While some investors stay away from companies based on their personal beliefs, other investors look to invest in the companies with the best potential to deliver returns on invested funds. This could include tobacco companies, regardless of their unpopularity and the current negative media focus.

Some of the tobacco companies have been working to reduce the negative effects of tobacco smoking and offer different methods of delivering the nicotine that its consumers desire. However, recent reports that e-cigarettes might not be as safe as had been originally thought could put a damper on these efforts to rebrand new nicotine-delivery methods as healthier alternatives.

While some investors will refuse to invest in any so-called “vice” stocks, others are taking advantage of investment opportunities to pad their investment portfolios. Furthermore, in addition to traditional “vice” industries, such as alcoholic beverages and casinos, some investors are also jumping at the opportunities to invest in new companies that offer products and services in the online gambling, cannabis industry and similar market segments’

While facing uncertainties and headwinds that all startups encounter, these new companies also have their advantages. A successful startup can grow quickly and deliver tremendous returns for early-stage investors through an initial public offering (IPO) or a buyout by a large company.

However, the traditional big tobacco companies have their own advantages as well. Many are large enough to influence markets and most of them offer steady dividend income payouts to their investors. In addition to their influence in the old business, some of these traditional big tobacco companies are either expanding into new segments on their own or buying some of these new startups. Despite the share price volatility and some recent struggles, a few of the big tobacco companies are still competitive and might be able to provide a steady dividend income and substantial asset appreciation for robust total returns, at least for the near future.

Altria Group, Inc. (NYSE:MO)

Altria Group, Inc. is primarily known as a manufacturer and seller of cigarettes and smokeless tobacco products. However, the company also produces and sells varietal and blended table wines as well as sparkling wines under several labels. The company also imports and markets several labels of international wines in the United States. Additionally, Altria Group provides finance leasing services primarily in aircraft, electric power, railcar, real estate and manufacturing industries. Altria Group, Inc. was founded in 1919 and is headquartered in Richmond, Virginia.

The company’s current $0.84 quarterly payout is 5% higher than the $0.80 payout from the same period last year. The $3.36 annualized payout corresponds to a 6.64% forward dividend yield, which is more than 40% above the company’s own 4.7% five-year yield average. The company started paying dividends in 1928. Since its last dividend cut in 2009, Altria Group has boosted its annual distribution at an average rate of 9% for the last 11 consecutive years.

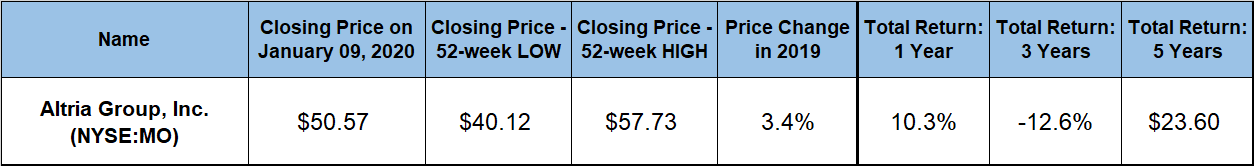

The share price entered the trailing 12-month period on a downtrend that was mostly driven by the overall market correction in the last quarter of 2018. The share price surged more than 30% during February and March before hitting its 52-week high of $57.73 on April 1, 2019. However, the share price gave back all those gains and more when it fell to its 52-week low of $40.12.

Sine bottoming out in mid-September 2019, the share price has regained its losses from the onset of the trailing one-year period to close on January 9, 2020 at $50.57. While still more than 12% short of its 52-week high, the Jan. 9, closing price was 3.4% higher than it was one year ago and 26% above the 52-week low from Sept. 2019. Share price struggles caused it to deliver losses over the past three years and limited total returns to less than 25% over the past five years. However, a resurgent share price and an above-average dividend yield have combined to deliver a total return of more than 10% over the trailing 12 months.

Philip Morris International Inc (NYSE:PM)

Philip Morris International Inc. manufactures and sells cigarettes, other tobacco products and other nicotine-containing products under some of the most well-known brands internationally. The company also owns various local cigarette brands across the globe. Philip Morris International Inc. was incorporated in 1987 and is based in New York, New York.

The current annual dividend payout of $4.68 is paid quarterly and yields 5.3%. Since the 2008 spin-off from Altria, Phillip Morris has enhanced its annual dividend payout by nearly 150%, which corresponds to an average rate of 8.4% per year. Most recently, the company boosted its quarterly payout for its Oct. 2019 distribution by 5% from $1.14 to $1.17.

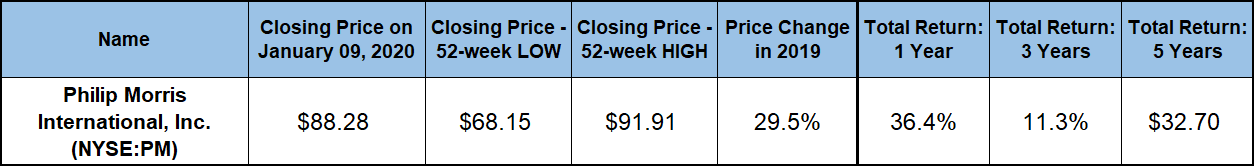

Recovering from a late-2019 decline, the share price entered the trailing 12-month period at its 52-week low of $68.15. From this low, the share price surged 35% to reach its 52-week high of $91.91 on March 21, 2019. However, the share price reversed immediately after peaking and dropped back to nearly $71 by mid-September 2019, which was just 4.5% above the 52-week low from January 2018.

However, the share price reversed once more and regained more than 80% of its losses from the March peak to close on January 9, 2020 at $88.28. Just 4% short of the 52-week high, the Jan. 9, closing price was nearly 30% higher than the 52-week low from one year ago. With this strong asset appreciation, the above-average dividend yield was able to push the company’s total return over the trailing 12-month period to more than 36%.

Vector Group Ltd (NYSE:VGR)

Vector Group Ltd. manufactures and sells cigarettes in the United States. The company produces cigarettes in 117 combinations under various brand names and e-cigarette products. In addition to its tobacco and e-cigarette business, the company provides residential brokerage and real estate sales marketing services, owns and manages its own real estate properties and engages in land development activities. Vector Group also operates the Elliman.com and AskElliman.com websites.

The company boosted its quarterly payout by 5% for the most recent dividend payout in late-December from $0.381 in the previous period to the current $0.40 distribution amount. This new payout amount corresponds to a $1.60 annualized payout and yields a 11.8% yield. In addition to outperforming the company’s own five-year yield average by more than 75%, this current yield is also nearly six-fold higher than the 2.05% average yield of the overall Consumer Goods sector. Furthermore, Vector Group’s current yield is also the highest in the Tobacco Products industry segment, as well as nearly 90% higher than the segment’s 6.26% simple average yield. Over the past two decades, the company has enhanced its annual dividend payout amount by 325%. This advancement pace corresponds to an average dividend rate of 7.5% per year.

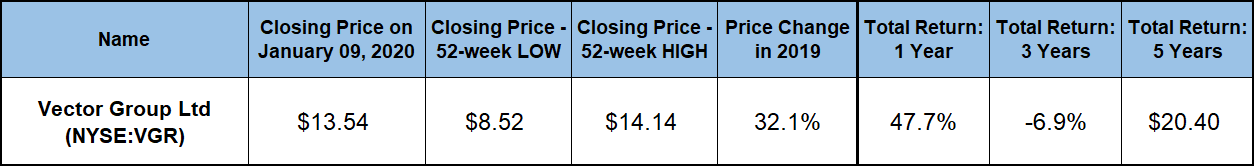

The share price declined nearly 17% between the beginning of the trailing 12-month period and its 52-week low of $8.52 on May 31, 2019. However, since bottoming out and reversing direction at the end of May last year, the share price recovered all those losses in less than 60 days. The share price rose 66% above the May low before it reached the 52-week high of $14.14 in early December 2019.

While pulling back more than 4% to close on January 9, 2020 at $13.54, the current share price is still nearly 60% above the May low and has delivered an asset appreciation of more than 32% just over the past year. After struggling with regards to total returns over the past three and five years, the Vector Group combined its double-digit dividend yield and robust capital gains to deliver total returns of nearly 48% just over the past year.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.