The broader domestic economy is showing clear signs of a pickup in forward growth, and this means that I’m developing a particular interest in high-yield assets that fit nicely with my appetite for floating-rate income.

On a continuous basis, I’m seeing smart money in the bond market selling on rallies and not doing a whole lot of buying on dips. This tells me that, ultimately, expectations for a bump in short-term rates won’t be too far behind the recent bump in long-term rates. With Fed Funds trading at less than 1.00% and the three-month LIBOR, or London Interbank Offered Rate, at 1.38%, there is really only one possible direction for both of these rates which are tied to floating-rate debt to go, and that’s higher.

So, if a business development company (BDC) can generate a current yield of 8.0% or higher from a portfolio of floating-rate loans while paying a monthly dividend, I’m very interested in getting involved while short-term rates are still artificially low. To that end, PennantPark Floating Rate Capital (PFLT) is, in my view, a fantastic way to increase one’s weighting in what should be an excellent place to ride the eventual rise in interest rates on the short end of the yield curve.

As stated on the company’s website, www.pennantpark.com, PFLT’s investment objective is to seek current income and capital appreciation by investing primarily in floating-rate loans and other investments made to U.S. middle-market private companies whose debt is rated below investment grade. Under normal market conditions, the company generally expects that at least 80% of the value of “managed assets” — net assets plus any borrowings for investment purposes — will be invested in floating-rate loans and investments with similar economic characteristics, including cash equivalents invested in money-market funds.

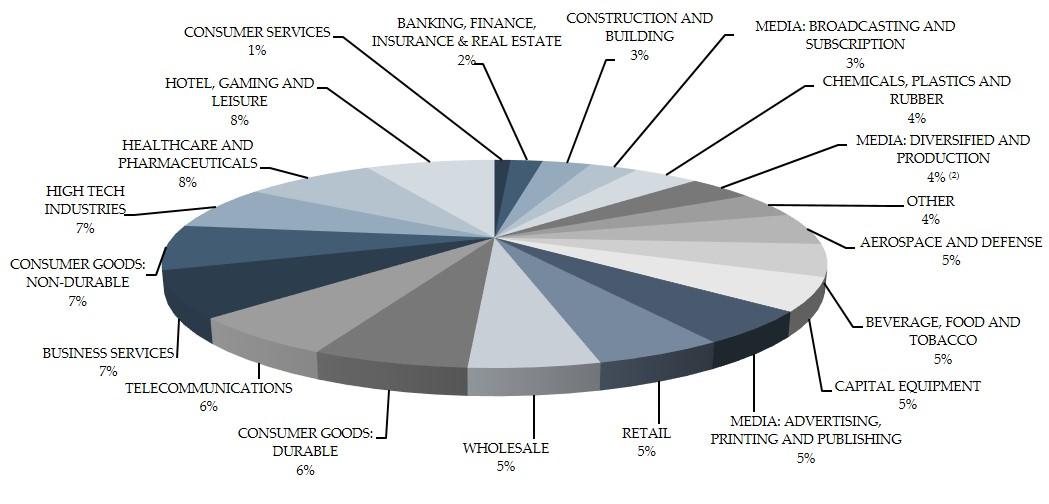

PFLT generally expects that senior secured loans will represent at least 65% of the overall portfolio. The company also expects to invest up to 35% of the overall portfolio opportunistically in other types of investments, including second-lien, high-yield, mezzanine and distressed-debt securities and equity investments. The investment size averages $8.1 million, on average, although PFLT expects that this investment size will vary proportionately with the size of its capital base. The current portfolio is made up of loans to 86 companies across 25 industries. Of those loans, 99% of them are structured as the floating-rate variety.

PennantPark also explains that floating-rate loans are typically made to U.S. and, to a limited extent, non-U.S. corporations, partnerships and other business entities which operate in various industries and geographical regions. Portfolio companies may obtain floating-rate loans to refinance existing debt; for acquisitions, dividends and leveraged buyouts; and for general corporate purposes.

Most of the floating-rate loans carry an average maturity of three to 10 years. In addition, PFLT may obtain security interests in the assets of its portfolio companies to serve as collateral in support of the repayment of these loans. This collateral may take the form of first- or second-priority liens on the assets of a portfolio holding.

Net asset value for PFLT, as of June 30, is estimated to be between $13.95 and $14 per share, right about where the shares are trading. The company also priced a secondary offering of six million shares on Oct. 25 at $14.06 per share, which provides a brief opportunity in which investors can acquire PFLT shares with current dividend yield locked in at just above 8.0%.

For many high-yield investors, 8% might not sound as tantalizing as the yield on other BDCs, but it would be hard to locate another BDC that has such a solid loan portfolio and sound management that will provide decent share price stability as interest rates rise. For my high-yield advisory Cash Machine, PennantPark Floating Rate Capital is a core holding with an ideal monthly dividend payout that makes it a prime income investment in the present market environment. To find out more about PFLT and other similar income opportunities, check out Cash Machine by clicking here and learn how to position a portfolio for high income in a rising-rate market.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)