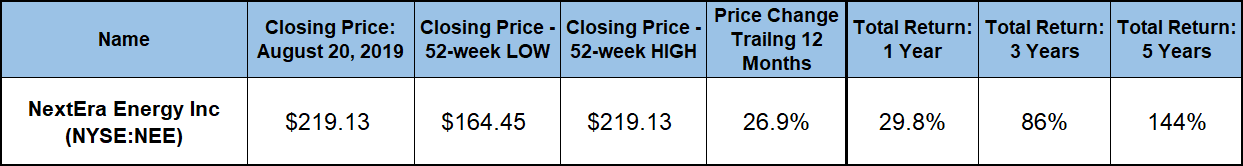

After nearly doubling its share price over the previous five years, NextEra Energy, Inc. (NYSE:NEE), a Florida-based electricity producer and distributor, has delivered a 27% share price gain over the trailing 12 months.

Despite declining more than 45% during the 2008 financial crisis, the NextEra stock followed a relatively stable uptrend for more than a decade. After losing nearly half of its value in the second half of 2008, the NextEra share price resumed its uptrend right away and regained all those losses by the beginning of 2013 and continued to rise with minimal volatility. Since bottoming out slightly above the $37 level in October 2008, the share price has advanced nearly six-fold.

While the share price is slowly approaching the Wall Street analysts target price of $222.10, most of the analysts still hold optimistic recommendations. Out of the 15 analysts currently covering the stock, more than 85% have either a “Buy” recommendation (8) or a “Strong Buy” recommendation (5). The remaining two analysts stand at a “Hold” recommendation.

Financial Results

While missing earning expectations in the fourth-quarter, NextEra beat expectations in the other three periods during the last year. The fourth quarter miss was just $0.04, and the company is currently 2.3% ahead of the cumulative earnings expectations over the trailing four quarters.

On July 24, 2019, NextEra released its most recent financial report for the second quarter. Operating revenues advanced 22.3%, or $900 million, from $4.1 billion in the second-quarter last year to $5 billion for the most recent period. Adjusted earnings per share (EPS) rose 13% from $2.08 to $2.35 and beat analysts’ earnings expectations of $2.31 by 1.7%.

Based on the results for the first half of 2019, NextEra reiterated its adjusted EPS forecast of $8.00 to $8.50 for full-year 2019. Additionally, the company expects to continue rising its adjusted EPS at an annual rate between 6% and 8% through 2022.

Share Price

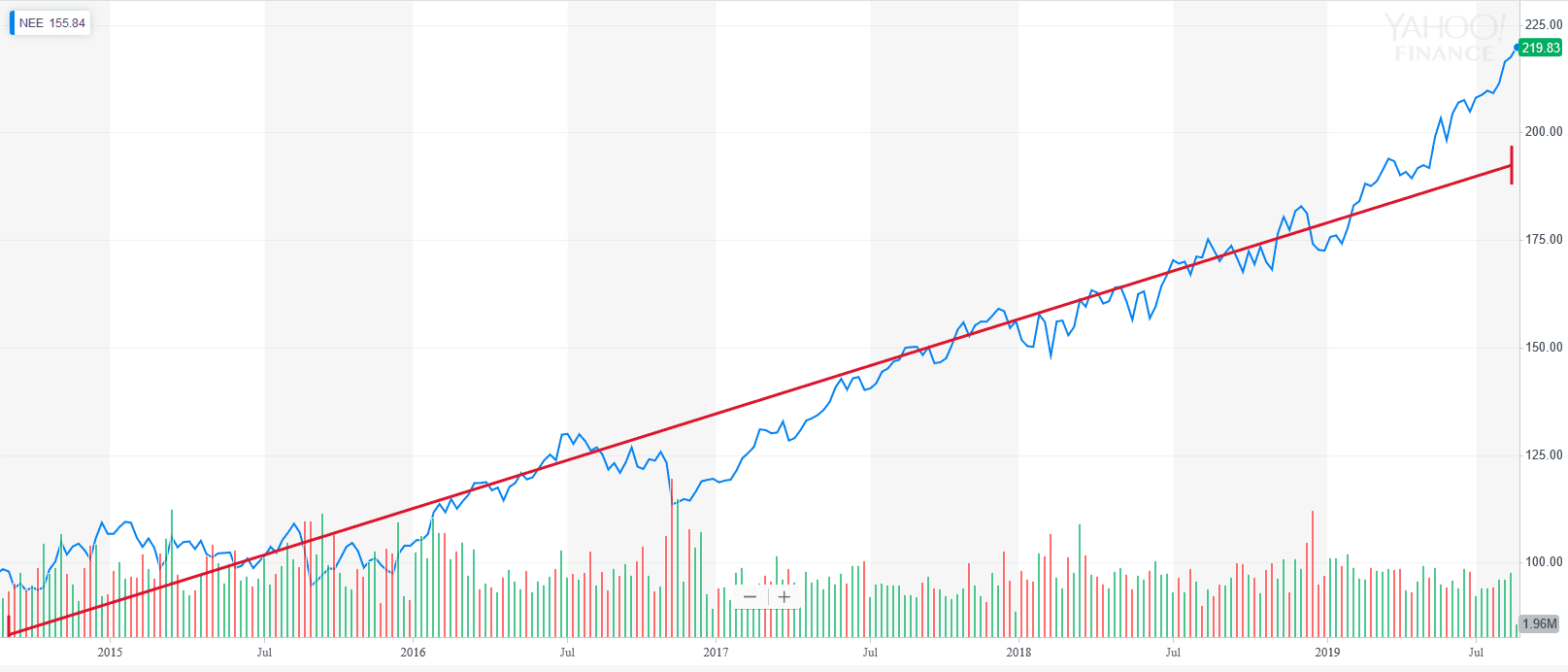

While investors might be able to find few equities with higher total capital gains over the past decade, very few of those equities would be as stable and volatility-free as the NextEra stock. The graph below of the stock’s five-year performance seems pretty dull. However, dull and boring with substantial gains is exactly what most long-term investors seek.

The red line on the graph below represents a five-year stock price regression. Only three sections of the share price graph appear to deviate substantially from the regression line. Additionally, most of the volatility appears to have occurred in the early part of the five-year period. The share price seems to follow the regression line exactly between May 2007 and the beginning of 2019.

Furthermore, once the share price begins deviating from the regression line in early 2019, the deviation turns into the above average territory, which is very positive for the company’s shareholders.

The share price continued its general uptrend in the early stages of the trailing 12-month period. After passing through its 52-week low of $164.45 on September 26, 2018, the share price continued rising. The only noticeable disruption was a small share price pullback in response to the overall market selloff in the fourth-quarter 2018.

However, while the overall market and many other equities exhibited declines in excess of 25%, the NextEra stock dipped less than 9% during December 2018. After resuming its uptrend at the beginning of 2019, albeit at a steeper slope, the stock recovered all its December losses by mid-February 2019 and continued advancing. Since regaining its losses from late-2018, the share price has resumed its course and continued setting a series of new all-time highs.

The share price closed at the end of trading on August 20, 2019, at its most recent all-time high of $219.13. In addition to gaining nearly 27% over the trailing 12-month period, the Aug. 20 closing price was also 33% higher than it was one year earlier. Moreover, the share price more than doubled over the last five years for a total return of 123%.

NextEra combined its strong capital gains with its growing dividend income distributions to reward its shareholders with robust total returns over the past few years. The capital gains of nearly 27% and the 2.3% dividend income delivered a total return on shareholders’ investment of nearly 30% just over the trailing 12 months. The shareholders enjoyed even larger returns over extended time horizons. The asset appreciation and dividend payouts combined for total return on shareholders’ investment of more than 85% over the last three years. Lastly, the shareholders more than doubled their investment over the last five years and enjoyed a total return of nearly 145%.

NextEra Energy, Inc. (NYSE:NEE)

Headquartered in Juno Beach, Florida, and founded in 1984, NextEra Energy, Inc. generates electric power and distributes electricity to residential and commercial customers primarily in Florida. Based on more than 46,000 MW of generating capacity with electric generation facilities located in 30 U.S. states and four Canadian provinces, NEE is one of the largest electric power companies in North America. The company operates through two main subsidiaries — Florida Power & Light Company (FPL) and NextEra Energy Resources (NEER). FPL provides electricity distribution to more than 5.5 million residential and commercial customer accounts and 10 million people across almost half the state of Florida.

Through its NEER subsidiary and its affiliated entities, NextEra Energy is the largest generator of renewable energy from the wind and sun in the world based on Megawatt hours (MWh) produced. Representing approximately 6% of U.S. nuclear power electric generating capacity, the company had one of the largest arrays of nuclear power stations in the United States, with eight reactors at five sites located in Florida, New Hampshire, Iowa and Wisconsin. NEER’s assets accounted for approximately 11% of the installed base of universal solar power production and about 16% of the installed base of wind power production capacity in the United States.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.