I previously wrote about the A&W Pledge as a sound economic policy that is often violated.

“A” stands for “accountability,” the idea that users should pay for the goods or services they buy, including health care and food. “W” stands for “welfare,” that you should only help those who really need help. The secret to good government is to find a balance between A&W. (Click here to read further about the A&W Pledge).

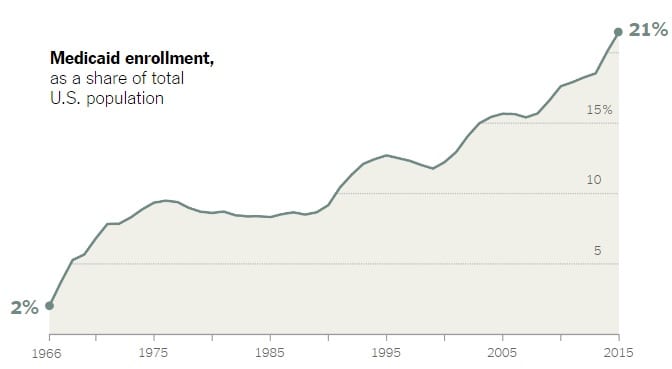

Unfortunately, the A&W principles are now out of balance in the United States. There is too much W and not enough A. Despite a means test for welfare, today 74 million Americans are on Medicaid, surpassing the number of elderly on Medicare (55 million). Almost 43 million Americans are on food stamps, but there are more on Medicaid because of disabilities.

Source: New York Times

Not surprisingly, even Republicans don’t want to rile their voters, many of whom are now getting welfare. (Click here to read the March 28 New York Times article, “In Health Care’s Defeat, Medicaid Comes of Age”).

Wilbur Mills, the powerful conservative Democrat and chairman of the House Ways and Means Committee in 1965, initially supported Medicaid but not Medicare. He did not think that well-off elderly people such as Warren Buffett should have their medical bills covered. Medicaid was limited to poor people, confirming the W principle (you help those who need help, but you don’t help those who don’t need help).

The Welfare Reform Act of 1996, supported by both Bill Clinton and the Republicans, did a good job of curtailing excessive welfare payments. It required able-bodied workers to go off welfare after five years. After the bill became law, the number of welfare recipients actually declined — until the financial crisis of 2008, when the numbers on food stamps and Medicaid skyrocketed. They haven’t come down much. It is time to go back to the Welfare Reform Act of 1996.

But there’s a silver lining: health care stocks have skyrocketed and investors have made money. Subscribers to my investment newsletter, Forecasts & Strategies, are among those who are profiting. In less than three months so far in 2017, my recommended health care real estate investment trust already has jumped 7% and is trending upward. Plus, my favorite health insurance company is coming off a whopping 38% gain in 2016 and has advanced an additional 3.7% so far this year.

I urge you to consider becoming one of my newsletter subscribers to profit from these winning investments, too. To learn more about how my investment newsletter can help you, please click here.

In case you missed it, I encourage you to read my e-letter from last week about how billionaires are made and how they maintain their status.

Upcoming Conferences

Join Me for Two Events in Las Vegas!

Las Vegas Investment Club, April 18, Orleans Hotel: I’ll be speaking at the Club meeting on Tuesday, April 18, about the Trump Agenda and how it will affect your business and investments. Also speaking is Dr. Bo Bernhard, PhD executive director for International Gaming Institute. For more information on attending, go to http://lvinvestmentclub.com.

MoneyShow Las Vegas, May 15-18, 2017, Caesars Palace: I will be moderating an opening ceremonies panel on “Trump and Your Portfolio” with Steve Forbes, Steve Moore and Wayne Allyn Root. Plus, join us for a luncheon and a breakout session, “Yellen at Trump!” Other speakers include Mike Turner, Jeffrey Saut, Jim Stack, Pamela Aden, Marilyn Cohn and Matt McCall. I hope to see you there. To register free as my guest, call 1-800-970-4355 or 1-941-955-0323 and mention priority code 042818. Click here if you prefer to sign up online.

You Blew It!

Border Tax is Batty

“In general the more free and unrestrained commerce is, the more it flourishes. No nation was ever ruined by trade.” — Ben Franklin

House Speaker Paul Ryan is at it again. After failing to propose a free-market alternative to Obamacare that could win passage in the House, he now is proposing a 20% Border Adjustment Tax (BAT) to offset a proposed reduction in corporate income tax rates from 35% to 20%. The border tax would impose a 20% tariff on imports only to encourage “Made in America” products. The legislation is aimed at raising $100 billion in annual revenues.

Ryan has converted Steve Bannon to the idea, as well as Reince Priebus and trade adviser Peter Navarro (producer of the infamous “Death by China” documentary).

Fortunately, National Economic Council Director Gary Cohn and Treasury Secretary Steven Mnuchin are against the border tax.

What Ryan and company don’t realize is how big trade is in this country. Exports plus imports amounts to 30% of gross domestic product (GDP) in the United States, and nearly 60% in all other countries. A trade war easily could escalate in response to BAT.

America has a long history of free trade and reducing tariffs over the past two centuries. Let free trade ring!