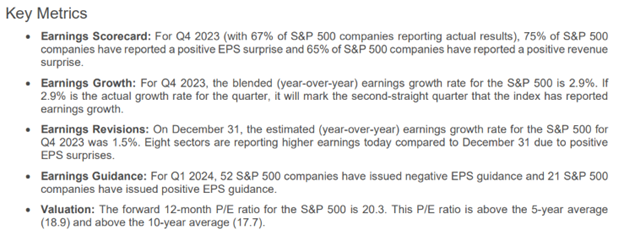

For the first six weeks of 2024, the Dow, S&P 500 and Nasdaq have added to 2023 gains, with the more concentrated Nasdaq 100 leading all averages up over 9% and the Russell 2000 lagging with a small loss year to date. Coming to the end of the fourth-quarter earnings season, there are generally decent results, but not impressive. From the latest FactSet Earnings Insight published on Feb. 9, the market is expensive as far as historic measures of price-to-earnings (P/E) ratios are concerned. The S&P now trades at 20.3 times earnings — above both the 5-and-10-year averages by a notable margin.

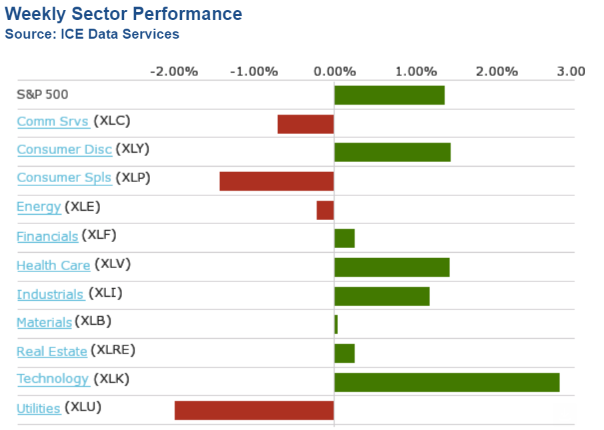

This lofty margin is due to the euphoria surrounding artificial intelligence (AI) and the outperformance of the Magnificent Seven and other mega-cap techs and select blue chip stocks within other sectors, like the weight loss drug leaders, a couple key industrials within the Dow, a couple consumer discretionary leaders, the duopoly in credit card processors and a couple transportation stocks that have the ability to move the needle on index performance.

The market is riding high on a strong consumer that accounts for 70% of U.S. GDP growth, and to most economists’ surprise, has proven resilient, at least at the top. Wall Street really only cares about the health of the top 10% of the population that own 90% of stocks along with hedge funds, sovereign funds, pensions and endowments. These are enormous pools of money in a market that has been shrinking in the number of stocks traded since the 1990s.

Fewer companies are going public, M&A activity is robust and companies are buying back their shares in record amounts. This trend has longer-term implications as it reduces market leadership to fewer big companies and increases potential volatility due to the higher concentration of market weightings. Morningstar.com reported on Feb. 10 that the total market cap of the U.S. stock market stood at $54.6 trillion, up from $31.8 trillion at the end of 2019, a gain of 41.2%, reflecting the influence of the mighty Nasdaq 100 where the top 10 holdings make up 45.2% of total assets.

Despite record issuance of debt by the U.S. government, the dollar has rallied 3% since the beginning of the year. According to the Treasury Department, $776 billion in debt was issued in Q4 2024, the most the government has ever borrowed due to stimulus measures. The Treasury also announced its plan to borrow $776 billion in Q1 2024 and $816 billion in Q2 at a time when the bond yields are elevated, driving up interest costs.

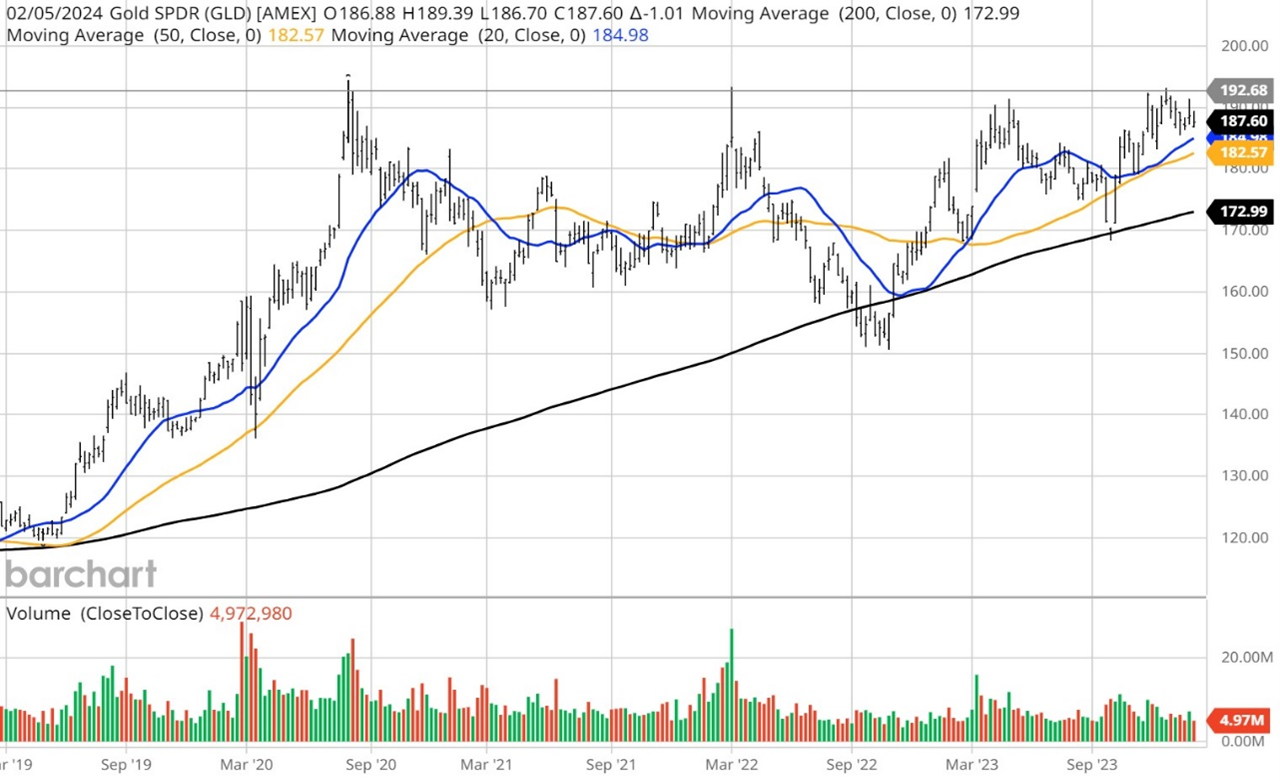

Both Bitcoin and gold prices are right back up to the high end of their respective ranges. This runs counter to the rally in the dollar, but I suppose it is a trend to hedge against some air coming out of the global debt bubble in the future. The 5-year chart below of the Gold SPDR ETF (GLD) is technically compelling, with a pattern of a major ascending pennant formation with an inverse head-and-shoulders formation in late 2022. It’s my view that if shares of GLD break above $193 on volume, further significant upside will soon follow.

For the S&P 500 to trade up another 10% to 5,500, it seems that just more of the same kinds of headlines have to cross the tape — tame inflation, decent employment data (even if it seems manipulated at times), the expectation of future rate cuts, affordable energy prices, a weak Chinese economy that keeps Xi preoccupied, wars in the Middle East and Ukraine that limit major U.S. exposure and some attention to the looming commercial real estate reset and how much U.S. debt the world wants to own.

Investors who have focused too much on the macro risks have missed out on this great rally, and it is a common issue that can frustrate to no end. The media sells fear and spends considerably less time on how well things are going for so many great companies, be they big cap, mid cap or small cap. There are always plenty of long-side investment themes that buck a negative tape. But being in a presidential election year, going back to 1928, the market rallies an average of 74% of the time.

The market is off to a good start for 2024. There is over $5 trillion in money on the sidelines earning 5%+ in an economy that looks to have skirted the risk of a recession, which is the #1 key takeaway heading into V-Day. The great majority of those in the business of predicting the future of the U.S. economy, with their Ph.D’s and seven-figure salaries, were dead wrong, at least for now. Like anything, with enough time, they will be right, but scores of investors sat out the rally and are now wondering when to get in. If you are buying the indexes, then you are likely chasing momentum. If you are stock picking, then in my view, there are attractive opportunities galore.

P.S. We are excited to invite you to a free, live webinar with George Gilder on Thursday, Feb. 15 at 10 a.m. Eastern Standard Time. In this Startup Investing Masterclass, George is teaming up with Jon Medved, the founder of OurCrowd, to discuss investing in private placements. George and John Schroeter from Gilder’s Private Reserve will be interviewing the CEO of George’s latest AI startup pick… so you’ll be receiving a great startup pick just by attending! Click here now to attend this amazing event.

P.P.S. I will be holding a subscribers-only teleconference on Feb. 15 at 1 p.m. EST called “How to Trade Big Cap Names for Big Cap Gains”. The event is free to attend, but you need to register here to be able to attend. Don’t miss out!