The price of gold soared to a new all-time high this past week, peaking as Bitcoin also traded to a new all-time high. Spot gold notched $2,160 per troy ounce on March 8 in what is a multi-year upside breakout. There is not one specific reason, but rather there are several forces and perceptions at work as catalysts for the yellow metal.

There is a growing consensus that the Fed Chair’s two-day testimony on Capitol Hill last Wednesday and Thursday, followed by a jump in the unemployment rate to 3.9% (the highest level in two years), is laying the groundwork for a rate cut in June. The latest forecast from the CME Fed Watch tool shows a 57.4% probability of a quarter-point cut to 5.00-5.25%.

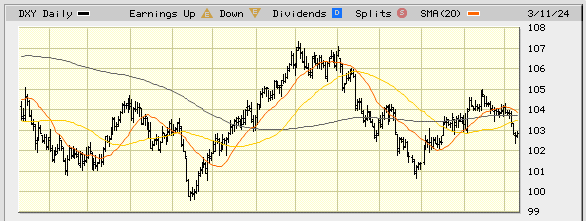

This growing narrative is pressuring the value of the dollar lower. It’s the view of many that the dollar gained in value at a time when the size of the federal debt was rapidly increasing only because the Fed increased rates 11 times, thereby offering higher yields on Treasuries to more than offset the weight of the growing debt burden. From the chart of the U.S. Dollar Index (DXY) below, one can see how the dollar lost 6% in value when the Fed started telegraphing to the markets that rate cuts in 2024 were part of the path forward for monetary policy.

When the Consumer Price Index (CPI), Producer Price Index (PPI), Personal Consumption Expenditures (PCE) and employment popped higher than expected in February, the dollar recovered 4% to the 105.0 level seen on February 13, followed by a fresh slide lower to close at 102.7 as of last Friday, when the higher unemployment figure crossed the tape, further galvanizing traders’ conviction that the Fed has the green light to begin easing. Major technical support for the DXY sits at 99.2 and a level that, if broken, opens the way for a move lower to 95.0.

Source: www.bigcharts.com

The latest update on the soaring national debt is also fueling the gold rally. The pace of growth is now increasing by approximately $1 trillion every 100 days — a shocking number that now sits at $34.4 trillion and is picking up speed. Breaking it down, that’s $10 billion per day, $416 million by the hour, $6.94 million by the minute and $115,740 per second (source: U.S. Treasury). Buyers of gold see this as a fundamental risk to financial markets, thereby raising caution about how the Treasury is going to be able to sell such vast amounts of Treasuries on an ongoing basis, especially if rates start to fall, making Treasuries less attractive.

Late last year, Moody’s reduced its U.S. credit rating outlook from “stable” to “negative” largely due to political gridlock in Congress.

“In Moody’s view, such political polarization is likely to continue. As a result, building political consensus around a comprehensive, credible multi-year plan to arrest and reverse widening fiscal deficits through measures that would increase government revenue or reform entitlement spending appears extremely difficult.”

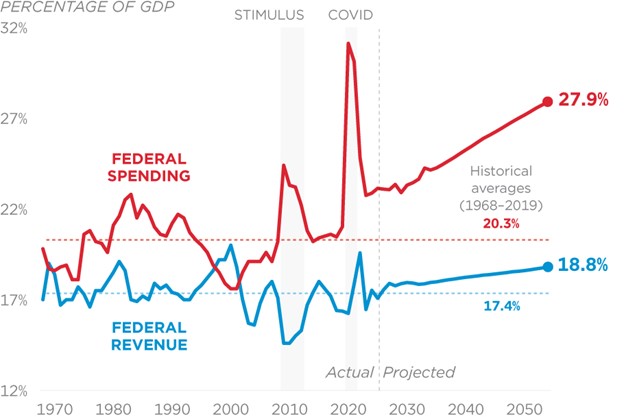

Federal spending is on an unsustainable trajectory and is the key driver of growing deficits and debt. Spending is growing faster than the economy. Raising taxes is not a workable solution because taxes cannot grow faster than the economic base in the long run. Source: Congressional Budget Office.

Not knowing the outcome of the future elections, a combination of increasing revenue AND spending reforms, is in my view, the only way this situation gets bipartisan support. According to the Peter G. Peterson Foundation, “spending for net interest will become the largest “program” in the federal budget within the next 30 years, outpacing spending on Medicare and Social Security.” Even though the Fed is supposed to keep its nose out of fiscal policy conducted by Congress, critics are quick to note that at some point, fiscal policy collides with monetary policy.

Higher gold prices are also being juiced by global tensions. The latest ceasefire talks between Israel and Hamas broke off late last week, right in front of Ramadan, further ratcheting up the risk of a wider regional conflict. Yemen’s Iran-backed Houthi rebels have launched repeated strikes on international commercial shipping in the Red Sea since mid-November in response to the conflict in Gaza, although the merchant vessels targeted have often had little or no link to Israel. The latest Houthi attacks involved sophisticated drones with the U.S. and Royal Navy being the primary targets.

Abdul-Malik al-Houthi — Leader of the Houthi movement.

Source: Wikipedia.com

The precious metal has gained more than $300 an ounce since the start of the Israel-Hamas war. Demand for a traditional safe haven has analysts now forecasting the price of gold could challenge $2,300 per troy ounce. Considering the current set of catalysts that also include the Russia-Ukraine war and the tensions involving China and its ambitions towards Taiwan — this upside breakout in gold prices not only looks legit, but it also has the technical makings of taking out $2,300 per ounce like a hot knife through butter. If modern Bitcoin is not appealing as a hedge against potential volatility, then the oldest storehouse of wealth in history might be a smart addition to one’s portfolio.

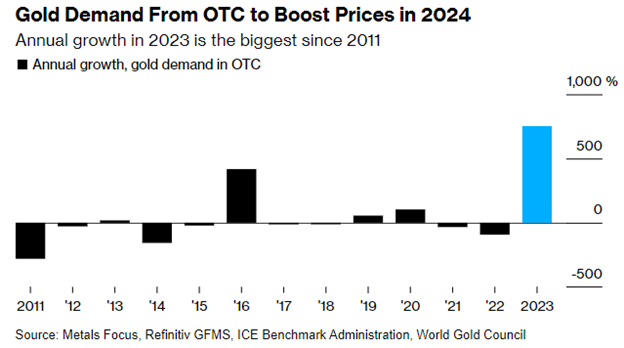

Annual demand growth in the OTC market hit 753% last year, the most since at least 2011, World Gold Council data showed. Investors are expected to continue accumulating gold at an accelerated pace this year. If modern-day Bitcoin is not appealing as a hedge against potential volatility, then maybe the oldest storehouse of wealth in history might be a smart addition to one’s portfolio.