The O’Shares FTSE Asia Pacific Quality Dividend ETF (OASI) is a refined yet simple way for investors to play the dividend market in the Asia-Pacific region.

Similar to the other O’Shares dividend funds, OASI chooses its holdings from the FTSE Developed Asia Pac Index, which is composed of roughly 800 of the largest publicly listed companies within the developed Asia-Pacific region. OASI screens the candidates and selects those that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds.

Since its inception date of August 19, 2015, OASI has been part of O’Shares ETF Investments, the vision of Chairman Kevin O’Leary, “a long-term investor who wants less risk.” O’Leary has also noted that OASI is a key component of his “diversified equity portfolio invested in the highest quality, large-cap and small-cap companies in the U.S., Europe and Asia.”

Interested investors can check out the O’Shares dividend ETF Talks for the United States and Europe, both published in earlier weeks, here: O’Shares FTSE Europe Quality Dividend ETF (OEUR) and O’Shares FTSE U.S. Quality Dividend ETF (OUSA).

Though OASI is a diversified fund, its holdings are skewed towards the Asia-Pacific region’s leading economic powers, who pay the highest-quality dividends. As of this writing, OASI is 44.05% invested in Japan, 26.25% in Australia, 14.08% in Hong Kong, 8% in South Korea and 5% in Singapore.

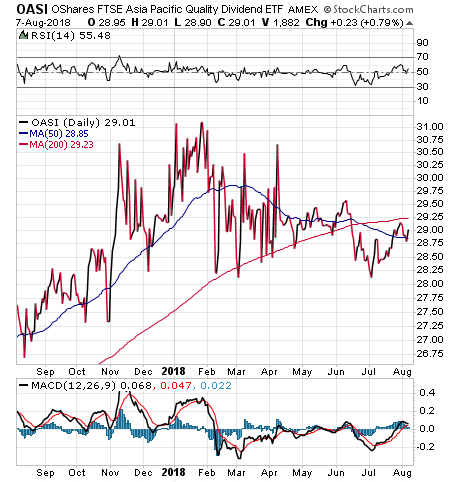

Year to date, OASI has experienced high levels of volatility and is down 1.31%. According to Seeking Alpha, part of the reason for the downturn in the Asian markets stems from China’s trade worries, which dragged the Asian markets to nine-month lows in early July. Investors who are considering plays on the Asian markets should do their due diligence.

The fund’s one-year return is 5.46%. OASI pays a distribution yield of 5.03% and charges an expense ratio of 0.48%.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.