There is an emerging sense of optimism being sparked by a trifecta of geopolitical happenings which have unfolded within the past 48 hours.

China wants to come to the table, a deal on the North American Free Trade Agreement (NAFTA) is making good progress and Qatar is providing a $15 billion lifeline to Turkey to steady the lira and soaring interest rates. While I support the first two items of progress, keeping pressure on Turkey for the release of American pastor Andrew Brunson — after that country tried to negotiate clearance for a Turkish bank that has been under legal investigation by the United States for violating sanctions against Iran as conditions for his release — is the right posture.

National Security Advisor John Bolton told the Turkish ambassador “no deal,” leaving the situation in a current stalemate. Here is my market analysis.

With five of the past six trading sessions being lower for the major averages, the headline that “China and U.S. to Resume Low-Level Talks in Bid to Resolve Trade War” came as a breath of fresh air. The market had been suffocating on the notion of further tariffs being triggered and potential additional action if China didn’t start to cooperate. China’s Ministry of Commerce announced that vice commerce minister Wang Shouwen will visit the United States in late August to discuss trade with U.S. Treasury Under Secretary David Malpass.

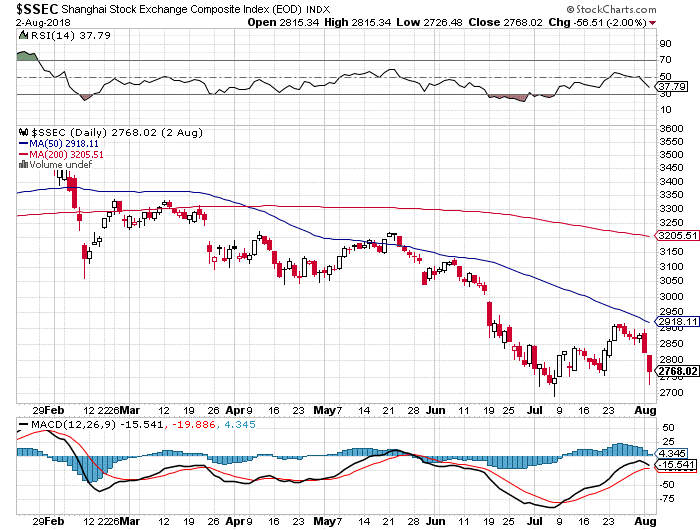

Several things will be on the table: opening foreign investment in Chinese companies, reworking the terms of transferring technology, increasing exports to China and reducing the trade deficit. It is also notable that China’s National Development and Reform Commission acknowledged that bankruptcy filings in China are on the rise this year. This might well be a larger catalyst than what is being reported. Additionally, two of China’s major consumer companies Tencent and JD.com, both missed profit forecasts this week, sending the Shanghai Composite Index to a new two-year low.

Chart courtesy of Stockcharts.com

More trade-related headlines crossed the tape as Chief Economic Advisor Larry Kudlow said in a Fox News interview that the United States is making headway in Europe and Mexico. Regarding NAFTA and specifically U.S.-Mexico, Kudlow said the new trade deal will be great for both countries. He also expressed that the current economic boom is far from over, which is being taken to heart by investors after much handwringing about a potential slowdown of domestic growth due to a trade war on many fronts. Although much work has yet to be done, the news sparked a big relief rally.

As to what the market cares about most, it is the stocks of those companies that exceeded Wall Street estimates and raised guidance for the third quarter and all of 2018. Earnings season always separates the wheat from the chaff, the future winners from those that will end up being a source of year-end tax selling to offset capital gains. Within every bull market there are various phases where even bad news is ignored and stocks trade higher. This is not one of those periods. We’re in a “take no prisoners” market where, if a company misses its quarterly numbers, its stock will suffer greatly.

What is even more compelling is that we are in the midst of what is arguably the riskiest time of the year for the stock market — Aug. 1 through Sept. 15. Wall Street’s A-Team is vacationing in the Hamptons and the B-Team is left to mange the market amid bold headlines and thin trading volume. A top priority for me in leading the Cash Machine investment advisory service is to maintain a high level of asset stability in light of the risk of the China trade talks failing, a Turkish lira currency crisis possibly involving capital controls erupting and an Italian bank crisis occurring from too much exposure to emerging market debt.

It could be any one or a combination of these exogenous factors, among others, that can trigger renewed selling pressure. Because trading is light, the moves are more exacerbated. And while the market landscape is currently somewhat of a post-earnings season minefield, there are plenty of stocks that are trading higher against nearly any and all negative forces that impact the broader market. Within the electronic payments sector, there are some true market standouts that rarely give much ground on bad days and just march higher month after month, year after year.

Visa (NYSE: V) and MasterCard (NYSE: MA) are the most widely known and owned, but there are other lesser-known stocks that are just as impressive. These companies facilitate the point-of-sale transaction companies like Visa, MasterCard, American Express (NYSE: AXP), Discover Financial Services (NYSE: DFS), PayPal (Nasdaq: PYPL), Square Inc. (NYSE: SQ), Apple Pay, Google Wallet along with bank debit and credit cards. Such digital payment infrastructure stocks offer technology that focuses on the smooth processing of billions of dollars of daily transactions around the globe. My favorite companies within this space include Global Payments (NYSE: GPN), Total Systems (NYSE: TSS) First Data (NYSE: FDC), Fiserv (Nasdaq: FISV) and Worldpay (NYSE: WP).

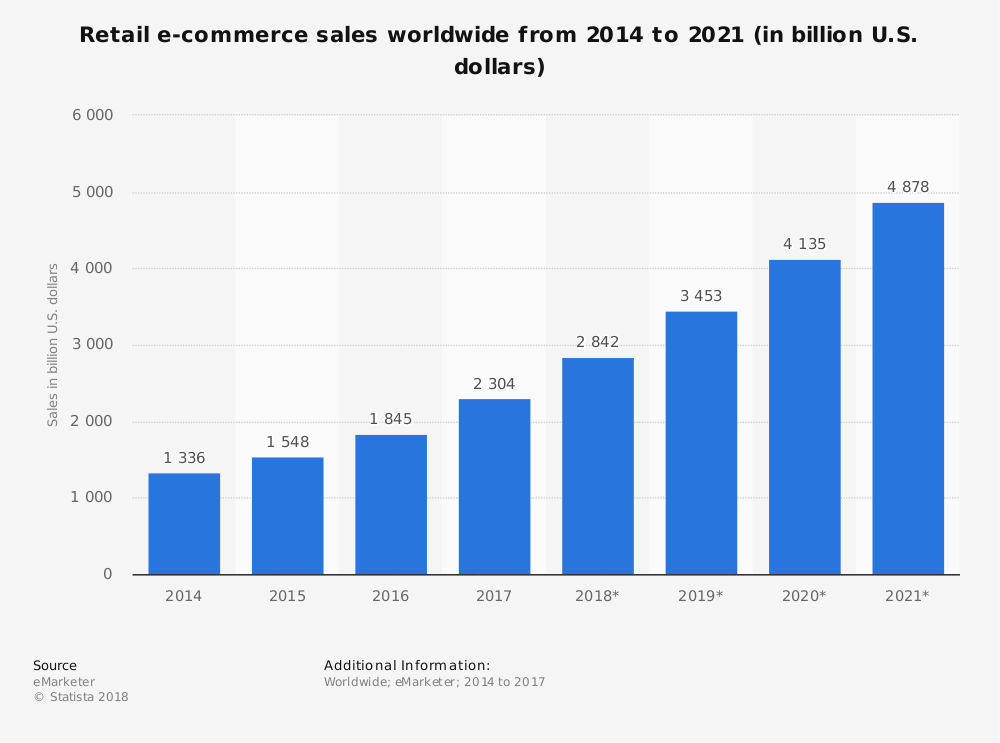

These companies operate in both the physical and mobile payment platforms where the compounded annual growth rate (CAGR) of digital payment just in the United States is expected to be 13.5% through 2022. The working term is “digital commerce” and the Transaction Value is set to grow from $2.8 trillion in 2018 to $5.4 trillion in 2022. So, no matter what happens with China, Iran, Turkey, NAFTA, the World Trade Organization, Europe or the mid-term elections, the growth of mobile e-commerce and digital commerce is going to rapidly expand.

My view is that any headlines that cross the tape that inflict any short-term price pressure on any of these stocks noted should be used as an opportunity to initiate and add to positions. It is rare that investors can buy into a five-year secular trend within a mature bull market that literally touches all aspects of businesses, governments and individuals. While Wall Street spends billions of dollars researching the “next big thing,” my advice to investors is simple — follow the money.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)