Despite missing earnings expectations for the first two quarters in 2019, robust financial results and rising dividend income distributions over the past 12 months provided a strong foundation for asset appreciation and have allowed the Entergy Corporation (NYSE: ETR) to reward shareholders with a total return of more than 35%.

Additionally, technical indicators suggest that Entergy’s share price advancement exhibited over the past year might have enough fuel to continue for at least few more periods. As with all financial decisions, interested investors should complete their own detailed analysis and consider factors relevant to their own portfolio strategy before making any decisions. However, with the August 7 ex-dividend date approaching quickly, investors should move quickly to capture the next round of dividend distributions, as well as any share price surge that might occur from Entergy’s relatively positive second-quarter earnings report.

Financial Results

After beating Wall Street analysts’ earnings expectations in the last three periods of 2018, Entergy’s first-quarter adjusted earnings per share (EPS) of $0.82 were down one cent versus the same period last year and fell 16.3% short of the $0.98 analysts’ first-quarter earnings expectations. While the company reported another earnings miss for the second quarter on July 31, 2019, the shortfall was much smaller than in the first quarter and the full-year outlook still looks promising.

For second-quarter 2019, the Entergy’s reported earnings of $236 million correspond to $1.22 per diluted share. While the earnings were 16.3% short of analysts’ estimates in the first quarter, the second-quarter adjusted EPS of $262 million, or $1.35 per share, was just 1.5% below the expected $1.37. However, even with missing earnings expectations now for the last two consecutive quarters, Entergy still beat cumulative earnings estimates over the trailing four periods by more than 12%.

“Our results for the quarter keep us well-positioned to achieve our full-year financial guidance,” said Entergy Chairman and Chief Executive Officer Leo Denault. “With a track record of success, clarity in our vision and confidence in our strategy going forward, we are raising our 2020 and 2021 adjusted EPS outlooks and narrowing our adjusted EPS ranges across our forecast period,” added Mr. Denault.

Entergy reported total second-quarter revenue of $2.67 billion, which was level with total revenue from the same period last year. However, revenue outlook for the third quarter might be slightly better. Above-average temperatures across Entergy’s service area have driven electric energy demand and consumption higher, which should translate to higher-than-forecasted revenues. Furthermore, relatively tepid fuel price increases this year should also deliver lower production cost escalation, relative to revenue increase.

In light of second-quarter results, Entergy reaffirmed its median earnings outlook, but narrowed the range by $0.05 on both ends from the previous range between $5.10 and $5.50 to the new EPS guidance range between $5.15 and $5.45 per share for full-year 2019. Additionally, based on identified opportunities to improve reliability and overhead efficiencies, the company also increased its EPS outlook for the subsequent two years and now estimates $5.45 to $5.75 EPS for 2020 and $5.80 to $6.10 for 2021.

Share Price

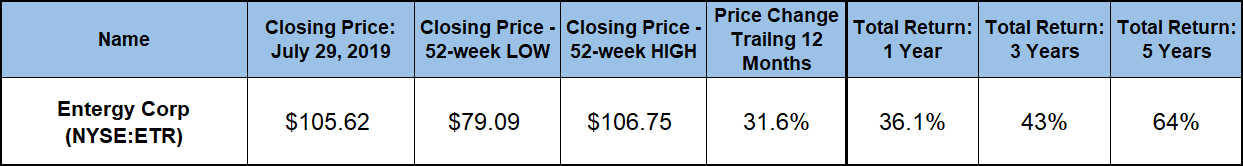

Despite riding a relatively steady uptrend for nearly four years, Entergy’s share price pulled back 1.5% at the beginning of the previous 12 months. After that brief pullback from regular price fluctuations, the share price reached its 52-week low of $79.09 on September 26, 2018. However, after bottoming out at the end of September 2018, the share price reversed direction and advanced 35% before reaching its 52-week high of $106.75 on July 18, 2019.

Since peaking in mid-July, the share price gave back some of those gains. After the second-quarter earnings announcement the share price opened at $104.90 on July 31, 2019, or 1% higher than the previous day’s closing price and gained another 1.7% by the end of trading to close at 105.62 by the end of day’s trading. While 1.1% lower than the 52-week-high, the July 31 closing price was still 31.6% higher than it was one year earlier, as well as 33.5% above the 52-week low from September 2018 and 44% higher than it was five years ago.

While asset appreciation provided most of the gains, Entergy’s dividend income payouts contributed nearly 10% of the company’s 36% total return over the past 12 months. The company also rewarded its shareholders with a 43% total return over the past three years. Furthermore, the combined total return of capital gains and dividend income exceeded 60% for the last five-year period.

Entergy Corporation (NYSE:ETR)

Formed in 1949 as the Middle South Utilities, Inc. and currently based in New Orleans, the Entergy Corporation produces and distributes electricity through two business segments. The Entergy Wholesale Commodities (EWC) segment owns and operates six nuclear power plant units in the northern United States and owns all or partial interest in several non-nuclear power plants. The electricity generated by nuclear power accounts for 30% of the company’s total electric generating capacity of approximately 30,000 megawatts (MW). In addition to nuclear power, Entergy generates electricity with natural gas, oil, coal, hydro and solar power sources. The company’s Utility segment generates, transmits and distributes electric power in a four-state service territory that includes portions of Arkansas, Mississippi, Texas and Louisiana, including the city of New Orleans. This segment owns and operates approximately 22,000 MW of generating capacity and 15,500 circuit miles of interconnected high-voltage transmission lines, as well as natural gas distribution businesses in New Orleans and Baton Rouge.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.