Investors concerned over a potential recession in the near future and looking to diversify their portfolio accordingly could consider the Franco-Nevada Corporation (NYSE:FNV) as a potential play to protect their current wealth.

Since its incorporation in late 2007, the Franco-Nevada Corporation has delivered consistent asset appreciation with relatively low volatility. Additionally, the company’s dividend income distributions have increased every year. Just over the last 12 months, the company delivered a total return of more than 60%.

Some economists are concerned that without resolution in sight, a continued trade war with China could bring about a potential recession. Therefore, investors who share those concerns are considering reallocating at least a portion of their portfolio into investments that are more likely to be recession resistant, such as utilities. Additionally, investors are considering investments that serve as safe havens during economic downturns, such as precious metals — especially gold.

Investors looking to invest in gold have multiple options. The most obvious and oldest option is investing in physical gold — gold coins and bullion bars. Physical gold ownership certainly is exciting and should be considered as the option for a minuscule portion of one’s portfolio. However, physical gold has many downsides regarding storage and security, as well as liquidity and ease of use in the current commerce dominated by electronic forms of payment and fund transfer.

Therefore, other options for investing in gold are gold mutual funds, gold exchange-traded funds (ETFs) and exchange-traded notes (ETNs), gold options and futures, gold individual retirement accounts (IRAs) and stocks of gold mining companies. However, another great exposure to gold has been gold streaming companies.

These companies are not involved directly in gold exploration or mining. Instead gold streaming companies offer financing to gold mining companies and receive a portion of the gold production as compensation. The advantage of investing in gold streaming companies over direct investment into mining companies and other gold investments is that gold streaming companies benefit from rising gold prices but are less sensitive to declining gold prices. When gold prices decline or when the overall gold mining segment experiences a tough period, gold streaming companies can make beneficial financing deals, which reflect positively on the overall outlook and share prices of those companies.

Dividends

The company’s current quarterly dividend of $0.25 payout marks a 4.2% increase over the $0.24 distribution from the same period one year ago. This new dividend distribution amount is equivalent to a $1.00 annual payout and a 1.03% forward dividend yield. The total annual dividend rose 22% over the past five years. However, the share price advanced 86% over the same period. Therefore, the current yield trails the 1.33% five-year yield average by more than 23%.

In addition to trailing its own five-year average the Franco-Nevada current yield is also nearly 60% lower than the 2.53% simple average yield of the entire Basic Materials sector. However, high dividend segments — like the Oil & Gas Pipelines, Oil & Gas Refining & Marketing or Agricultural Chemicals — drive the sector average higher.

Compared to its peers in the Gold industry segment, the current Franco-Nevada yield is nearly double the 0.54% segment average yield. Additionally, the Franco-Nevada 1.03% yield is also in line with the 1.04% yield average of the segment’s only dividend paying companies.

Since beginning dividend payouts in 2008, Franco-Nevada has enhanced its annual dividend amount more than four-fold. That level of advancement over the past decade corresponds to an average growth rate of nearly 14% each year.

Share Price

The company’s share price declined nearly 28% during the year leading up to the start of the trailing 12-month period. However, after reversing direction at the beginning of September 2018, the share price delivered a steady uptrend.

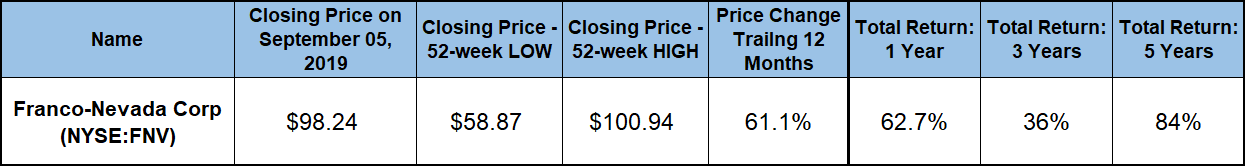

On September 11, 2019, just three trading sessions into the trailing one-year period, the share price hit its 52-week low of 58.87. After bottoming out that early, the share price embarked on a steep uptrend, recovered all its losses from the prior year and reached its previous all-time high by late-June 2019. The share price continued its rise and — after setting more than a dozen new highs — broke the $100 level for the first time ever and reached its most recent all-time high of $100.94 on September 4, 2019.

The share price pulled back 2.7% during the subsequent trading session and closed on Sept. 5 at $97.24. This closing price was 61% higher than it was one year earlier as well as nearly 67% higher than the 52-week low from early-September 2018. Additionally, the share price was 86% higher than it was five years ago.

This combination of steep asset appreciation and steadily rising dividend income payouts delivered robust total returns to the Franco-Nevada shareholders over the past few years. Driven mainly by the exceptional share price growth, the company delivered a total return of more than 61% over the past year. The share price pullback of nearly 30% in late 2017 and first three quarters of 2018 limited the total return over the past three years to just 36% over the past three years. However, shareholders almost doubled their investment over the past five years with a total return of nearly 95%.

Franco-Nevada Corporation (NYSE:FNV)

Headquartered in Toronto and incorporated in 2007, the Franco-Nevada Corporation operates as a gold-focused royalty and stream company. In addition to its investments in gold, the Franco-Nevada Corporation also has investments in other precious metals, such as silver and platinum group metals. Additionally, the company invests in the energy sector through streaming and royalty agreements in oil, gas and natural gas liquids. As of August 2019, the company had investments in 372 total assets around the globe. Nearly 80% (291) of those assets were related to precious metals mining and production, with the remaining 81 assets generating revenue from the exploration and production of oil and gas.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.