Best investments for the new year include dividend-paying equities, ecommerce, health care and inflation hedges.

The best investments for the new year also account for a new U.S. president, a split Congress, the expected appointment of former Federal Reserve Chair Janet Yellen as the next Treasury Secretary and continued easy-money policies from the U.S. central bank. Asset allocation also is an area that warrants an increase in dividend-paying stocks and scaled-back holdings in fixed-income investments.

A Congress that is expected to have Republicans narrowly keep control of the Senate and let Democrats continue to reign in the House is “good for markets” to restrain changes in taxes and policies, said Connor O’Brien, chief executive officer of Boston-based O’Shares ETFs. Many people are happy with President-elect Joe Biden’s plans to name Yellen, a “dovish” ex-Fed head, to lead the U.S. Department of the Treasury, he added.

Policy Outlook and Vaccine Improve Prospects of the Best Investments for the New Year

The Food and Drug Administration (FDA) is expected to approve at least two new COVID-19 vaccines in the coming days that have produced 95% effectiveness in final-stage clinical trials, O’Brien said in a recent podcast. On Dec. 2, the United Kingdom approved a COVID-19 vaccine for emergency use from dividend-paying Pfizer Inc. (NYSE:PFE), a New York City-based multinational pharmaceutical company, and its partner BioNTech.

Pfizer, which offers a current dividend yield of 3.57%, has requested Emergency Use Authorization from the FDA to begin providing its vaccine initially to high-risk health care providers and caregivers in the United States. The need for that vaccine to be stored at negative 80 degrees will complicate but not prevent its gradual distribution in the months ahead.

Another plus would be a proposed $908 billion bipartisan stimulus package that currently is under consideration in Congress. However, lawmakers still need to pass it, said O’Brien, who added he will take a wait-and-see view of the legislation.

“The election is over, so maybe members of both political parties can reach a compromise to approve a stimulus package,” said O’Brien, who added he does not expect “massive” changes from the White House with the expected swearing in of President-elect Biden on Inauguration Day, Jan. 20.

Expect a K-Shaped Recovery in Assessing the Best Investments for the New Year

Investors tend to look 12 months ahead to find the best investments, O’Brien said. They also should expect a K-shaped economic recovery with an upward arm and downward leg, O’Brien added.

“The thinking by many economists is that some companies and industries will recover nicely and sloop up,” O’Brien said. Others will be challenged, struggle and sloop downward, he added.

The industries that rise should include technology, ecommerce, internet, health care and some industrials, O’Brien predicted. The ones the might sloop downward encompass travel, lodging, restaurants and old-style retail, he added.

Connor O’Brien, CEO of O’Shares ETFs

Money Manager Kramer Offers Her Best Investments for the New Year

“This is the time in the market cycle where conventional growth sectors hit a wall while value comes roaring back from a miserable pandemic environment,” said Hilary Kramer, host of a national radio program, “Millionaire Maker,” and head of the GameChangers and Value Authority advisory services. “I’m looking for the financials to outperform technology in terms of profit momentum — the banks are on track to show more year-over-year growth than all of Silicon Valley’s giants except for Amazon.com Inc. (NASDAQ:AMZN).

“Industrials, consumer stocks, materials producers and even the battered energy sector have the hot hand now. Established technology leaders and ‘Big Pharma’ aren’t doing badly, but investors who stuck with what worked in 2020 face a real prospect of getting left behind.”

But if value has the growth profile of equities, it also has the income profile that bonds are not likely going to deliver until Fed Chair Jerome Powell takes his “thumb” off interest rates, Kramer said. She voiced a preference for 2-4% dividend yields from world-class stocks over locking in guaranteed after-inflation losses on Treasury debt.

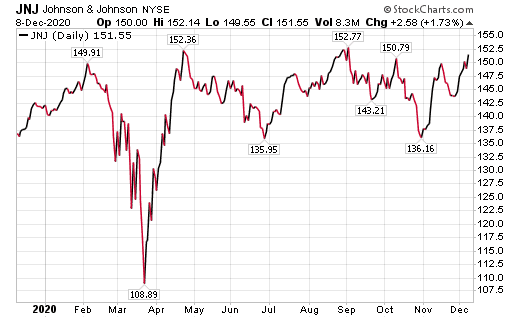

“You don’t have to get fancy, at least to begin with,” Kramer said. “Johnson & Johnson (NYSE:JNJ) has a stronger credit rating than the U.S. government and pays 2.7% right now, which is enough to stay above the Fed’s 2% inflation target and still have a reasonable chance of repaying your principal over the long term.”

Chart courtesy of www.stockcharts.com

Best Investments in the New Year Feature Johnson & Johnson, Kramer Says

Newly issued 5-year Treasury bonds, on the other hand, guarantee that fixed-income investors will lose 1.4% a year even in a current mild inflation environment, Kramer said.

“I’m looking for JNJ to raise the bottom line faster than Facebook Inc. (NASDAQ:FB) next year,” Kramer continued. “On a forward earnings basis, it’s cheaper than the broad market and carries roughly half the multiple of a stock like FB. And it can replace your fixed-income allocation in the short term. Beyond the sizzle factor, why would anyone buy FB when they could be grabbing better growth at half the price?”

Johnson & Johnson, a New Brunswick, New Jersey, maker of medical devices, pharmaceutical and consumer packaged goods, offers a 2.67% dividend yield and trades at a P/E ratio of 23.82%.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Selected Technology Stocks Rank with the Best Investments for the New Year

Investors also may want to consider business services, which thrive on the margins of a recession as executives reach for new partnerships to get through stormy economic waters, Kramer said.

One way to do so is through Cognizant Technology Solutions Corp. (NASDAQ:CTSH), a global staffing giant in Teaneck, New Jersey, that is poised to shine as rhetoric around foreign work visas eases, Kramer opined. It offers a dividend yield of 1.10% and trades at a P/E ratio of 29.61%.

Chart courtesy of www.stockcharts.com

HP Inc. (NYSE: HPQ), a technology company in Palo Alto, California, is a “screaming bargain” at 9X projected P/E to show faster growth than FB or JNJ, along with a sizable dividend yield of 3.3%, Kramer said.

Chart courtesy of www.stockcharts.com

Asset Allocation Should Shift Toward Likely Best Investments for the New Year

Growth stocks have continued to outperform value in 2020 and may do so again in 2021, O’Brien said.

“Value has recently had a bit of a bounce,” O’Brien continued.

A key question is whether value’s recent rise is a trend or a just a bounce, O’Brien said.

Kevin O’Leary, chairman of O’Shares and a wealthy panelist on the “Shark Tank” television program, said in a recent podcast that his family trust has shifted to a 70% allocation to equities and a 30% share of fixed income, compared to its previous 50-50% split in each.

In assessing O’Leary’s equity investment is more than 50 private companies, 20% of them are expected to go to zero and the others could do “really well,” O’Brien said. A micro-economic view of data from the 50-plus companies owned by O’Leary is telling, O’Brien added.

Paul Dykewicz interviews Kevin O’Leary in Las Vegas before the COVID-19 crisis.

Those that are doing well in 2020 likely have pivoted by using technology to reposition their business, cut their costs, eliminate travel and pursue direct-to-consumer sales, O’Brien said.

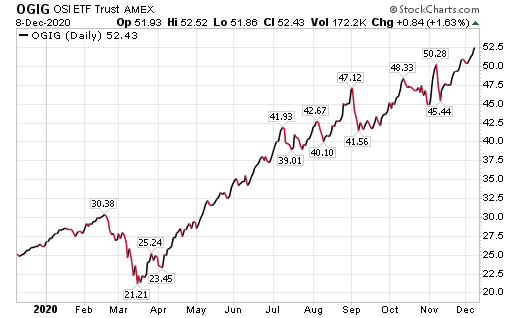

Some of the themes are in the portfolio of O’Shares Global Internet Giants ETF (OGIG), a rules-based fund that is designed to provide investors with the means to gain exposure to some of the world’s largest global companies, O’Brien said. Several of its top holdings are ecommerce companies.

“Everyone who blindly says they like tech — and let’s face it, such blind calls have worked well in the past — are ignoring the recent acquisition-fueled earnings and or guidance of cloud companies Splunk (NASDAQ: SPLK) , Workday (NASDAQ: WDAY), Veeva Systems (NYSE: VEEV) and Salesforce.com (NYSE: CRM).

“All were lower after earnings,” Kramer said. “These cloud companies have had a tremendous run, but growth is slowing for them, as well as Amazon Web Services. If we a slowdown in the adaptation in cloud or distributed computing, tech will fall at current valuations. And the cloud has been around for a while, has gotten large, so the law of big numbers may be at work.”

The law of large numbers is the idea that as an industry or company matures, its growth rate will inevitably slow, Kramer added.

Chart courtesy of www.stockcharts.com

Pension Fund Chairman Eyes Inflation Hedges as Best Investments for the New Year

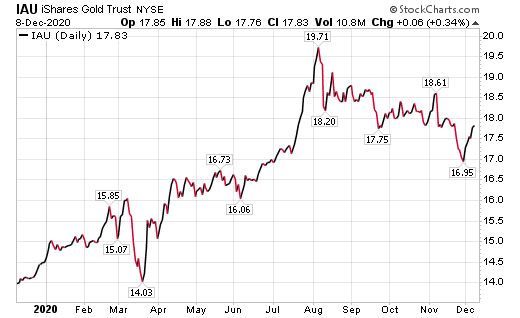

“For 2021, I’m recommending inflation hedges,” said Bob Carlson, who writes the Retirement Watch investment newsletter and serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “I expect inflation to steadily increase over the next few years.”

The reasoning partly stems from central banks wanting inflation to increase, Carlson said. The factors that kept a lid on inflation the last few decades are fading and include increased globalization and trade, low wages and higher productivity, he added.

Carlson identified inflation hedges such as gold through the ETF iShares Gold Trust (IAU) and TIPS through the ETF SPDR Portfolio TIPS (SPIP).

Chart courtesy of www.stockcharts.com

Chart courtesy of www.stockcharts.com

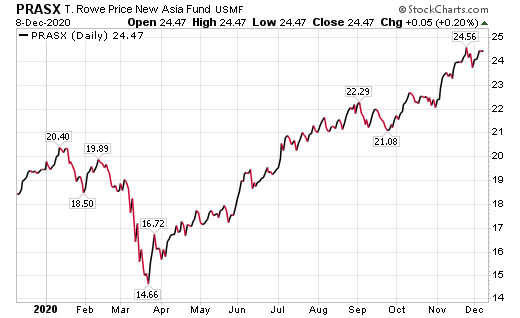

“I also recommend an increase in stocks outside of the U.S.,” said Carlson. “In particular, I like Asian emerging markets. Growth prospects there are better, and there is more room for stock prices to increase. I like T. Rowe Price New Asia (PRASX).”

Chart courtesy of www.stockcharts.com

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social

The COVID-19 pandemic not only caused a severe economic blow in the United States but led to a new surge in cases included the infection of President Trump and his hospitalization Friday, Oct. 2, until Monday, Oct. 5. The overall weekly hospitalization rate has hit its highest level in the pandemic, with steep increases in individuals aged 65 years and older, according to the Centers for Disease Control and Prevention (CDC). The number of people hospitalized with COVID-19 reached a record 102,148 on Monday, Dec. 7, to mark the sixth straight day above 100,000.

COVID-19 cases have totaled 15,171,676 and led to 286,307 deaths in the United States, along with 68,252,608 cases and 1,557,343 deaths worldwide, as of Dec. 9, according to Johns Hopkins University. America has the dubious distinction of facing the most cases and deaths of any nation.

The best investments for the new year feature dividend-paying equities, ecommerce, health care and inflation hedges that should excel amid the COVID-19 crisis. Investors who recognize the relatively benign benefits to the market from a division of power in Washington between the Republicans and the Democrats have a chance to do well in the months ahead.

******************************************************************

Publisher’s Note: Are you looking for a great holiday gift? We were going through some areas of our office and found a box of beautiful Rose Pendants that were widely popular a few years ago. These are 24K gold and pure silver — a hard combination to find in any jewelry store. Click here now to learn more about these elegant pendants and put a big smile on a special person’s face this holiday season! But hurry, we only have 78 of these!

Roger Michalski, Publisher

******************************************************************

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.

![[gold pill]](https://www.stockinvestor.com/wp-content/uploads/3022618543_9ab124cc98_b.jpg)