Despite missing earnings expectations for the last four quarters, the UGI Corporation (NYSE:UGI) stock might be oversold, which could make the stock an opportunity to take position at the currently discounted prices.

Share prices of energy companies have been struggling amid uncertainties resulting from the currently unresolved trade conflict between the United States and China, as well as the weak outlook on global economic growth. The short-term outlook for large energy companies, such as ExxonMobil (NYSE:XOM) or Chevron (NYSE:CVX), appears bleak. However, a shortage of capacity and several bottlenecks in the distribution segment might be the setting that midstream companies, such as the UGI Corporation can use to reverse the current downtrend and deliver share price gains.

Wall Street analysts currently covering the stock downgraded their recommendation for August. The one “Buy” and three “Strong Buy” recommendations in July became just one “Strong Buy” and three “Hold” recommendations for the current month. However, these recommendations are more relevant to the short-term outlook. Over the horizon, the UGI stock might have a more positive outlook.

In the past two decades, UGI managed to deliver 12.1% adjusted earnings per share (EPS) compounded annual growth rate (CAGR). The actual growth rate exceeded the company’s EPS target growth of 6% to 10%. Furthermore, the company also exceeded its 4% dividend growth rate target and delivered 6.1% average annual dividend growth over the past two decades.

While past performance over extended periods is no guarantee of future performance or immediate trend reversal, the UGI’s fundamentals and recent investment might pay off with a share price gain over the mid- to long-term. Furthermore, even is the analysts generally recommend a “Hold” for now, UGI’s current share price in the mid-$49 range still has nearly 20% room on the upside before it reaches the analysts current average price target of $59.

Financial Results

On August 5, 2019, the UGI Corporation reported financial results for its fiscal third-quarter 2019. The company reported year-over-year volume reduction in its natural gas distribution due to warmer-than-expected temperatures, especially in April, which had average temperatures 30% higher than normally. UGI reported a one cent loss per share for the current period versus a $0.30 earnings per share for the same period last year. However, on the adjusted basis, UGI’s third-quarter 2019 EPS of $0.13 was nearly 45% higher than the $0.09 EPS from one year ago. Despite the positive year-over-year growth, the current earnings fell 31.6% short of the $0.19 EPS expected by analysts.

Despite missing earnings expectations and based on the results of the first nine months of the fiscal year, as well as expectations for the fourth quarter, UGI reiterated its $2.40 to $2.60 earnings expectations for the full fiscal year that will end on September 30, 2019. However, UGI expects the full-year adjusted earnings to be at the lower end of that range.

Share Price

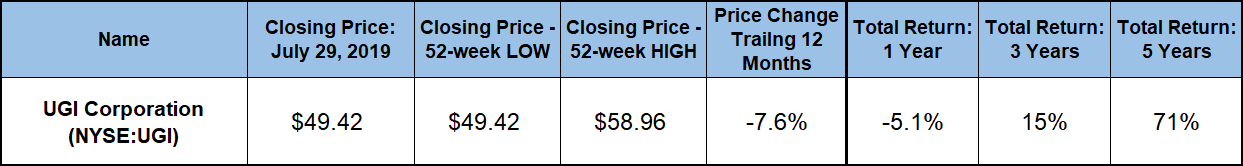

While experiencing strong overall growth over the past decade, the share price has been trading relatively flat in the past two years. While the overall market and most other equities declined in the last quarter of 2018, UGI’s share price actually rose significantly. In the first four months of the trailing 12-month period, the share price rose more than 10% to reach its 52-week high of $58.96 on December 7, 2018.

However, the price reversed that uptrend and declined slowly to give back all those gains by early July 2019. The share price continued to depreciate and closed on August 5, 2019, at $49.42. In addition to being 16% lower than the 52-week high from December 2018 and 7.6% lower than one year earlier, the August 5 closing price was also the new 52-week low. However, compared to its own level from five years ago, the current share price was 47% higher.

While insufficient to counter the 7.6% share price decline over the last year, dividend income distributions managed to offset one-third of that decline and limit total losses to 5% over the trailing 12 months. However, asset appreciation combined with steady dividend distributions for positive gains over extended periods. The three-year total returns were 15%. Furthermore, the UGI shareholders enjoyed a 71% total return over the past five years.

UGI Corporation (NYSE:UGI)

Based in King of Prussia, Pennsylvania, and founded in 1882, the UGI Corporation distributes, stores, transports and markets energy products and related services. The company operates through four business segments — AmeriGas Propane, UGI International, Midstream & Marketing and UGI Utilities. Through 1,900 propane distribution locations, the UGI Corporation distributes propane to approximately 1.7 million residential and commercial customers. Additionally, the company sells, installs and services propane appliances, including heating systems and propane-powered generators. In addition to propane, the UGI Corporation also distributes liquefied petroleum gases (LPG). The company’s retail operations comprise more than 35,000 locations that offer natural gas, liquid fuels and electricity to residential, commercial, and industrial customers.

Furthermore, the company also distributes natural gas to nearly 650,000 customers in 44 counties across eastern and central Pennsylvania through its distribution network of more than 12,000 miles of pipelines. Additionally, the UGI Corporation also owns and operates a network of 13 substations and 2,200 miles of electrical supply network that provides services to more than 60,000 customers in northeastern Pennsylvania. Moreover, the company also operates its own electric generation facilities powered by a variety of fuels — coal, landfill gas, solar and natural gas. Additionally, UGI also operates its own natural gas liquefaction, storage and vaporization facility, as well as propane storage facilities, mixing stations and rail transshipment terminals. The UGI Corporation also manages natural gas pipeline and storage contracts for third-party service providers and offers heating, ventilation, air conditioning, refrigeration, mechanical and electrical contracting services.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.