Technology stocks, often considered the “wave of the future,” can provide relatively strong growth prospects because the industry evolves at a faster rate than many others. One exchange-traded fund (ETF) that combines the promise of technology with the high-growth emerging market of China is the Guggenheim China Technology ETF (CQQQ).

This fund invests in technology companies based in mainland China, with allowances made for Hong Kong and Macau-based companies if most of their revenues come from China, Hong Kong and Macau. Market capitalization is a factor for index inclusion here, with a requirement of $200 million being the threshold for initial inclusion in the fund.

As a result, CQQQ’s top holdings are some of the biggest names in Chinese technology, and nearly 60% of the assets are invested in Hong Kong-based companies.

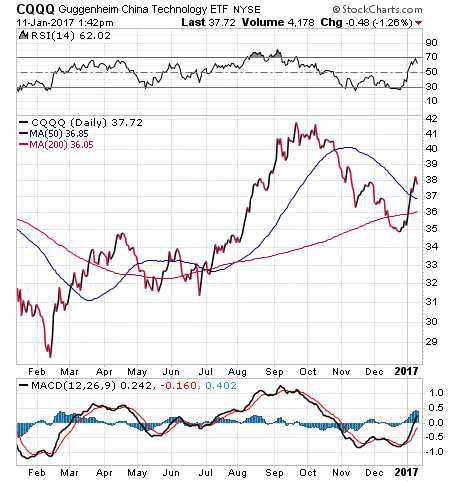

Over the last year, this fund has increased in value by 8.3%, not quite living up to the 12% return posted by the S&P 500 in that time. It pays a 1.66% yield and has an expense ratio of 0.70%.

The fund’s total assets are about $47 million. This means that it is below my recommended threshold for investment, but its strategy is one that is worth bringing to your attention. And 2017 could be a very different year for international and emerging stocks than what we saw in 2016.

The top five holdings for this fund are Tencent Holdings, 10.15%; Alibaba Group, 8.83%; Baidu Inc., 8.02%; NetEase Inc., 6.94%; and Semiconductor Manufacturing, 4.79%. The fund’s assets are concentrated in its top holdings because of its market-cap weighting. All told, there are about 75 positions in the fund at any given time.

If investing in a double-whammy of growth possibilities appeals to you, Guggenheim China Technology ETF (CQQQ) could be a good place to start your research.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)