 holdings in the PEY portfolio.

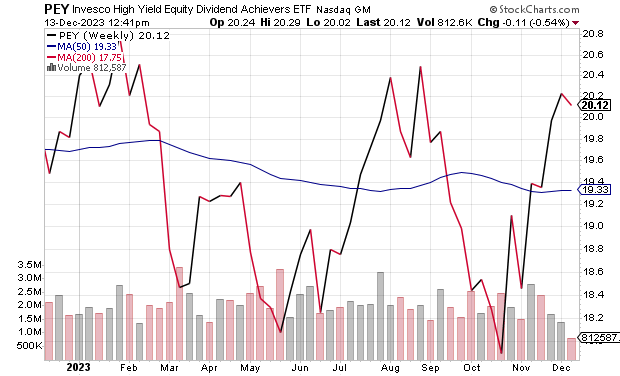

As of December 12, 2023, this fund is up by 5.91% over the past month, 0.87% for the past three months and 1.13% year to date.

The fund has $1.3 billion in net assets under management, and an expense ratio of 0.52%. The year-to-date daily return of the fund is 2.19% and the current dividend yield is 5.12%, as of Dec. 11. Meanwhile, the price-per-earnings (PE) ratio recently stood at 10.71.

Source: StockCharts.com

Overall, dividend ETFs hold promise for long-term investors seeking high-yield returns. Dividend ETFs such as PEY show their potential resilience amid market uncertainty. While PEY boasts a track record of dividend growth and a diverse portfolio, investors must navigate eligibility criteria and associated risks.

With its predominantly U.S.-based holdings, coupled with a sprinkle of Swiss assets, recent gains and manageable expenses, PEY may seem alluring. Yet, investors should be familiar with the associated risks.

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)