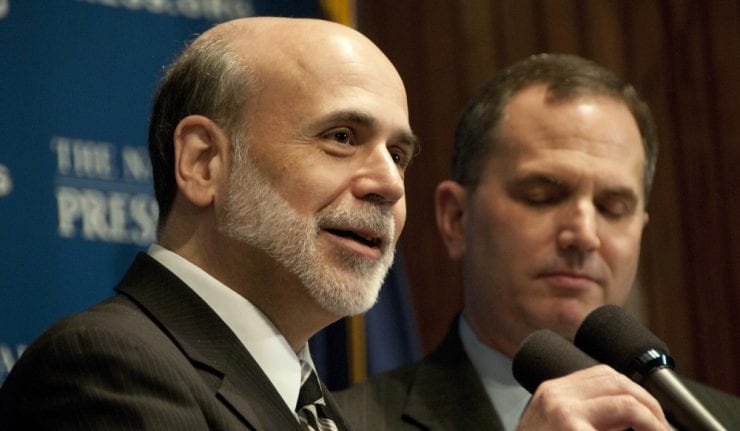

Ben Bernanke, two-term chairman of the Federal Reserve (2006-2014), came to the SALT conference this week in Las Vegas, and was interviewed by Bloomberg editor Erik Schatzker. The interview was not allowed to be televised or streamed, so I expected some fireworks with some tough questions.

Unfortunately, all we witnessed were softball questions that bored the audience to tears. (I saw hundreds checking their cell phones.) Sadly, the audience was not allowed to ask questions. I would have been the first in line.

Here are two questions I would have asked.

- In January, 2007, you gave a talk called “Bank Regulation” before the annual American Economic Association meetings, in which you used the words “panic” and “crisis” at least 34 times. You apparently knew trouble was brewing. As the nation’s chief banker, you knew about the irresponsible sub-prime and no-documentation mortgage loans (John Allison’s BB&T bank and other commercial banks refused to participate in this clear violation of the “prudent man” rule in banking). Yet for two years before the mortgage crisis hit (2008), you, as head of the Fed and top bank regulator, allowed this fraud to continue. Shouldn’t you have resigned or been fired for this dereliction of duty?

- You passed on discussing whether the banking industry is overregulated as a result of Dodd-Frank, passed in 2010. Since then, not a single community bank has been approved. What steps would you take to re-establish a vibrant banking community?

While I think we can all agree that Bernanke was not the leadership the Federal Reserve exactly needed during a difficult time for the markets, I almost wish that he was the Fed chair right now, just so I could see how he would hold up in a different kind of market environment, and under a very different president.

In 2014, when Janet Yellen took over the reigns of the Federal Reserve, there was a lot placed on her shoulders. Thankfully, regardless of any flaws she might have, Yellen is a cool customer. She plays her cards close to her chest and doesn’t make it easy for markets to guess her next move. She was also willing to propose and champion some very controversial (at the time) policies, such as beginning to hike interest rates after nearly a decade of inaction by the Fed.

Maybe that should’ve been my third question for Ben Bernanke, what do you think of Janet Yellen’s leadership?