The push by companies to have employees work from home has stressed information technology (IT) infrastructure and highlighted the need for cutting edge products to ensure productivity and security.

These workplace changes have spurred strong demand for IT products to support remote working through cloud computing, software-as-a-service and videoconferencing. Many areas of the country are re-opening for business, and experts predict that workers who are telecommuting will continue to do so.

This “new normal” will drive demand for the latest enterprise IT products. Here are the 10 best IT stocks to buy, considering these trends.

10 Best IT Stocks to Buy Now: Alphabet

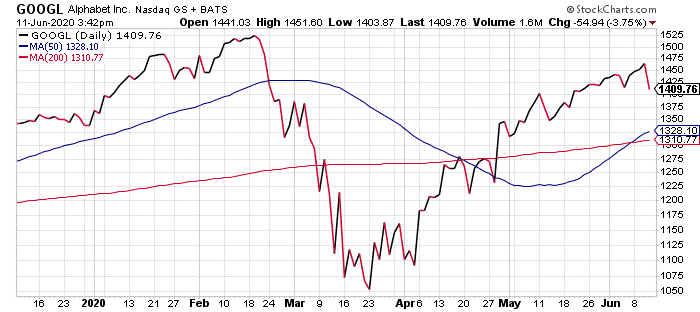

Alphabet (NASDAQ: GOOGL) reported first-quarter 2020 revenue of $41.2 billion, a year-over-year increase of 13%. The company posted non-GAAP earnings per share of $9.87, down from $11.90 for the same quarter last year. YouTube advertising revenue was helped by people watching more videos during the COVID-19 lockdown.

Following the posting of its quarterly results on April 28, Alphabet’s stock surged more than 7% because investors expected lower revenue growth. The stock price leveled off and then gradually increased through May, reaching $1,464.70 on June 10, but considerably below its year-to-date high of $1,525 on Feb. 19.

Chart courtesy of www.StockCharts.com

The consensus of 13 analysts surveyed by Nasdaq is a “strong buy” for Alphabet’s stock, with an average 12-month price target of $1,488. Also, 34 of 42 analysts reviewed by the Wall Street Journal have a “buy” recommendation for the stock.

10 Best IT Stocks to Buy Now: Amazon

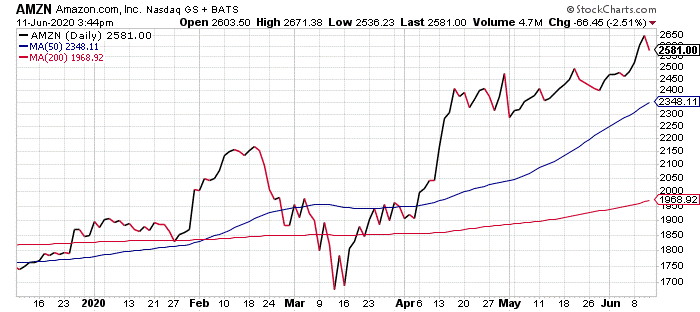

Amazon’s (NASDAQ: AMZN) cloud business led the way in its first-quarter results, with revenue crossing the $10 billion mark for the first time, a 33% year-over-year surge. Overall, Amazon posted a healthy $75.45 billion in revenue, up from $59.7 billion in the year-ago quarter. The company reported earnings per share of $5.01, compared to $7.20 per share in last year’s first quarter.

After posting its results, Amazon’s stock price fell 5% in after-hours trading on April 30. The company missed its earnings estimates but exceeded revenue expectations. The stock price rebounded and hit its year-to-date high of $2,498 per share on May 20. The stock price dipped a bit at the end of May but increased in early June to close at $2.647.45 on June 10.

Chart courtesy of www.StockCharts.com

Forty-one out of 48 analysts tracked by the Wall Street Journal have a “buy” recommendation for Amazon’s stock. The consensus of 14 analysts examined by Nasdaq is a strong buy for Amazon stock, with an average 12-month price target of $2,714.

10 Best IT Stocks to Buy Now: Apple

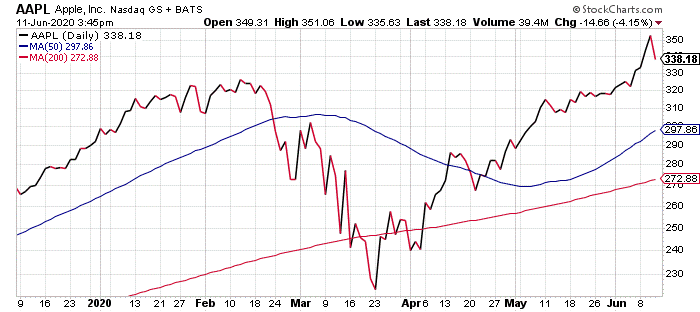

Apple (NASDAQ: AAPL) reported revenue of $58.3 billion for fiscal 2020 second quarter ended March 28, an increase of a modest 1% over the same quarter last year, while quarterly earnings per diluted share were $2.55, a 4% increase. Apple’s board of directors declared a cash dividend of 82 cents per share of the common stock, an increase of 6%.

Following its earnings report on April 30, Apple’s stock price climbed more than 10%, reaching a year-to-date high of $354.77 on June 10 before it closed trading for the day at $352.84.

Chart courtesy of www.StockCharts.com

Twenty-four out of 41 analysts examined by MarketWatch have a “buy” recommendation for the stock. The consensus of 13 analysts surveyed by Nasdaq is a “strong buy” for Apple stock, with an average 12-month price target of $323.79, well below the company’s new high. The company also pays a dividend and offers a current yield of 0.95%.

10 Best IT Stocks to Buy Now: AT&T

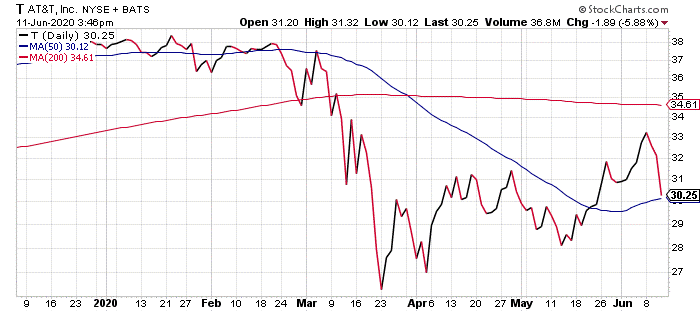

AT&T (NYSE: T) announced consolidated revenues for the first quarter of $42.8 billion, down from $44.8 billion in the same quarter last year. The IT giant posted diluted earnings per share of 63 cents, compared to 56 cents per share in the year-ago quarter.

One of the attractions of AT&T is its dividend payouts that provide a current yield of 6.38%. AT&T paid dividends for common shares totaled $3.7 billion and it repurchased 142 million of its common shares in the first quarter.

AT&T saw its stock price drop from a year-to-date high of $39.37 in January to a low of $26.77 on March 23. It has slowly climbed in fits and starts before closing at $32.14 on June 10. This suggests that stock price has some growing room to return to its previous 2020 high.

Chart courtesy of www.StockCharts.com

The consensus of 19 analysts surveyed by Nasdaq is a “buy” for AT&T stock, with an average 12-month price target of $33.62. By contrast, 20 of 31 analysts examined by the Wall Street Journal have a “hold” recommendation on the stock.

10 Best IT Stocks to Buy Now: Cisco

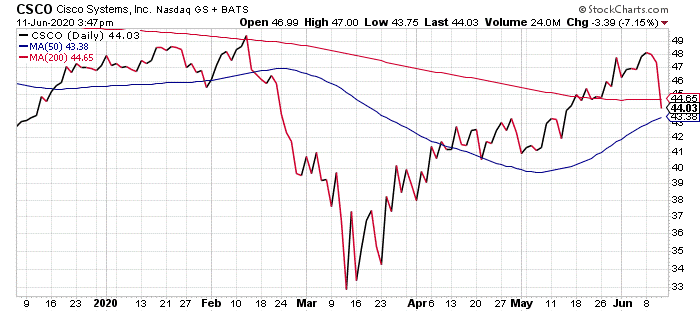

Cisco (NASDAQ: CSCO) reported revenue of $12 billion, a decline of 8% year-over-year, for its fiscal 2020 third quarter ended April 25. The company posted non-GAAP earnings per share of 79 cents, an increase of 1% year-over-year.

The networking giant paid a cash dividend of 36 cents per common share, or $1.5 billion, and repurchased approximately 25 million shares of common stock for $981 million. Cisco’s current dividend yield is 3.0%.

Like most tech stocks, Cisco’s stock price has been on a roller coaster ride. It reached close to $50 per share in February, before dropping to around $33 in mid-March. It then gradually climbed to $47.42 as of June 10.

Chart courtesy of www.StockCharts.com

The consensus of 12 analysts surveyed by Nasdaq is a “strong buy” for Cisco stock, with an average 12-month price target of $47.27. The Wall Street Journal’s review of 27 analysts found that 11 analysts have a “buy” recommendation for the stock.

10 Best IT Stocks to Buy Now: Dell Technologies

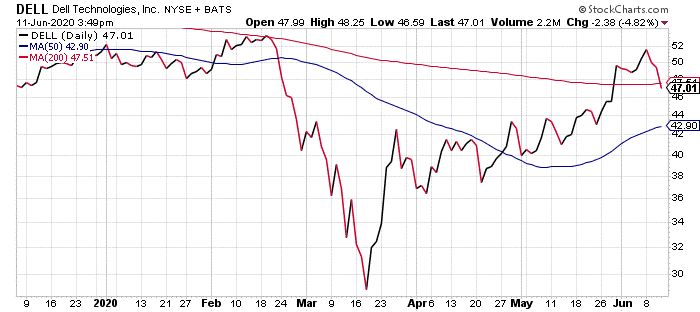

Dell (NYSE: DELL) reported revenue of $21.9 billion for its fiscal 2021 first quarter ended May 1, the same as the year-ago quarter. By contrast, its VMware unit revenue surged 12% year-over-year, reaching $2.8 billion in the first quarter. The company posted non-GAAP diluted earnings per share of $1.34, down from $1.45 per share for the year-ago quarter.

The company stock price has been climbing steadily since it bottomed out at $28.87 in mid-March to $49.39 on June 10, still short of its year-to-date high of $53.34 in February. Unfortunately for income investors, Dell does not pay a dividend.

Chart courtesy of www.StockCharts.com

The consensus of 9 analysts surveyed by TipRanks is a “moderate buy” for Dell stock, with an average 12-month price target of $47.50. Seven of 19 analysts examined by the Wall Street Journal have a “buy” recommendation for the stock.

10 Best IT Stocks to Buy Now: Facebook

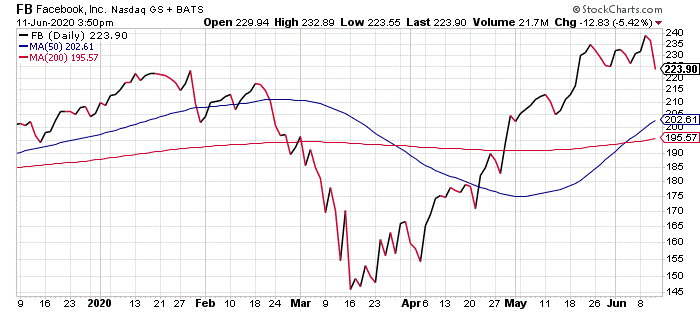

Facebook (NASDAQ: FB) amassed revenue of $17.4 billion in the first quarter of 2020, a 17% increase from the same quarter last year. The company posted diluted earnings per share of $1.71, double the 85 cents per share notched in last year’s first quarter.

Facebook’s stock price has climbed from a low of $146 in mid-March to a year-to-date midday high of $241.21 on June 10, before slipping to $236.73 by the close of trading that day. Income investors will need to look elsewhere for dividends, since Facebook does not offer any.

Chart courtesy of www.StockCharts.com

The consensus of 13 analysts surveyed by Nasdaq is a “strong buy” for Facebook stock, with an average 12-month price target of $243.21. Thirty-six of 48 analysts tracked by the Wall Street Journal have a “buy” recommendation for Facebook’s stock.

10 Best IT Stocks to Buy Now: Intel

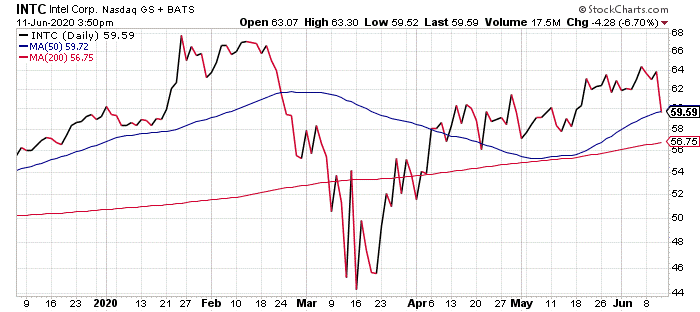

Intel (NASDAQ: INTC) reported revenue of $19.8 billion for the first quarter, up 23% year-over-year. The company posted non-GAAP earnings per share of $1.45, an increase of 63% year-over-year.

The chip maker’s stock price reached a year-to-date closing high of $68.47 on Jan. 24, before diving to $44.61 in mid-March. It gradually climbed back up to close at $63.87 on June 10.

Chart courtesy of www.StockCharts.com

Income investors may like the stock’s 2.09% current yield. Plus, U.S. lawmakers are proposing an estimated $25 billion in funding and tax credits to strengthen domestic semiconductor production to combat rising competition for government-subsidized companies in China.

The consensus of 15 analysts surveyed by Nasdaq is a buy for Intel stock, with an average 12-month price target of $62.44. Fourteen of 43 tracked by The Wall Street Journal have a “buy” recommendation for Intel’s stock.

10 Best IT Stocks to Buy Now: Microsoft

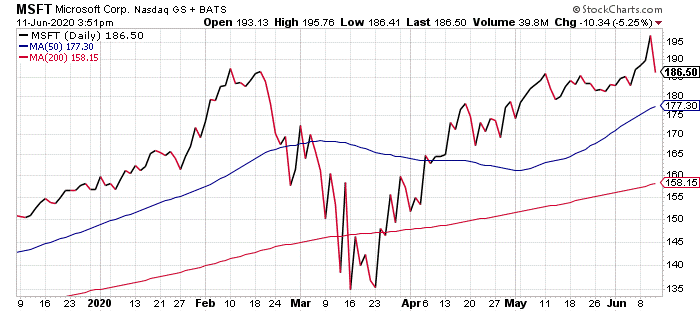

Microsoft (NASDAQ: MSFT) notched revenue of $35 billion for the fiscal 2020 third quarter ended March 31, a year-over-year increase of 15%. The company posted diluted earnings per share of $1.40, a 23% year-over-year increase.

Microsoft reported it returned $9.9 billion to shareholders in dividends and share repurchases during its last quarter. The result is a dividend yield of 1.07%.

The company’s stock price reached a year-to-date midday high of $198.52 on June 10 to a low of $135.98 in mid-March. The stock reached its closing high for the year of $196.84 on June 10.

Chart courtesy of www.StockCharts.com

The consensus of 15 analysts tracked by Nasdaq is a “strong buy” for Microsoft stock, with an average 12-month price target of $210.15. Twenty-eight of 34 analysts examined by the Wall Street Journal have a “buy” recommendation for Microsoft’s stock.

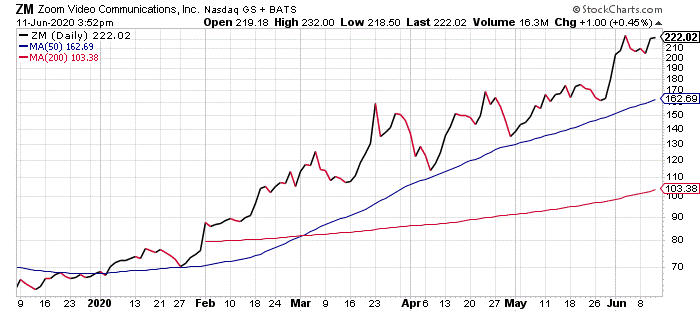

10 Best IT Stocks to Buy Now: Zoom Video Communications

Zoom (NASDAQ: ZM) reported revenue of $328.2 million for fiscal 2021 first quarter ended April 30, up 169% year-over-year. The company posted non-GAAP earnings per share of 20 cents in the first quarter, compared with 3 cents per share in the year-ago quarter.

Unlike other tech stocks, Zoom’s stock price has increased gradually from $68.72 at the beginning of this year to close at a high of $223.87 on June 3, before finishing at $221.02 on June 10. This steady climb is no doubt due to the popularity of the platform for work-from-home scenarios.

The consensus of 4 analysts surveyed by Nasdaq is a buy for Zoom stock, with an average 12-month price target of $211.65. Eleven of 31 analysts tracked by the Wall Street Journal have a “buy recommendation for Zoom’s stock.

Chart courtesy of www.StockCharts.com

Income investors will need to look elsewhere for dividends, since Zoom does not pay any. However, it is offering a fast-rising share price right now with demand for its services growing.

The 10 best IT stocks to buy now offer an array of companies within the technology arena. Income investors who like regular payouts from the equities also can find stocks among this group that offer cash dividends.

Fred Donovan is a seasoned free-lance writer and contributor to www.StockInvestor.com who has covered the intellectual technology industry closely for many years.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)