Don’t look now, but while investors are all gaga about the momentum in semiconductor, home-building and bank stocks, the energy refiners are stealing the show and outperforming every sector on the board.

The crack spread between the price of crude and the price of gasoline, jet fuel, diesel, distillates and lubricants has widened to where the companies that refine oil into these end-market products are seeing a “gusher” of profits pouring into their coffers. During all of 2019, the energy sector as a whole has sorely lagged, with many favorite stocks like Chevron Corp. (NYSE: CVX), ExxonMobil (NYSE: XOM), Royal Dutch Shell (NYSE: RDS.A), BP plc (NYSE: BP), Occidental Petroleum (NYSE: OXY), ConocoPhillips (NYSE: COP) and Pioneer Natural Resources (NYSE: PXD) enduring stock valuation drops of as much as 30 percent.

The junior exploration and pipeline companies have fared no better, with several of these stocks like Concho Resources (NYSE: CXO), Devon Energy (NYSE: DVN), Diamondback Energy (NASDAQ: FANG) and Apache Corp. (NYSE: APA) down by as much as 50%. It has been a tale of two tapes, with the S&P trading to new highs while energy investors are wallowing in a full-fledged bear market.

The world is awash in crude capacity and every time the price of WTI crude trades up to between $55-$60 per barrel, the U.S. and global spigots get turned on to full output. This saturates the market until there are coordinated efforts by OPEC and non-OPEC nations to cut production to stabilize prices. Rest assured, there is no shortage of oil and won’t be anytime soon.

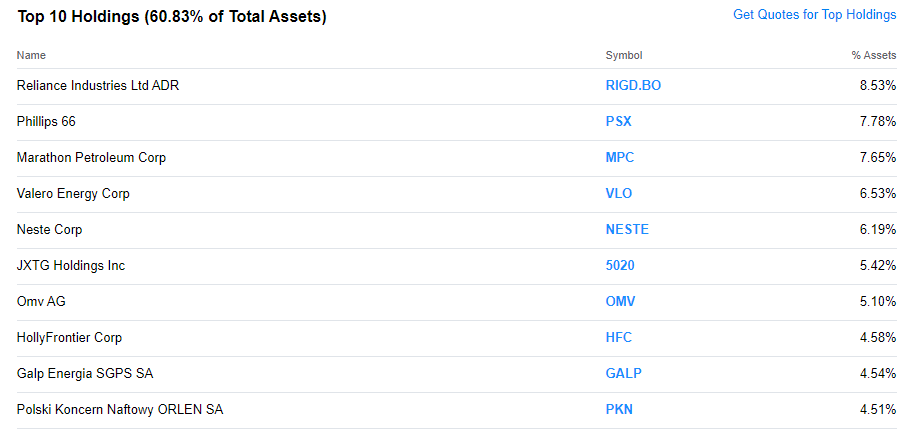

On the other hand, there is incredibly tight capacity within the refining sector as you can count the number of publicly traded refiners on one hand. The top 10 holdings in the VanEck Vectors Oil Refiners ETF (NYSE: CRAK) account for 60.83% of total assets.

And while this ETF has moved up 20% in the past two months, it’s the performance of some of the individual stocks, which pay excellent dividend yields and are hitting new 52-week highs, that deserve mention. Shares of Phillips 66 (NYSE: PSX) have rallied 43% in five months — rising from $80 to $115 and still pay a 3.15% dividend yield.

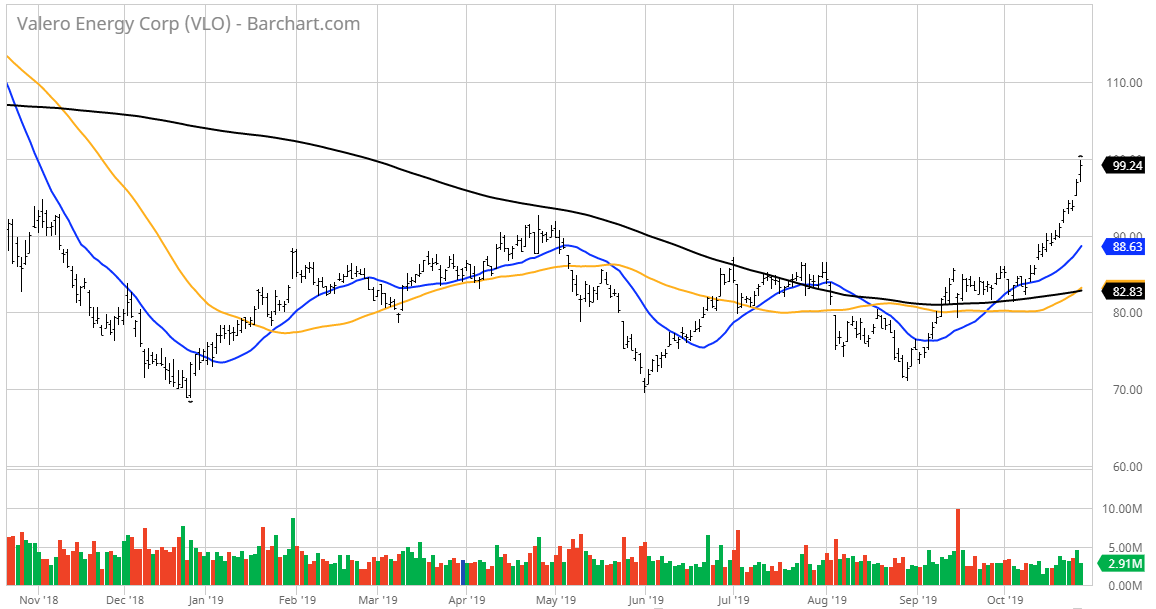

Shares of Valero Energy (NYSE: VLO) have gained 38% during the same period — soaring from $72 to $100 and still offer a fat 3.63% yield.

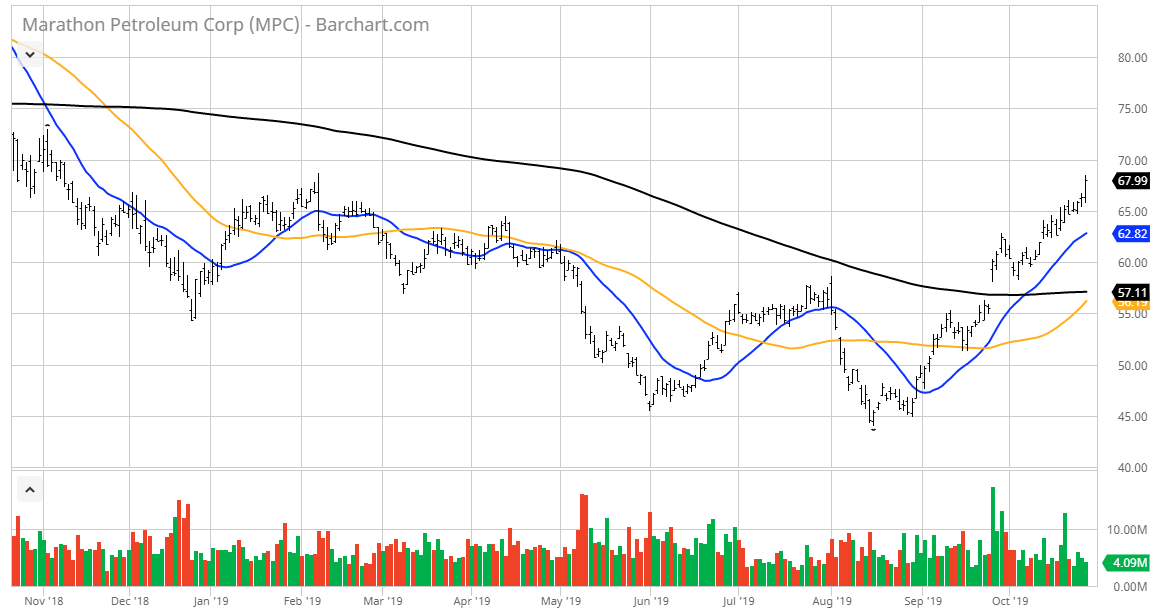

Shares of Marathon Petroleum (NYSE: MPC) have gained 51% during this same period and pay a generous 3.12% dividend yield.

My view is that these three stocks are the very best to own and trade. For real yield-hungry investors, CVR Energy (NYSE: CVI), with its 7.02% dividend yield, is hard to beat. In fact, Carl Icahn owns a majority stake in the company. But whether one buys into a single stock or all four, there is clearly a stealth bull market in the oil refining business which shows that sub-sectors of larger sectors can flourish.

My Quick Income Trader advisory service offers stock recommendations, as well as covered call and naked puts trades on bullish breakouts. I’ll be looking to take positions within these hot stocks when they pull back. Refining stocks are volatile, as the charts clearly show. As the crack spreads tighten, they will correct. But there is a lot of money to be made in this sector where the business of refining is in the hands of just a few companies.

Take a tour of Quick Income Trader by clicking here and set up an account to prepare to trade the refining stocks. There is a powerful uptrend underway where good timing can translate into big and consistent profits. Having a system in place that can maximize income and capture capital appreciation is what Quick Income Trader is all about. And getting the most out of a bull run is what makes the difference between average market gains and the kind of gains that can make a real difference in your financial well-being.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)