Day trading uses three strategies of Andrews’ Pitchfork to pursue potent profits.

Andrews’ Pitchfork may sound a bit mysterious initially, but the three key strategies are not that daunting with expert guidance. Invented by Alan Andrews, the technical indicator of trendlines that bear his name can help day traders to identify profitable opportunities, as well as what are known as “swing” possibilities.

Andrews’ Pitchfork aids traders in gauging overall cycles that affect spot price activity. Day traders may be able to time their activity to buy during brief dips and sell amid upticks.

Day Trading Uses Three Strategies of Andrews’ Pitchfork, Stock Sherpa Says

“The Andrews Pitchfork is one of the only predictive tools available to market technicians,” said Ahren Stephens, co-leader of the Trading Room and Pick of the Day advisory services. “It is an incredibly versatile tool that originated in the golden age of technical analysis in the early 20th century.”

Ahren Stephens co-heads of Pick of the Day and the Trading Room.

Roger Babson, an entrepreneur, market forecaster and ultimately a politician, began studying the markets at an early age. After Babson’s oldest sister, Edith, drowned during the 1880s in the Annisquam River in Gloucester, Massachusetts, he wanted to understand gravity to the fullest.

To do so, Babson created the Gravity Research Foundation in 1960, which gives awards to essays on gravity-related topics. Generally, Andrews’ Pitchfork is based on the work of Sir Isaac Newton. The Newtonian law that every action has an equal and opposite reaction came into play to create Andrews’ Pitchfork to help plot trend lines on financial charts, rather than hand-draw Action Reaction sets, Stephens explained.

During the Depression period of the late 1920s and early 1930s, Andrews managed money for Joseph Kennedy, a prominent political family patriarch, and generated more than $450 million in the stock market crash of 1929. Today, that $450 million would be worth billions of dollars today, Stephens continued.

Andrews ended up working at the University of Miami and developed the Action Reaction course. When he launched his course at the University of Miami, the line of students seeking to take it was so long it was wrapped around the block.

Day Trading Uses Three Strategies of Andrews’ Pitchfork: Secrets Unveiled

The three secrets of using Andrews’ Median Line, previously called the Normal Line by Babson, were unveiled by Stephens during his presentation at the Money Show/Traders Expo event in Las Vegas in February 2024. Stephens told me the audience seemed especially attentive. Maybe the compelling term Andrews’ Pitchfork Secrets had something to do with the strong interest.

The word pivot also is integral in understanding the first secret of the Andrews’ Pitchfork. The following description should be illuminating.

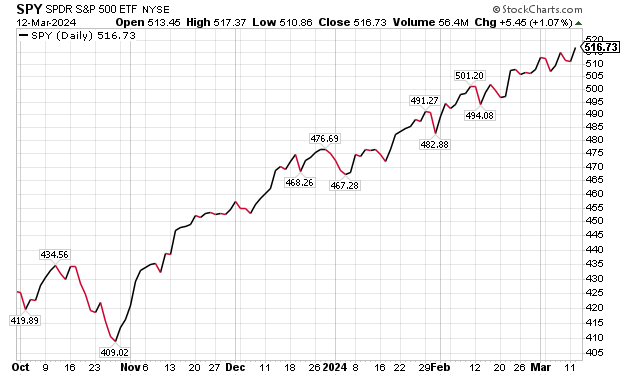

By identifying the major pivots on that chart, a trader can find possible turning points in the future by using the Andrews’ Pitchfork tool, Stephens said. Stephens and senior partner Hugh Grossman avoid complication by generally only trading options in the SPDR S&P 500 ETF Trust (SPY), a fund that seeks to provide investment results that correspond to the price and yield performance of the S&P 500 Index.

Hugh Grossman leads DayTradeSpy’s Trading Room.

The S&P 500 Index tracks a diversified group of large-cap U.S. stocks across all 11 Global Industry Classification Standard (GICS) sectors. CICS also has 25 industry groups, 74 industries and 163 sub-industries into which the S&P uses to categorize all major public companies.

Chart courtesy of www.stockcharts.com

Day Trading Uses Three Strategies of Andrews’ Pitchfork: Secret 1 – Recognize Pivots

If an investor can think of ABC, that person can find the pivots that will allow one to forecast the probable path of the price of any stock or commodity, explained Stephens, who added that the technique is used when he guides subscribers in the Trading Room advisory service.

“Many people in our Trading Room want to know how we come up with our amazing predictions in our crystal ball,” Stephens told me. “And the answer is we use tools that can find the probable path of the price.”

Day Trading Uses Three Strategies of Andrews’ Pitchfork: Secret 2

Andrews Pitchfork Secret #2 is to trade in the direction of the trend for enhanced profitability. That may sound easy. But identifying the trend and knowing when to buy and sell are of paramount importance.

“Knowing the direction of the trend will help you understand and correctly forecast and trade the probable path of the price,” Stephens said. “Are we making higher highs and higher lows? Are we making lower highs and lower lows?

“By identifying and marking the correct larger timeframe direction, specifically the Daily and 240-minute trend direction, you are able to catch the momentum of larger traders and institutions and have the wind at your back to help push you to greater profits.”

Day Trading Uses Three Strategies of Andrews’ Pitchfork: Secret 3

Andrews Pitchfork Secret #3 is to enter at the test and retest to gain the best entry, but exit at extremes, Stephens advised. To maximize gains, the goal is to let winning trades run, but keep losses small, Stephens advised.

“To utilize the best entries, you need to draw a fork that can contain the price,” Stephens said. “After a test of a median line, whether it’s the lower parallel, the upper parallel, or the middle median line, you need to determine if the price is going to hold that area and continue running in the trend.”

When the price continues in the trend, a trader can maximize profits by continuing to follow the price to the next median line on the chart, Stephens said.

“This is where the test and retest of the Median Line comes in,” Stephens explained. “When the price hits a level of support and rises, this is a test. When the price hits the area again, this is a retest.”

The same principle applies with a diagonal line. When the price tests and retests, that indicates a chance to board a virtual “elevator to profits,” Stephens counseled.

“Think of it this way,” Stephens opined. “When you are wandering around the mall, eventually you have seen everything you want to see and want to go to the next level. You need an elevator to get you to the next floor.”

When investing in the markets, the catalyst could be a news event, a geopolitical event, an earnings release, etc., Stephens continued.

“You need this to move the price from level 1 to level 2,” Stephens told me. “It is the same thing with the Andrews Pitchfork as well. When you have found a catalyst and an entry on a retest of the fork, the elevator will take you to the next level of profits.”

Day Trading Strategies Highlighted in Ultimate Trading Workshop

Grossman, who launched DayTradeSpy’s Trading Room, teams up with Stephens to offer their Ultimate Training Workshop to help people day trade profitably. They created a set of training videos based on a live event held a few months ago, teaching everything they thought would help day traders.

“No stone is left unturned,” Grossman said. “If you have never traded options before, this is what you need. Even if you are a seasoned trader, the nuances, tips, tricks and traps you will pick up from this series of 11 sessions, each roughly an hour and a half in length, will benefit you immensely.”

The two investment gurus share their “deep in the trenches” experience with concepts that cannot be found anywhere else, Grossman said. Key topics include setting up Schwab (formerly TD Ameritrade) Think or Swim charts to visualize patterns, identifying key indicators and strategies, “repairing trades,” money management and more, he added.

Stephens provides a deep-dive analysis that can answer many questions in the Q&A section of the Ultimate Training Workshop, Grossman said.

“It’s all there,” Grossman advised. “Of course, there may be other updated information only available through our trading room sessions, but the Ultimate Training Workshop will provide you the launch pad you need to get started day trading SPY options.”

The videos are available for at least six months and they can be viewed as often as desired during that time period, Grossman said.

“Fast forward, pause and rewind,” Grossman continued. “We recommend going through them at least once completely, even if you are an experienced trader. It’s the little subtleties that can make all the difference in your trading. Take advantage of 40+ combined years of Hugh and Ahren’s market participation… master the Ultimate Training Workshop.”

A Scalping Strategy Involves Buying ‘at the Money’ Calls

The duo also use a scalping strategy that involves buying ‘at the money’ options, Grossman told me.

“I like to buy 30 to 100 contracts, investing up to $20,000 per trade, depending on expiration dates,” Grossman said. “While it sounds like a high-risk trade, and it could be, by using our proven indicators, we minimize the risk. We make our gains quickly and, of course, see a prompt return of our capital in the process.

“I generally earn $500 to $1,000 on such trades. Repeating the process delivers several thousand dollars before most of corporate America takes its first coffee break.”

Further out expirations, of three to six days, offer a measure of stability and security, Grossman said. They also give traders high liquidity, he added.

Soaring Geopolitical Risk

Geopolitical risk is soaring amid escalating wars and threats around the world. Such risks may may develop further interest in day trading to avoid longer-term investments that can backfire during tumultuous times.

Under the direction of President Joe Biden, America’s Department of Defense (DoD) unexpectedly announced on Tuesday, March 12, that it would give up to $300 million in additional military aid to Ukraine. The assistance comes at a critical time during Russia’s invasion of Ukraine that began in February 2021, as waning supplies of military equipment forced Ukrainian soldiers to retreat on the battlefield in key places that they had retaken from the aggressors during its counteroffensive in the past year.

The Carnegie Endowment for International Peace, a Washington-based think-tank, estimated that Russia’s artillery was firing at five times the rate of Ukraine’s rapidly shrinking capacity to fire back at the attackers.

With a lack of replacement funds available to replenish DoD inventories, the Biden administration had paused Presidential Drawdown Authority (PDA) packages since December 2023. The DoD subsequently identified contract savings from previously appropriated supplemental funding that can be used to replace its equipment stocks. The move offers a short-term stop gap, but it is “nowhere near enough” to meet Ukraine’s battlefield needs, according to the DoD.

“Without supplemental funding, DoD will remain hard-pressed to meet Ukraine’s capability requirements at a time when Russia is pressing its attacks against Ukrainian forces and cities,” the DoD added.

New Supplies for Ukraine

The equipment worth up to $300 million encompassed in this announcement include:

- Stinger anti-aircraft missiles;

- Additional ammunition for High Mobility Artillery Rocket Systems (HIMARS);

- 155mm artillery rounds, including High Explosive and Dual Purpose Improved Cluster Munitions rounds;

- 105mm artillery rounds;

- AT-4 anti-armor systems;

- Additional rounds of small arms ammunition;

- Demolitions munitions for obstacle clearing; and

- Spare parts, maintenance and other ancillary equipment.

“U.S. leadership is essential to sustaining the historic efforts of some 50 allies and partners from around the globe that have committed more than $87 billion in security assistance to Ukraine since Russia launched its unprovoked, full-scale invasion in February 2022 – a war of choice that continues to undermine global security and stability,” according to the DoD. “Security assistance for Ukraine remains a smart investment in our national security. It deters potential aggression elsewhere in the world, while strengthening our defense industrial base and creating highly skilled jobs for the American people.”

U.S. Congressional leaders have been not found a compromise that would protect America’s southern border to win support from House Republicans to provide fresh funding of $95.3 billion mainly for Ukraine and Israel. The bi-partisan bill previously passed the U.S. Senate.

House Speaker Mike Johnson (R-La.) has stated his top priorities are to secure the southern border of the United States and to fund the operation of the U.S. government. The latter concern received a extra time to seek a solution late last week with passage of short-term funding to avoid a default on the country’s debt.

Addition of Sweden Strengthens NATO

With the addition of Sweden to NATO on May 7, the organization now has 32 member nations. The addition makes the alliance more united, determined and dynamic than ever, President Biden said.

“NATO will continue to stand for freedom and democracy for generations to come,” President Biden said in a statement. “I look forward to hosting all 32 Allies for the 75th Anniversary NATO Summit this summer in Washington, D.C.”

President Putin’s surprise attack of Ukraine with Russian forces more than two years ago has turned into a quagmire that has caused him to send continuing waves of soldiers into battle as human sacrifices to gain land that is within the sovereign borders of its neighboring nation. The invasion, which President Putin still calls a “special military operation,” shows no signs of waning. Russian political opposition leader Alexei Navalny was imprisoned by Putin and transferred to an Artic prison where he died suddenly on Feb. 16 under mysterious circumstances after appearing in good health at a court hearing the previous day.

After refusing to release Navalny’s body to his mother for a funeral, Putin relented days later once enough time had passed to prevent the detection of any traces of poison. The burial, held on Friday, March 1, drew thousands of mourners.

Navalny, who was serving a 19-year prison term for what Westerners would describe as publicly offering alternative views about Russia’s future direction, was convicted of “extremism” after he returned to the country following his survival of poisoning in August 2020 reportedly carried out under the direction of Putin, a former KGB agent. Navalny’s family claims their loved one was fatally poisoned at the arctic prison with a nerve agent on Putin’s orders.

Geopolitical Risk Mounts in the Middle East

The Middle East remains a powder keg with Hamas militants and the Israeli Defense Force (IDF) engaged in a war that reportedly has led to more than 31,100 deaths in Gaza alone. The war began on Oct. 7 when Hamas fighters invaded southern Israel in a murderous assault that reportedly killed 1,163. Other barbarous acts included rapes, torture and the abduction of at least 250 others.

Israel responded with a military assault on the Gaza Strip to destroy tunnels used in attacks against its civilians and to pursue the perpetrators of the Oct. 7 butchery. IDF officials report that hundreds of its soldiers have been killed in Gaza during its military response.

A week-long truce in late November led to Hamas freeing more than 100 Israeli and foreign hostages in exchange for Israel releasing about 240 Palestinian prisoners. However, talks aimed at securing the release of additional hostages have not produced results.

President Biden recently approved and initiated a humanitarian air drop of relief supplies and plans to build a temporary port to provide additional aid for Palestinians in Gaza. Roughly 130 hostages abducted on Oct. 7 by Hamas remain trapped there, but Israeli officials say about a quarter of them are believed to be dead.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Easter Season Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)