“Government is not reason, it’s not eloquence, it is force. Like fire, it is a dangerous servant and a fearful master.” — George Washington (attributed)

Happy birthday, George Washington!

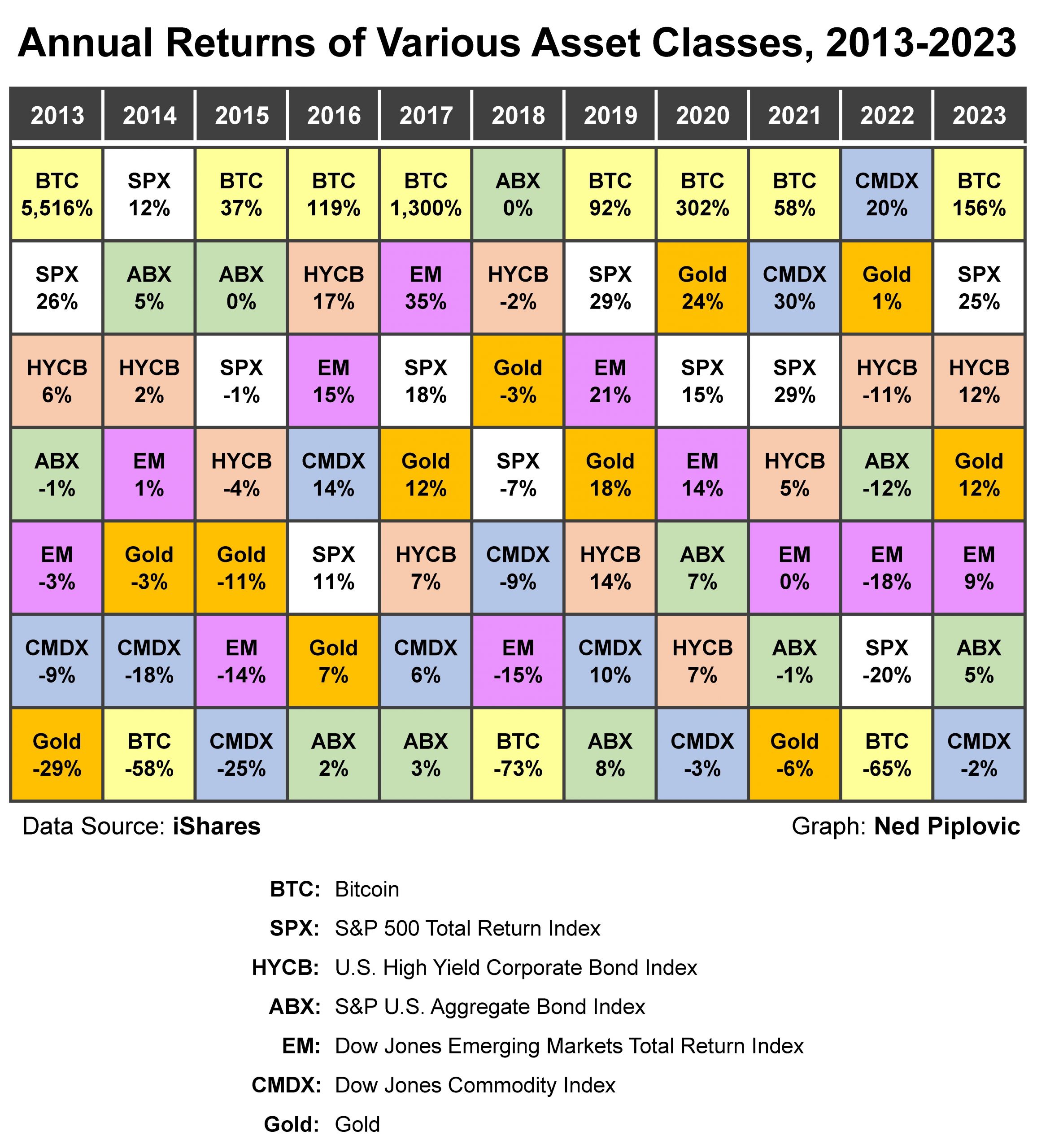

It’s not often that a chart sends out a shocking message. This one does:

The Ideal Inflation Hedge: Stocks, Gold, Real Estate or… Bitcoin?

Over the past 11 years, what has been the best performing asset and hedge against inflation?

Gold bugs tell me that gold has outperformed every other asset in the 21st century.

Jeremy Siegel, the Wizard of Wharton, has published a chart in his bestselling book, “Stocks for the Long Run,” showing that U.S. stocks have done way better than bonds or gold over the past two hundred years or more.

Real estate gurus contend that houses, rental properties and real estate investment trusts are the way to hedge against inflation.

But the above chart says there is a new sheriff in town — bitcoin, the digital currency.

In eight out of the past 11 years, bitcoin has outperformed stocks, bonds, gold and commodities by a significant margin.

Real estate is not included in the chart, but studies have shown that real estate has done well since 2011, though nowhere near what bitcoin has done.

And guess what? In 2024, bitcoin is again ahead of the asset race, advancing from $44,000 to over $51,000. That’s a 16% increase since Jan. 1.

Is Bitcoin a Bubble?

Many critics consider bitcoin, the digital currency, a classic Tulipmania or dotcom bubble. But most bubbles don’t keep coming back like bitcoin has. Bitcoin has collapsed three times since 2011, as the chart above shows.

It fell 58% in 2014, 73% in 2018 and 65% in 2022.

And yet, it keeps roaring back, year after year. Maybe it has something to do with the George Washington quote above — fear of government.

Bitcoin, like other cryptocurrencies, is volatile. It’s either feast or famine. And yet, most of the time, it’s a feast.

We’re going to have a big debate on bitcoin at this year’s FreedomFest. Two of the debaters are John Mackey (former CEO, Whole Foods Market) and Alex Green (chief investment strategist, Oxford Cub). They will take on two advocates of bitcoin (to be named soon).

Update: Tom Woods interviews me in celebration of the 50th anniversary of Friedrich Hayek winning the Nobel prize in economics. Watch or listen to it here.

Tom Woods will be a featured speaker at this year’s FreedomFest.

The Money Show Starts Today!

Las Vegas MoneyShow, Feb. 21-23, Paris Resort, Las Vegas: I look forward to seeing many of you there. I’ll be giving a keynote address this morning, plus two workshops. Jim Woods, my co-editor of our Fast Money Alert, will also be speaking. Other speakers include Steve Forbes, Nicholas Vardy (all the way from London), Keith Fitz-Gerald, Jeff Hirsch, Dave Phillips, Louis Navallier, Mike Turner and Kelly Wright. The standard price is only $99 per person. To register, go here… or call 1-800-970-4355.

I’ll be signing copies of the new 10th edition of “The Maxims of Wall Street.” Not coming to Vegas? You can order your personally autographed and numbered copy at www.skousenbooks.com. Only $21 for the first copy, and all additional copies are $11. No charge for postage if mailed inside the 50 states.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

The Post Office’s Bias is Showing

By Mark Skousen

I go to the post office practically every day mailing my books around the country and noticed that there’s already a commemorative stamp for Supreme Court Justice Ruth Bader Ginsburg, who died in 2020.

I also see that Ginsburg’s close friend on the court, Justice Antonin Scalia, has not been so honored with a commemorative stamp. He died in 2016. So, is this a case of discrimination against conservative justices and Italians?

Even Ruth Ginsburg would be ashamed of this sin of omission.

Or how about a stamp for Milton Friedman (1912-2006), the great free-market economist, who has obtained celebrity status? No such luck.

Or during Black History Month, how about honoring the great economist Walter E. Williams (1936-2020), the popular professor at George Mason University and frequent guest host of the Rush Limbaugh Show?

The first stamps were issued in 1847 with George Washington and Ben Franklin on the covers. Since then, Washington and Franklin have had more postage stamps than any other person.

When was the last time George Washington was on a U.S. stamp? 2002.

Ben Franklin, the first postmaster general? 2006.

For years, I’ve proposed a permanent one-cent stamp with a picture of Ben Franklin, and the saying, “A penny saved is a penny earned.” In honor of this stamp, I recommend the post office should REDUCE its first-class stamp by a penny!

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)