“A wise trader never ceases to study general conditions.” — Jesse Livermore, “Speculator-King” (“Maxims of Wall Street,” p. 64)

“Too much of a good thing can be wonderful.” — Mae West

We’ve just witnessed one of the most successful money-making opportunities in our lifetimes in 2023-24, with record gains in stocks (due to the tech revolution)… a huge comeback in bitcoin and cryptocurrencies… and now, gold, the traditional inflation hedge, has hit an all-time high after languishing for 13 years.

The bulls are back in town — on Wall Street, in Silicon Valley and at the New Orleans Gold Conference (which is celebrating its 50th anniversary in November. I’ll be there!).

And this, despite price inflation, the Fed’s tight-money policy, foreign wars and a president who is half asleep most of the time. As William Rees-Mogg once wrote, “When Washington sleeps, the economy grows.” (Maxims, p. 151)

It now appears that two old fogies are going to face each other in the November elections.

Why Stocks Are Moving Higher

Let’s go through each sector and why they are doing well.

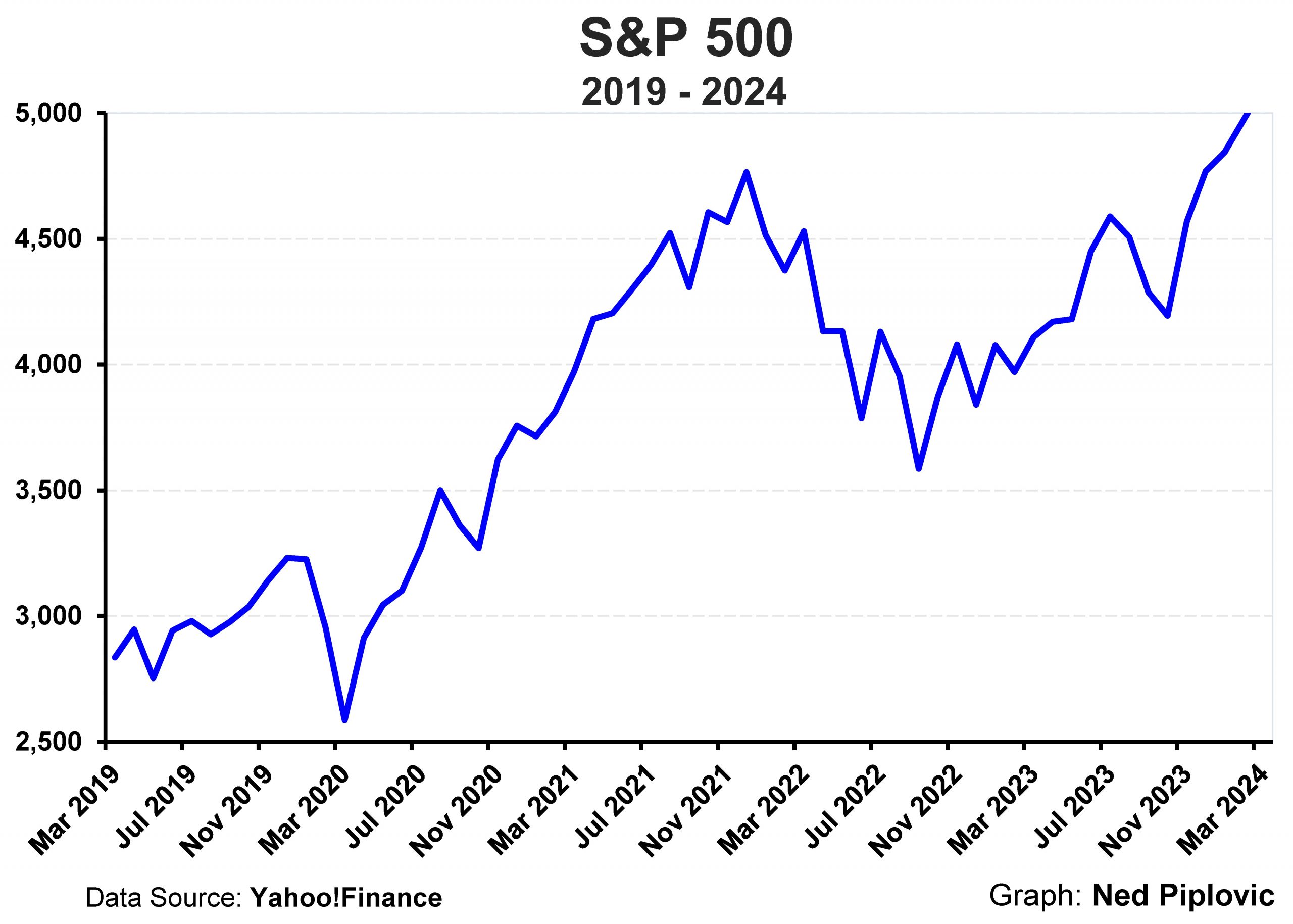

First, stocks. The Dow, the S&P 500 and the Nasdaq have all hit new highs recently.

The big driver behind record stock prices is technology. All seven of the top holdings in the S&P 500 Index are linked to advances in artificial intelligence (AI), the blockchain, the Internet of Things (IoT), automated driving, robotics and the creation of new drugs. There’s no telling how these new innovations will increase productivity and our standard of living.

These tech stocks include Apple, Microsoft, Nvidia, Google, Amazon, Facebook and Tesla.

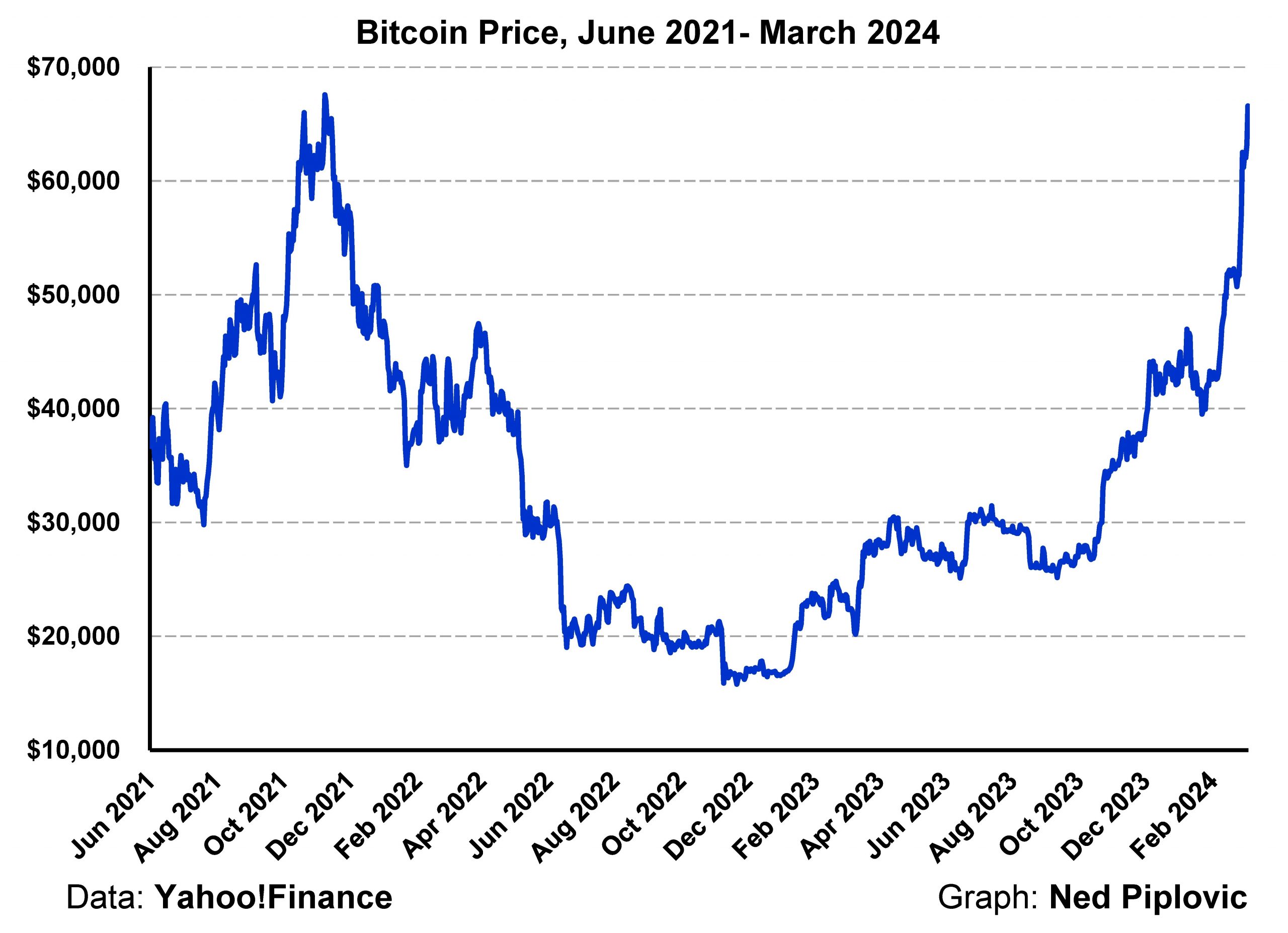

Second, bitcoin and cryptocurrencies. What’s driving bitcoin to new highs?

First, the Securities and Exchange Commission (SEC) finally approved bitcoin exchange-traded funds, such as Grayscale Trust (GBTC) and Bitcoin Trust (BITO).

Second, bitcoin’s “halving” event sometime in April. Halving refers to a technical situation that occurs every four years. The bitcoin code requires that after every 210,000 blocks are added to the chain, the mining reward is cut in half. This has been done to slow down the pace at which the supply of bitcoin can be added to circulation. Ultimately, the number of bitcoins is capped at 21 million, although several million have been lost forever due to lost passwords.

In the past, every halving event has resulted in a sharp increase in the price of bitcoin. For example, in May 2020, bitcoin price rose nearly 80% six months later.

The critics of bitcoin are having to eat crow. They say that the crypto market is nothing more than a tulipmania and solely a vehicle for criminal activity. But how many financial bubbles have collapsed and then recovered five times? There must be something to this new technology.

The Sun Also Rises on Gold

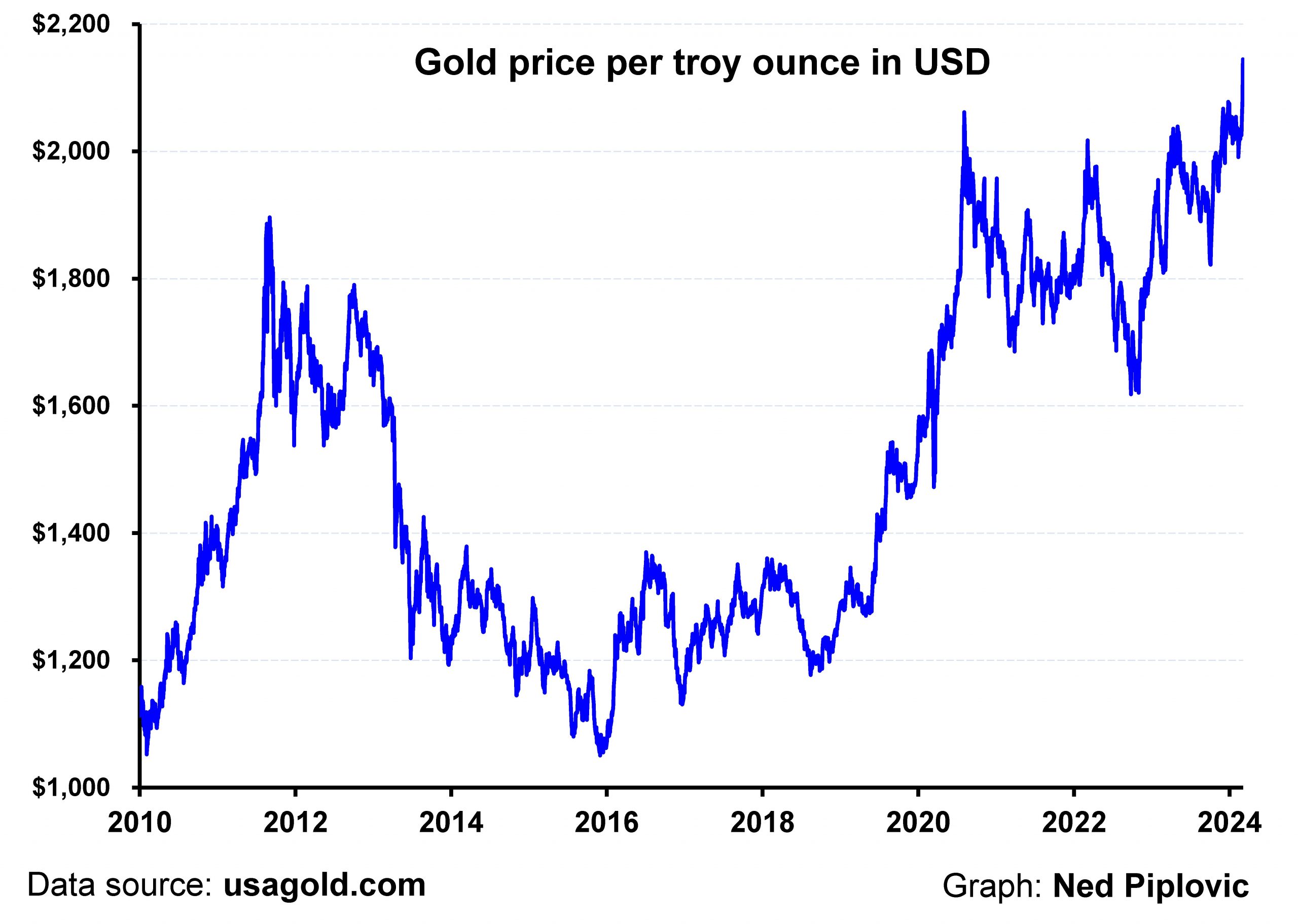

Third, gold. Gold has taken the longest to hit record highs, having hit $2,100 back in 2011. It’s probably been affected by the popularity of bitcoin as an alternative inflation hedge.

Gold has benefited from the Fed’s decision to back off its aggressive tight-money policy and to cut rates sometime this year. Price inflation is moderating but is still very real.

It’s important to note that price inflation has become permanent since World War II due to a variety of factors: chronic deficit spending, going off the gold standard and never-ending wars.

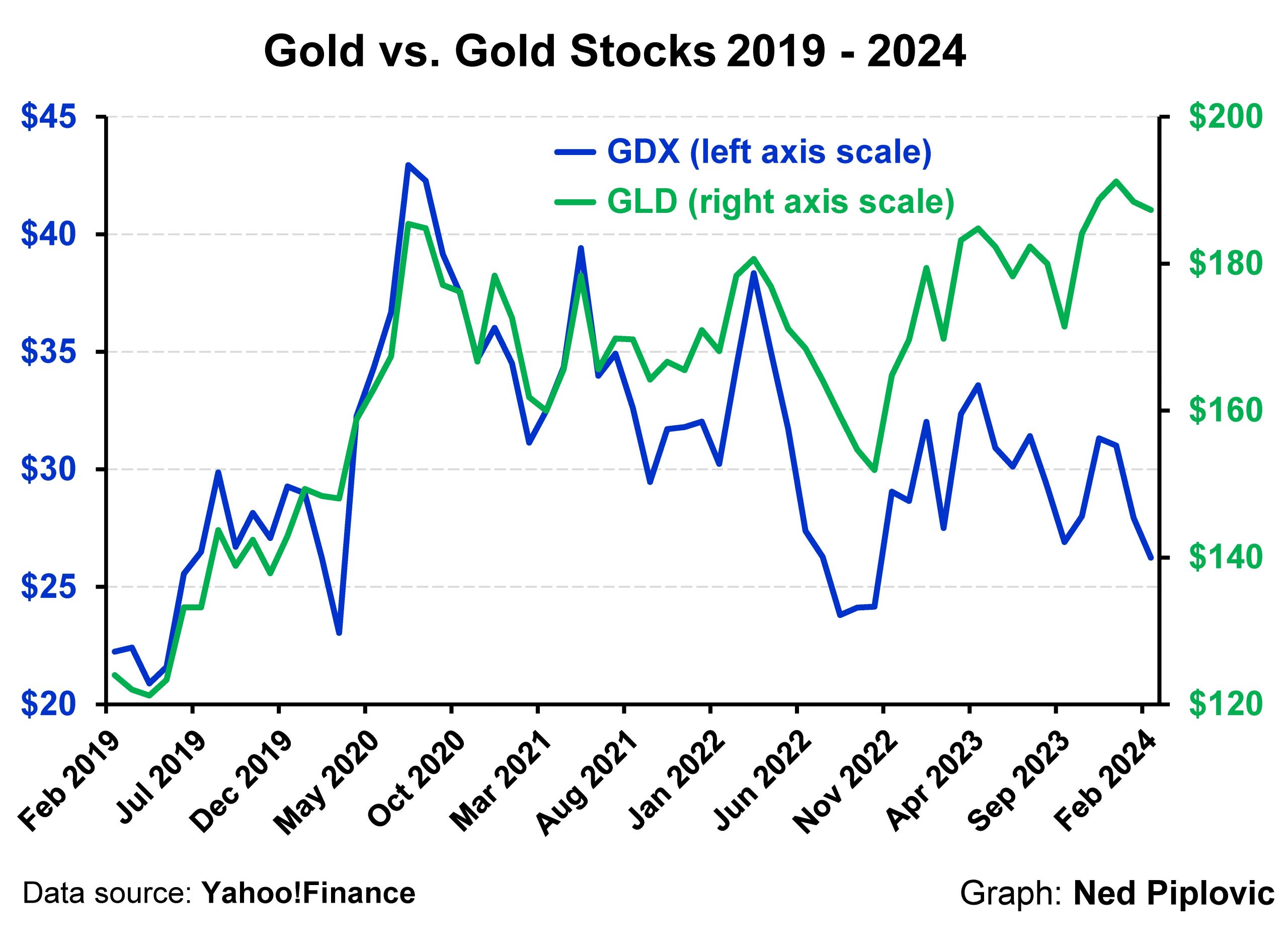

Gold Versus Gold Stocks

For investors, note the difference between buying gold itself versus buying gold mining stocks. Gold stocks are more volatile and few, if any have done well in the long term, over a 10- or 20-year period.

Long-term investors should stick with gold; gold stocks are a pure short-term speculation.

You can see that with this chart:

He Read My Book Eight Times!!

Last week, I received a letter from Steven Mulvenna, an Englishman. He wrote:

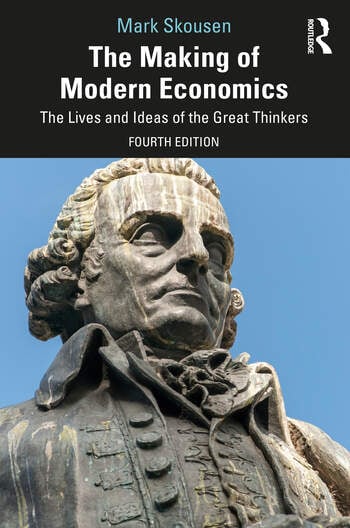

“I am an armchair economist and have consumed your book, ‘The Making of Modern Economics’ in print and audio eight times so far. It has become my economics encyclopedia, prompting me to read/listen to many of the books you mention in the text as I broaden my understanding of economics.”

His reading of my book eight times must be a record.

He has far surpassed John Mackey, the former CEO of Whole Foods Market, who wrote, “I’ve read Mark’s book three times. It’s fun to read on every page. I have recommended it to dozens of my friends.”

There’s a reason why my book has gone through four editions and is published by a major academic publisher (Routledge).

What’s ‘The Making of Modern Economics’ All About?

Here are its unique features:

- It’s the only history with a hero, Adam Smith, and his “system of natural liberty” and a cunning plot: The father of free-market economics comes under attack by his enemies (socialists, Marxists and Keynesians) and is often left for dead, only to be rescued by his friends (French laissez-faire, Austrian, Chicago and supply-side schools) — and in the end triumphs with the collapse of the Berlin Wall and the collapse of the Soviet central-planning model.

- It offers the most devastating critique of both Marxism and Keynesianism, the two biggest critics of free-market capitalism.

- It includes five chapters on the Austrian and Chicago schools of free markets.

- It is the only history with illustrations, portraits and photographs.

Want to know more? Click here.

What Others Are Saying

Greg Feirman, manager of Top Gun Financial, writes: “Skousen is a brilliant and prolific economist as well as writer of a popular financial newsletter, Forecasts & Strategies, for decades now. Because of his interest in financial markets, Skousen is an economist obsessed with the real-world applicability of his economic ideas. He has written over 20 books, including ‘The Making of Modern Economics’, the best history of modern economics around.”

The late great William F. Buckley, Jr., wrote, “I champion Skousen’s book to everyone. I keep it by my bedside and refer to it often. An absolutely ideal gift for college students.”

And Richard Rahn states, “Mark Skousen has produced the single best book on virtually all of those who have had a significant impact in economics. It’s a delight to read cover to cover.”

How to Buy My Book at a Super Discount

Routledge and Amazon charge over $50 for my book, “The Making of Modern Economics.” But I offer a major discount — only $37 — at my website, www.skousenbooks.com. I autograph each copy and mail it for no additional charge if mailed inside the United States.

The new 4th edition is also available on Kindle and Audible. Click here for more information.

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed it!

Supreme Court Confirms Democratic Rule in America

Earlier this week, the Supreme Court ruled 9-0 that states like Colorado and Maine could not remove Donald Trump or anyone else from state ballots in the 2024 election.

It ruled unanimously that the 14th amendment did not give states the power to remove candidates from office — this action was strictly a federal one determined by Congress.

As subscribers know, I’m no fan of Donald Trump, but this was a victory for democracy. The people should have the right to decide for themselves who to vote for, not Trump’s enemies. The Democrats, who have gone down this route, should be ashamed of themselves. They should no longer call themselves members of the “Democratic” Party.

It’s not often that the Supreme Court rules unanimously on any issue, but fortunately, it did on this one — and left no doubt that democracy will be an integral part of America’s free society.

This November, the people will decide if Donald Trump should be elected to a second term… assuming the Democrats don’t try to stuff the ballot boxes with suspicious mail-in ballots like they did in 2020.