How often have you said, “I don’t invest in that…”

…only to watch everyone else make a mint?

Anyone who avoids Chinese stocks like the plague missed out on a 10% rally in less than two weeks, with names like Alibaba jumping over 17%.

You’re guaranteed to NEVER make money in the stocks you avoid.

However, maybe it’s time to adjust your thought process.

Look, there’s no question that China’s repressive government hates free markets.

Jim Woods painted a dark portrait of America’s future in his latest report.

So, there’s good reason to say “No thanks” to holding any Chinese stock long-term.

But what if you didn’t look at these as investments but bets you might make?

Anyone who’s played Texas Hold ‘Em knows you push your chips in if you’re holding pocket rockets (two Aces).

However, it wouldn’t be wise to pull a second mortgage on your home and dump it all on that one hand. Because even if you’re the statistical favorite, you can still lose.

We want to offer a three-step strategy approach for those interested in playing the Chinese market.

By treating these as bets, you open up a new set of profitable plays that you can structure to match your style and goals.

Step #1 – Find a Comparable U.S. Company

Investing is all about balancing risk and reward.

When risk increases, we demand a higher reward.

Believe it or not, there are many profitable Chinese companies: Alibaba, Baidu, Yum China, etc.

However, we know China’s government can and does change the rules of the game at any time.

We saw it crack down on perceived “data sharing,” destroying companies like Didi overnight.

And when companies like Alibaba get too big, the government clamps down through arbitrary regulations.

This risk doesn’t exist for U.S. companies.

To compensate for this risk, investors discount the shares of the Chinese company.

This is known as country-specific risk.

To see how this works, let’s consider two companies: Baidu and Google.

Both companies largely operate the same way. They are the prominent internet search engines in their respective countries, making most of their money through advertising.

Yes, there are other differences we could account for with a deeper analysis. However, these two are close enough for our purposes.

We can use these two companies to figure out the discount placed on Chinese companies relative to similar U.S. companies.

Now we have what we need to calculate the spread or the discount being placed on Chinese companies.

Step #2 – Calculate the Spread

What metrics would you use to calculate the value of a stock?

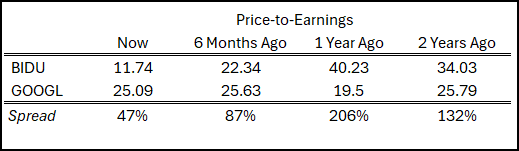

The most popular is the price-to-earnings ratio.

So, we need to calculate those values for the stocks and then the spread between the stocks.

Lastly, we need to look back, say, six months, a year and two years to see how the current discount compares to the historical figures.

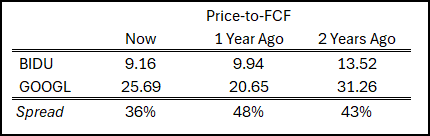

It’s always a good idea to use other valuation measures for this analysis.

So, we’ve pulled the price-to-free-cash flow ratios for Baidu and Google as well.

Note: Chinese companies don’t report free cash flow on a quarterly basis

Now that we have data, here’s how you analyze them.

Step #3 – Look for Extremes

The goal of this analysis is to find places where valuations are stretched and place bets they will snap back to the average.

What might that look like?

Immediately, we can see that Baidu’s stock now trades at 47% of the value of Google’s based on earnings.

Yet, six months ago, it was only being discounted by 13%.

And a year ago, it actually traded at a premium.

Was this an aberration?

Maybe. But Baidu traded at a premium two years ago as well.

However, we see the same expansion and contraction in free cash flow.

Using this information, we could assume that Baidu now trades at an extreme discount relative to Google.

So, we’d make a bet the discount on Baidu’s stock should move back to the historical average.

Does This Guarantee a Win?

Of course not.

No one can make that claim because no one can control the outcome.

We CAN make smarter decisions.

The process we outlined isn’t limited to Chinese stocks.

You now have a method to compare any type of equity or asset.

However, there’s one last piece of the puzzle to pull this all together.

This entire strategy is pointless if you don’t understand what’s happening and how everything fits together.

Right now, the relationship between the United States and China presents some once-in-a-lifetime chances.

There’s a plethora of strategic moves to consider, from China’s currency manipulation and the ongoing trade wars to the anticipation surrounding the upcoming election.

That’s why Jim Woods has dedicated himself to keeping you informed about the situation.

His latest report delves into the dynamics from A to Z, ensuring you don’t overlook any of these critical moments.

Don’t miss this opportunity. Click HERE to read this report.

P.S. We are excited to invite you to a free, live webinar with George Gilder on Thursday, Feb. 15 at 10 a.m. Eastern Standard Time. In this Startup Investing Masterclass, George is teaming up with Jon Medved, the founder of OurCrowd, to discuss investing in private placements. George and John Schroeter from Gilder’s Private Reserve will be interviewing the CEO of George’s latest AI startup pick… so you’ll be receiving a great startup pick just by attending! Click here now to attend this amazing event.