Three aviation stocks to buy as ways to diversify offer alternatives to Boeing (NYSE: BA) amid its quality control concerns after a Jan. 5 mid-air malfunction of a 737 MAX 9 when a door plug blew off at 16,000 and required an Alaska Airlines (NYSE: ALK) flight to make an emergency landing in Portland, Oregon.

Image of damaged Boeing 737 MAX 9 courtesy of the National Transportation Safety Board

The three aviation stocks to buy offer exposure to an industry currently benefitting from rising demand for air travel as wars are boosting military aerospace needs. Selected aviation stocks could be a good addition to the portfolios of investors who may want to diversify beyond technology stocks.

In 2023, technology stocks rebounded strongly after a dismal 2022 when they averaged a drop of 33%. Buoyed by its concentration in technology stocks, NASDAQ jumped 43% in 2023 to mark its best performance since 2020.

Former pension fund chairman Bob Carlson, who heads the Retirement Watch investment newsletter, advocates diversification and typically recommends funds to help avoid excess exposure to individual stocks. He cautions that the past year’s big winners often cannot repeat the success as investors rotate into other sectors.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

Three Aviation Stocks to Buy as Ways to Diversify: Heico

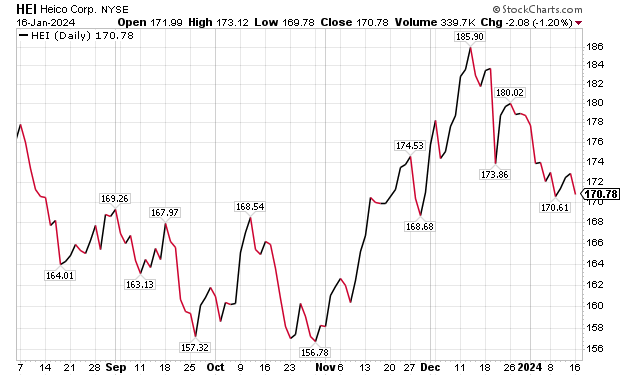

Hollywood, Florida-based Heico Corporation (NYSE: HEI), rated as “outperform by the William Blair investment firm in Chicago, announced on Jan. 16 that its Sunshine Avionics subsidiary entered an exclusive perpetual license and acquired key assets from Honeywell (NYSE: HON) to produce, sell and repair Boeing 737NG and Boeing 777 Cockpit Displays and Legacy Displays. Financial terms for the transaction were not disclosed, but Heico leaders said the acquisition would be accretive to earnings in the year after the transaction’s closing.

Last October, VSE Corporation (NASDAQ: VSEC) established a similar licensing agreement with Honeywell for fuel control systems, with VSE paying $105 million for that transaction. The deals show Honeywell’s plan to divest aerospace assets and licenses to other partners like Heico.

In addition, Heico is still in the process of integrating Wencor into its business, wrote Louie DiPalma, an aerospace and defense analyst with William Blair. In that deal, Heico paid $2.1 billion for Wencor.

However, Heico’s management previously had expressed an interest in reducing its debt and not not focusing on acquisitions within its Flight Support Group, DiPalma wrote in a Jan. 16 research note. The valuation of Heico’s shares that trade at 42 times forward year earnings is below its five-year average of 48 times but at a premium to its peers, DiPalma pointed out.

“We believe the premium to peers is warranted because of Heico’s lower leverage relative to competitors, proven business model and high margins,” DiPalma wrote. “In our view, the biggest risk to Heico shares is another COVID-like pandemic reducing demand for air travel.”

Chart courtesy of www.stockcharts.com

Three Aviation Stocks to Buy as Ways to Diversify: Textron

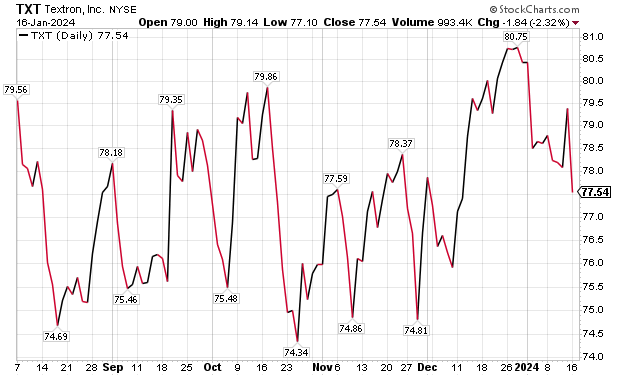

Textron Inc. (NYSE: TXT), of Providence Rhode Island, has a mission of offering innovative defense, government and aerospace technologies and services. With its aim to defend, protect and support its customers, Textron earned a “buy” rating when Citigroup began to cover it last July.

If a recession is thwarted, the potential upside of Textron’s stock at 15-20% during the next 12 months, said Michelle Connell, president and owner of Dallas-based Portia Capital Management, LLC.

“Given the current volatility and nervousness of the market, I would not take any position until specifics on earnings and some signaling on future orders is given,” Connell counseled. With Textron next reporting financial results on Jan. 24, the wait for such guidance will not be long.

Michelle Connell heads Portia Capital Management LLC.

Due to its mid-cap status, the stock has gained 11% during the past 12 months. Its mid-cap size did not allow it to participate in the large-cap rally, Connell told me.

Textron’s debt-to-equity ratio is about .49. That manageable debt level is important with interest rates high and the possibility of a recession around the corner, Connell told me.

During the past 10 years, Textron has generated an average $1.125 billion in cash flow each year. Another plus is that the stock was included in the Goldman Sachs (NYSE: GS) 2024 conviction list, with a 22% upside estimate, Connell continued.

Chart courtesy of www.stockcharts.com

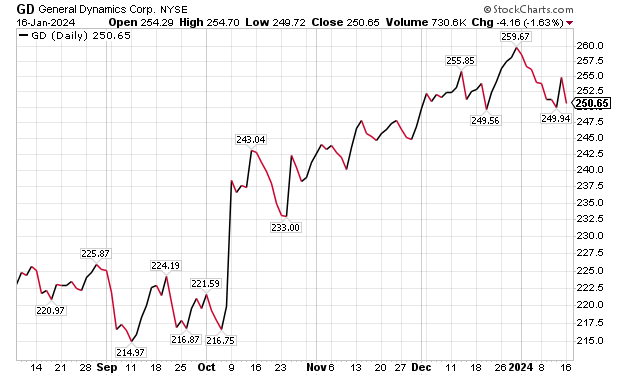

Three Aviation Stocks to Buy as Ways to Diversify: General Dynamics

Reston, Virginia-based General Dynamics (NYSE: GD) is an aerospace stock that DiPalma recommends with an “outperform” rating. The company’s technology division has experienced bookings momentum over the past two quarters that should allow it to continue to notch solid growth despite the loss of a computer hardware system (CHS-6) contract with the U.S. Army last September, DiPalma wrote in a Jan. 11 research note. At the same time, the Gulfstream G700 certification slipped out of the fourth quarter and will pressure fourth-quarter earnings, he continued.

“In our view, the G700 delay is related to timing rather than any quality concerns,” DiPalma wrote. “We expect General Dynamics’ shares to have a strong 2024 as supply chain constraints ease.”

General Dynamics has more than 100,000 employees in 70-plus countries. A key business unit of General Dynamics is Gulfstream Aerospace Corporation, a manufacturer of business aircraft. Other segments of General Dynamics focus on heavy mobile military equipment such as Abrams tanks, Stryker fighting vehicles, ASCOD fighting vehicles like the Spanish PIZARRO and British AJAX, LAV-25 Light Armored Vehicles and Flyer-60 lightweight tactical vehicles.

For the U.S. Navy and other allied armed forces, General Dynamics builds Virginia-class attack submarines, Columbia-class ballistic missile submarines, Arleigh Burke-class guided missile destroyers, Expeditionary Sea Base ships, fleet logistics ships, commercial cargo ships, aircraft and naval gun systems, Hydra-70 rockets, military radios and command and control systems. In addition, the company provides radio and optical telescopes, secure mobile phones, PIRANHA and PANDUR- wheeled armored vehicles and mobile bridge systems.

Chart courtesy of www.stockcharts.com

Two-Man Team Profits with Aviation and Aerospace Stocks

A pair of proponents of aviation and aerospace stocks are Mark Skousen, PhD, and seasoned stock picker Jim Woods. The two-man team heads the Fast Money Alert advisory service. They recently took a profit in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert. LMT is a alternative way to invest in aviation and aerospace without the drama Boeing will be incurring in the months ahead as regulators look to identify the root cause of the in-flight Boeing 737 MAX 9 emergency and require manufacturing reforms to prevent any recurrence.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Military Demand Soars Amid Wars

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov 16 at a national security conference. Prime examples of the need are raging wars in Ukraine and the Middle East, as well as a cold war involving China and its strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel triggered ongoing fighting in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the national security conference held at Johns Hopkins University.

Russia’s 360-foot-long Novocherkassk war ship was damaged on Dec. 26 by a Ukrainian attack on a Black Sea port in Crimea. This video shows the ship exploding at the port when struck by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can require immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins attendees of a critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg remarked before the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center.

Michael Bloomberg, philanthropist and founder of Bloomberg L.P.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

The three aviation stocks to buy as ways to diversify provide alternative paths to profit than technology stocks that tend to rise and fall faster than most other sectors.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.