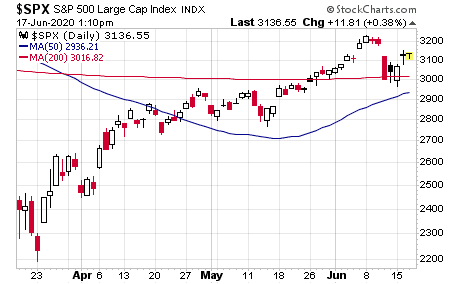

A funny thing happened in the markets last Thursday. Well, not funny “ha ha,” but rather, funny “unusual.” You see, after about four weeks of stocks surging some 12% or so, stocks abruptly turned tail and headed sharply south nearly a week ago.

The one-day loss on Thursday, June 11, in the major domestic averages of approximately 6% took out roughly half of the progress this market made in those four weeks. This is what can happen when a market runs up too far, too fast. It also is the reality of this COVID-19 market.

So, what prompted the market plunge that day? Well, there were two proximal causes: Federal Reserve Chairman Jerome Powell and the pandemic.

Specifically, despite its dovish proclamations on interest rates likely remaining at basically zero for the next two-and-a-half years, the outlook on future economic growth from the Federal Reserve at the July Federal Open Market Committee meeting was anything but encouraging.

On Wednesday, June 10, Federal Reserve Chairman Jerome Powell made no mention of a sustainable economic rebound, although he did acknowledge the improvement in the labor market. Yet it was the downbeat, even pessimistic, tone from the Fed chairman on future growth that upset markets.

As I’ve been telling readers of my Successful Investing and Intelligence Report advisory newsletters for months now, the economy needs to get back to something close to “normal” by the end of the summer/early fall if we are going to have the earnings and economic activity in 2021 that can support stocks at these valuation levels. The market is pricing in just that, or at least it did until Powell’s commentary last week.

Powell basically said that the economy was horrible, and there were no signs of a rebound on the horizon. Positively, however, Powell did say that the Fed is ready, willing and able to support the economy (and the markets) with whatever monetary policy easing it can deliver. Unfortunately, the bulls wanted a bit more positivity from Powell on economic growth, hence the first reason stocks plummeted.

The second reason is something I’ve also been warning subscribers about, and that is the possibility of a “second wave” of coronavirus cases as we continue to relax the stay-at-home orders, social distancing measures and the wearing of masks. While we need to do this for economic reasons, I suspect it almost certain that this will lead to more cases of COVID-19.

On that downbeat morning last Thursday, the number of U.S. coronavirus cases topped 2 million, with the death toll rising past 111,000. According to data from Johns Hopkins University, there has been an uptick in cases in Florida, Texas and California. That spooked markets into concerns that a second wave of infections could lead to a return of restrictions on social and business activity. So, take a pessimistic Powell and fears over a second coronavirus wave in the same morning, and you get the worst day in markets since the COVID-19 crisis began.

Now the question becomes whether the June 11 sell-off is the start of a new downtrend or simply a healthy and much-overdue pullback in markets.

If I had to deliver an answer here, I would say that although the selling that day was intense, I don’t think it will end up being a bearish game changer. I say that because there really wasn’t any real news about an acute intensification of new coronavirus cases in the United States. As of now, the data do not support this fear.

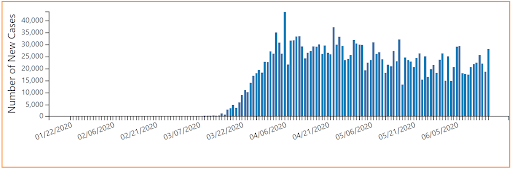

Daily new coronavirus cases have been averaging around 20,000 for the past several weeks, and in the days leading up to this writing, the number of new cases nationwide was mostly trending lower. The chart here from the Centers for Disease Control and Prevention (CDC) of the number of new COVID-19 cases reported each day in the United States since the beginning of the outbreak tells us just that.

Of course, we are very likely to see this chart trend higher in the weeks ahead, and the reason why is the country is opening up again. Every state has eased restrictions to some extent, and most now are well past the initial post-lockdown stages. Oh, and then there were those nearly nationwide protests of late, which also are likely to increase transmission rates. Let’s face it; there wasn’t much “social distancing” going on in those throngs.

If we do see a significant second wave of the virus result in more economic disruption, that will bring about more selling in stocks. While that is certainly a possibility, at least for now, the data itself does not justify last week’s sharp plunge. And, that’s not just me saying it. It is also the market reflecting that sentiment, as the S&P 500 is up some 4.5% from Thursday’s close.

That’s a resilient market, and one that begs for the embrace of your investing capital.