“Don’t buy what’s hot — buy what’s not!” — Rick Rule (“Maxims of Wall Street,” p. 38)

Special Note: Attention all holiday shoppers and subscribers: Orders for my books are still coming in. Before I left on my Latin American cruise, I signed copies of the new editions of “The Maxims of Wall Street” and “Economic Logic.” Yes, there’s still time to order copies of my books in time for Christmas at www.skousenbooks.com. See more details below.

My wife and I are on a two-week Latin American cruise sponsored by Eagle Publishing. All the talks by the Eagle editors — George Gilder, Jim Woods, Dave Phillips, Jim Woods, Bryan Perry, Keith and Michele Schneider and myself — focus on U.S. stocks, which have outperformed all other stock markets around the world.

Wall Street reacted positively after the Federal Reserve announced yesterday that it plans to reduce interest rates next year.

The U.S. dollar fell on the news, causing commodity prices such as gold, oil and bitcoin to rally. Gold is again over $2,000 an ounce.

New Opportunities in Latin Stocks

It made me wonder if, finally, there’s an opportunity to make money in emerging markets, especially Latin America.

I’m giving a talk on Latin America on the cruise. For a variety of reasons, the stock markets of Mexico, Brazil, Argentina and other Latin countries have stagnated in the past dozen years while Wall Street has been hitting new highs.

One has to be a bit of a contrarian to invest in stocks south of the Mexican border. But there are a few bright spots, such as Chile and Panama. They are the only two Latin American countries that qualify as “mostly free” nations according to the Fraser Institute’s Economic Freedom Index.

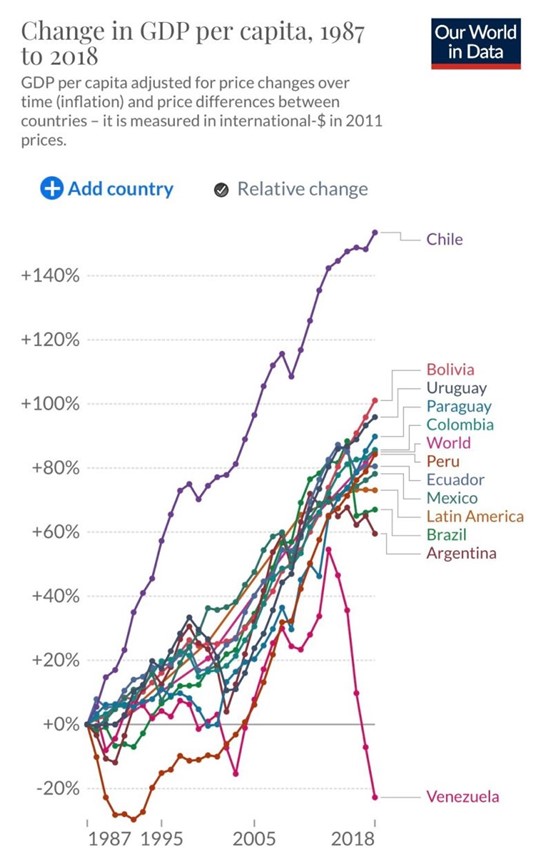

A few years ago, José Piñera, the former Labor Secretary of Chile and a Cato scholar sent me this remarkable chart.

This chart says it all about the best way to achieve success in Latin America — governments need to adopt the free-market model from Chile’s Chicago boys and avoid the tragedy of Venezuela’s Marxists.

Could Argentina Return to Its Glory Days?

Perhaps the trend is changing. We could start by assessing the possibility of a dramatic turnaround situation in Argentina. At the turn of the 20th century, Argentina was among the top ten most prosperous countries in the world.

Then a series of events caused this great nation to enter a period of economic decline, thanks to the socialistic authoritarian policies of Juan Peron (1895-1974), who was dictator from 1946 to 1955, followed by a brief comeback in 1973-74. The Peronistas have been in power ever since, adopting protectionism, high taxes, inflation, unionism, corruption, nationalization of industries and other anti-growth policies.

Suffering from slow growth and triple-digit-percentage inflation, apparently, the citizens of Argentina had had enough.

Last month they elected a libertarian economist, Javier Milei, who has vowed to dismantle the excesses of the socialist welfare state.

In Monday’s inauguration speech, he promised to stabilize the country’s budget by slashing wasteful government spending, dismissing unproductive workers and eliminating inflation by adopting the U.S. dollar as its currency. His shock therapy will face an uphill battle with fierce opposition from the Peronistas and the unions. Yet he has public support, having won a decisive victory in the national elections. I’m optimistic. If Chile can do it, why can’t Argentina?

The Economic Miracle of Panama

As part of our tour, we went through the Panama Canal, one of the wonders of American engineering. Panama City has also boomed as a financial center, attracting flight capital and immigrants from all over South America, especially Venezuela, which has been a disaster zone thanks to the Marxists who took over there over twenty years ago.

When I first visited there in the late 1960s, Panama was poverty stricken, except for the Panama Canal Zone. There was not a single skyscraper in the city. But government officials adopted a number of pro-market decisions, including dollarization, a duty-free zone in Colon and low-cost financial services. Now there are hundreds, and Panama City looks like Hong Kong.

Dave Phillips and I toast Panama with a Malta drink.

According to the International Monetary Fund (IMF), Panama’s gross domestic product (GDP) has been the fastest-growing in Latin America over the past 25 years.

Dollarization: An Easy Way to Fight Inflation

Adopting the dollar was a smart move. By abolishing their central bank, inflation was subdued. Fifty years ago, their Balboa currency traded one-to-one with the US dollar. Today it’s still one-to-one.

Fifty years ago, the Honduras currency, the Lempira, was pegged two-to-one to the dollar. Today it’s 25-to-1.

You can see why Argentina’s new president is keen on converting the peso to the dollar.

My Visit to an “Enterprise Zone” in Honduras

Here’s another example of how things are changing for the better in Latin America.

As part of our Latin American cruise, we visited the island of Roatan off the coast of Honduras, where a great experiment in free-market capitalism is taking place.

We were guests of the organizers of Prospera, a special enterprise zone created over ten years ago in Honduras. Private investors have poured hundreds of thousands of dollars into this private city, building an industrial park, agricultural development, office and residential space and a first-class golf course and hotel resort, all with private funds. I’ve admired their efforts to create free-market capitalism in Latin America.

They’ve made great progress even without the support of the current Marxist government (the president’s last name is Castro!) and no financing from the local banks. The fight with the communists is very real, and the outcome is still uncertain, but they have certainly made a valiant effort to create a market-friendly environment in Latin America. For more information, go their website.

There are plenty of ways to invest in various country funds (Mexico, Brazil, Argentina, etc.) through exchange-traded funds in Latin America.

Three Great Books for the Holidays

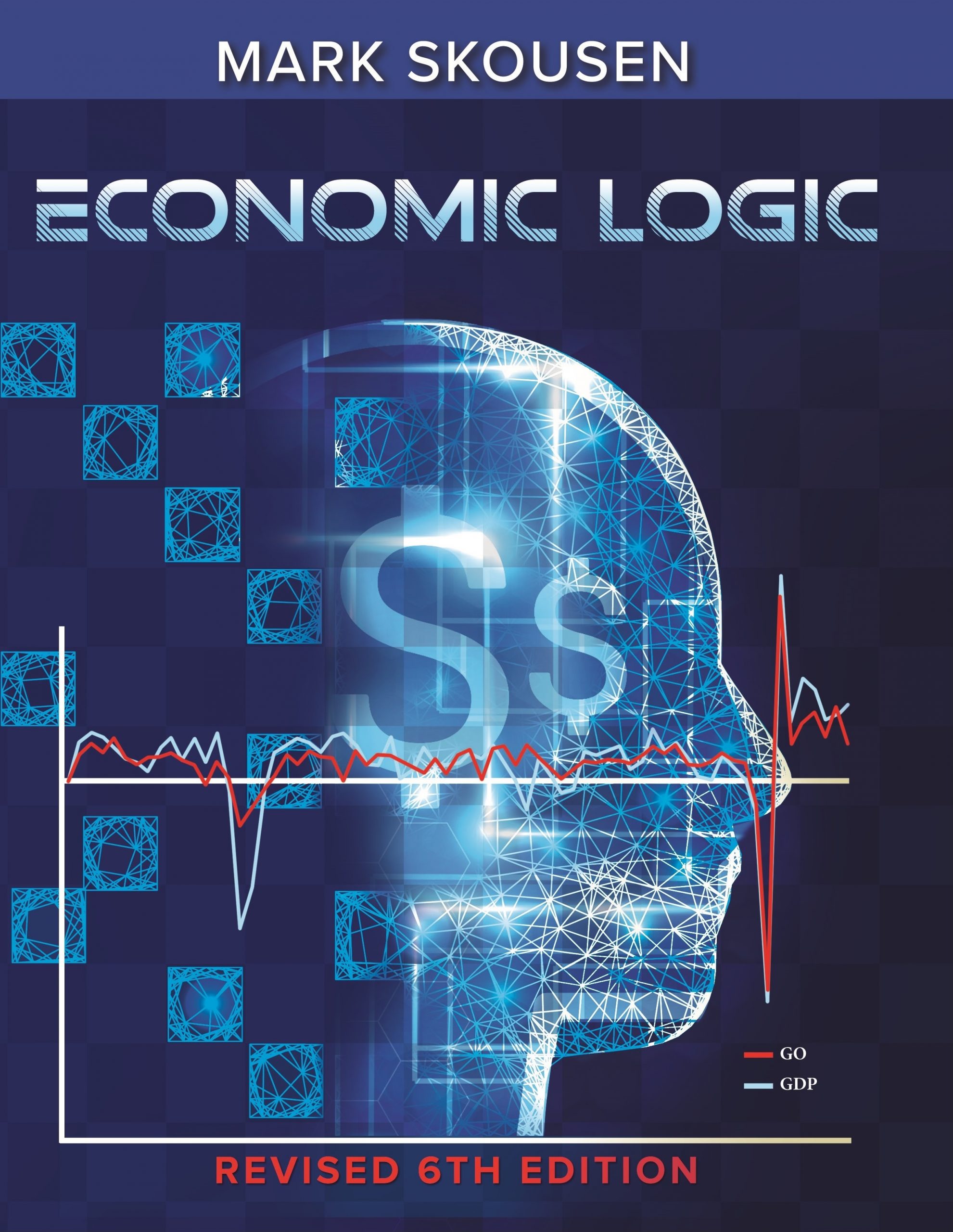

Christmas is only a few weeks away. Now is the time to order these books for the holidays. The 6th edition of “Economic Logic,” my free-market textbook, arrived last week. For more information on why my textbook is unique, go here. The retail price is $129.99 a copy, but I sell it for only $35 postpaid at http://skousenbooks.com/.

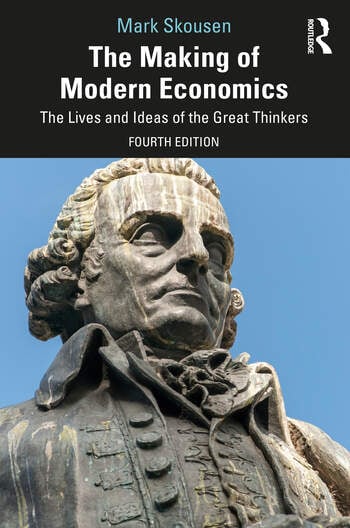

The 4th edition of “The Making of Modern Economics” is also available. I also sell it at a substantial discount — only $35 postpaid.

Last, but not least, the new 10th edition of “The Maxims of Wall Street” is now available.

What better gift to give your friends, relatives, clients and your favorite stockbroker than the new 10th edition of “The Maxims of Wall Street.”

I’ve added some 20 new quotes to the new edition.

“Maxims” has been endorsed by Warren Buffett, Jack Bogle, Kim Githler, Alex Green and Bert Dohmen and has been reviewed favorably by Barron’s.

It makes an ideal gift during the holidays for family, friends, clients and your favorite stockbroker or money manager. As Rodolfo Milani states, “I find them to be ideal gifts for my best clients.”

‘Maxims’ at a Super Discount

Despite rising inflation and shipping costs, I’ve managed to keep the price of the new 10th edition to only $21 for the first copy, and only $11 for all additional copies. And if you order an entire box (32 copies), the cost is only $327 (around $10 each).

I pay all shipping costs if mailed to any of the 50 states. Plus, I autograph and number each copy. The book is a real keepsake!

To order copies of any of these three books, go to http://skousenbooks.com/.

Upcoming Investment Seminar

Orange County AAII Conference, Saturday, January 20, 2024: If you live in Southern California, please join me for my two-hour presentation on the outlook for stocks, commodities and real estate, 9 — 11 a.m. at the Center of Founder’s Village, 17967 Bushard Street, Fountain Valley, CA 92708. Parking is free, but there is a $5 charge for attending this event sponsored by the Orange County chapter of the American Association of Individual Investors. See you there!

Good investing, AEIOU,

![]()

Mark Skousen

You Blew it!

California is Going Broke Again

Following up on last week’s debate between Florida Governor Ron DeSantis and California Governor Gavin Newsom, it turns out that California’s budget is going broke while Florida’s budget has a record high surplus.

California announced last week that it faces a record $68 billion budget deficit in 2023, thanks to a weak real estate market and the costs associated with extreme weather (including fires).

Meanwhile, on the other side of the country, Florida is flush with cash — a $7 billion surplus in its budget.

And this despite the fact that California has higher gasoline taxes, higher income taxes and high sales taxes.

Steve Moore, chief economist at the Heritage Foundation, concludes:

“Gavin Newsom is fiscally unfit to be president of the United States. Second, balancing the budget by continually raising taxes is a fool’s errand. The state with the highest taxes has the biggest deficit.”