Inflation hasn’t gotten down to 2%.

In fact, it hasn’t even cracked 3%.

So, why did the Fed already forecast three rate cuts in 2024?

We’ve argued ad nauseam that inflation would be far more stubborn than anticipated, largely due to housing and energy costs.

So, why is it already planning for rate cuts?

After digging through the data, we’ve come up with two reasons.

One is positive.

One is downright scandalous.

So, let’s start with the juicy one, shall we?

Politics… Politics… Politics

Indeed, Mel Brooks said it best in “History of the World Part I”.

Joe Biden’s campaign is running on fairy dust and fumes.

Neither he nor his left-wing administration seem to understand basic economics.

Just the other day, he proposed a $10,000 first-time homebuyer credit to help make it more affordable.

Let us be crystal clear.

Homes are unaffordable because:

- Supply had shrunk since the Great Recession

- Demand continued to increase

- Demand finally exceeded supply

Why does he think the Fed hiked interest rates? Because Chairman Jerome Powell wanted his savings account to yield more?

No, it’s because the Fed can only indirectly influence demand through interest rates. It cannot change supply.

But Biden doesn’t care.

He’s willing to put the economy in danger over the next two-to-four years just so he can juice everything to make it look better going into the election.

But there’s a darker reason than even Joe’s reelection.

We’ve written about the weight of the national debt crushing the nation.

What most people don’t realize is the cost of that debt is directly tied to the interest rates decided by none other than the Federal Reserve.

Now, by law, the Fed is expected to be independent to avoid conflicts of interest.

However, no Fed governor wants to preside over the destruction of the government’s balance sheets.

Given the effects of compound interest, the Fed has every incentive to drop interest rates at its earliest opportunity.

But rather than tell you, let us show you.

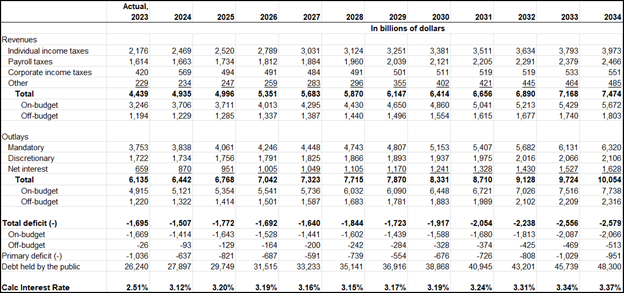

This is the latest budget from the Congressional Budget Office. At the bottom, we calculated the interest rate on debt by dividing net interest by debt held by the public.

Last year, the government paid an effective rate of 2.51% on its debt.

That rate jumps to 3.12% this year and stays constant through about 2029 before creeping higher.

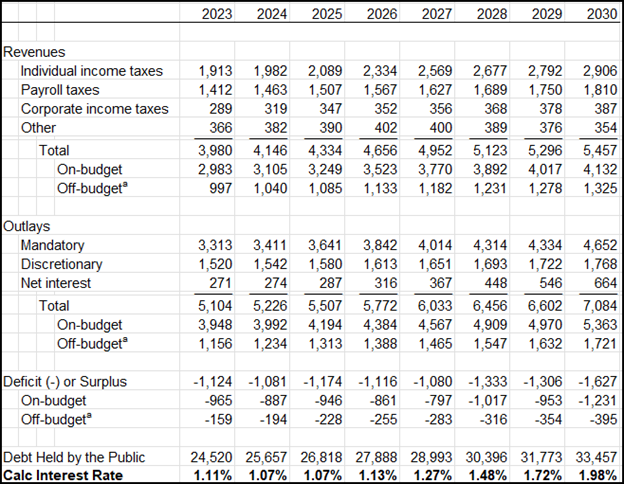

This is what the same projection looked like back in 2019 when interest rates were close to 0%.

Our current interest rate regime has added $404 billion in additional interest expenses by 2030 alone. The rest of the impact comes from higher debt levels.

That’s the double whammy of higher interest rates.

Not only do they cost more, but they force us to borrow more, increasing our interest expense.

It’s like the whole rocket fuel equation to get into space. More fuel adds more weight, which requires more fuel to get it into space.

And around and around we go.

So, if you think that Joe Biden and the Fed aren’t looking for any and every excuse to drop interest rates, then I’ve got a few DVD players to sell you.

Besides this dreadful moral hazard, might there be a good reason to drop interest rates?

Housing

It is entirely possible that the Fed is truly independent and capable of making decisions based on the data.

As we discussed earlier, housing has been a massive drag on the Fed’s deflationary efforts.

However, recent data suggests that these efforts might be succeeding.

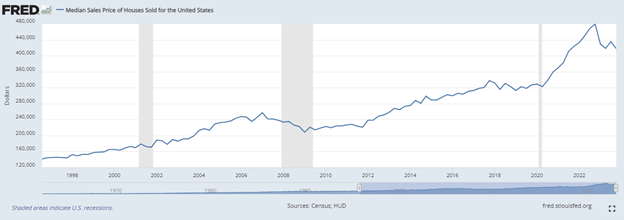

Below is the median home sales price over time.

Since Q4, 2022, the median home price has been on the decline.

And the sales pace has fallen off a cliff, though single-family home inventory remains tight at three months of inventory.

So, at a high level, it seems like the Fed is working its magic.

Here’s why we disagree.

Source: National Association of Realtors

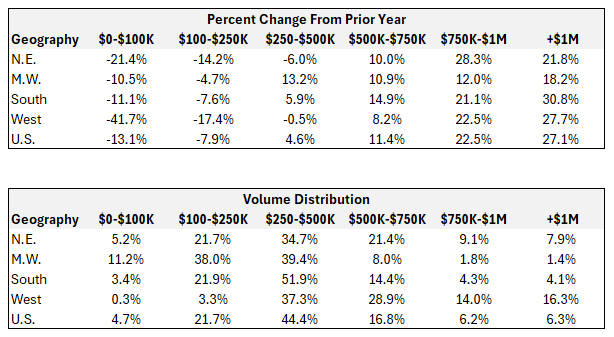

When you take a look at the percentage change in sales from a year ago and sales distribution by price range, home sales below $250,000 have plunged. Otherwise, they’re still intact.

In fact, sales over $500,000 get quite robust.

Here’s why.

The typical price a person pays for a home has increased to the point that it has moved from one bucket to the next.

Yeah, sales are falling below $250,000 because homes that used to cost less than $250,000 now cost more than $250,000.

We can see that by the sales distribution by price range with almost half of all the sales in the United States falling into the $250,000-500,000 bucket.

Countering the Narrative

Now that you have all the facts, it should make a lot more sense why it’s not good if the Fed were to cut interest rates.

But honestly, we’ve seen this before.

Political elites cling desperately to their own careers at the expense of Main Street.

That’s why it’s critical to take advantage of the opportunities available to you NOW.

And there is one such phenomenon scheduled to take place on May 1 at 2 p.m.

The last time this event took place, investors had an opportunity to more than double their money in a matter of weeks.

By no means is this guaranteed.

But with the Fed breathing down our necks, we’ve got to take every advantage we can get.