The three best 5G stocks to buy now include a United States telecommunications giant, a global semiconductor leader and a powerhouse in the material sciences industry.

The long-awaited, fifth-generation mobile network, also known as 5G, is finally here. First introduced to the United States in late 2018, its rollout has been undeniably slow and confusing at times, mainly due to COVID-19. However, with the potential to be up to 500% faster and handle 100x more traffic than 4G, 5G is undeniably the future of communication.

There is a reason the U.S. government has placed emphasis on facilitating 5G advancements at home. The arrival of 5G is much more significant than simply connecting to the internet faster or downloading movies quicker. The speed of 5G opens the door to significant technological advancements not possible under 4G, ranging from remote surgeries to interconnected fleets of self-driving smart vehicles. The 5G industry is forecast to exceed $180 billion in North America alone by 2030.

According to Swedish Telecommunications giant Ericsson (NASDAQ: ERIC), despite the slow rollout worldwide, more than one billion individuals already reside in an area with 5G coverage. The company projects that by 2026, 40% of all global mobile subscriptions will be 5G. By 2035, 5G is expected to support $13.5 trillion of the global economy.

Although 5G is undeniably a long-term investment, it has a higher ceiling than just about any other industry. The right 5G stock could become a highly successful investment. Here are the top three 5G stocks to buy now.

3 Best 5G Stocks to Buy Now: #3

Corning Inc. (NYSE:GLW)

Corning Inc. (NYSE:GLW), founded in 1851 and headquartered in Sommerville, Massachusetts, is a technology company dedicated to producing specialty glass, ceramics and optical fiber. The firm sells its products for use in various industrial and scientific applications, from displays for flatscreen televisions to gasoline particulate filters for cars. The company currently possesses a market capitalization (market cap) of $33.3 billion.

At its heart, 5G’s core infrastructure shares many of the same characteristics as 4G. Although billed as “wireless,” like 4G, 5G data spends much of its journey traveling through optical fiber cables before being transmitted through cell towers to our various devices. Before 5G access can become commonplace globally, billions of miles of fiber must be laid down.

Corning is the worldwide industry leader in fiber optics, boasting 16.3% of the global market share. The company raked in $3.6 billion in optical communication sales in 2020. Beyond simply producing optical fiber, Corning announced last year that it is partnering with Qualcomm (NASDAQ:QCOM), the world’s third-largest semiconductor producer, to develop 5G mmWave infrastructure for enterprises and public venues. If successful, the infrastructure systems will be among the first to deliver 5G-NR mmWave capabilities to indoor spaces such as offices, colleges and hospitals.

Although optical communications are Corning’s largest revenue driver, it is not the only product Corning produces. Outside of 5G, Corning creates Gorilla Glass, a glass covering designed for smartphones, laptops and smartwatch touch and camera screens. To date, Corning’s Gorilla Glass has been implemented on over six billion devices across 45 major brands worldwide, from Samsung’s Galaxy Z Fold 3 smartphone to Dell’s (NYSE:DELL) XPS 15 laptop.

Corning also designs and builds organic light-emitting diodes (OLED) and liquid crystal displays (LCD) products for televisions, laptops and monitors, environmental filters to reduce pollution and life science equipment to produce vaccines. In total, the company generated $11.5 billion in annual revenue in 2020.

The biggest concern surrounding Corning is its lower growth in recent years compared to other technology companies. Corning has significantly outpaced the electronic component’s industry average of a 7.3% decline in sales over the past five years, compared to the company’s 8.1% growth rate. However, Corning’s growth rate trailed the S&P 500’s 12.3% average revenue growth rate for the same period, according to Stock Rover.

However, Corning stock is projected to skyrocket as the 5G rollout accelerates in the coming years. The company has already begun to experience increased returns. Over the past year, Corning has seen its sales increase by 22.8% and its earnings-per-share (EPS) surge by 678.6%. The company is expected to continue the trend, with a forecasted revenue growth rate of 22.4% in 2021. As a result, GLW has experienced a 21.7% climb in stock price over the past 12 months. The change in share price is displayed with a 50-day moving average below.

Chart provided by Stock Rover.

Despite GLW’s recent climb, the stock remains undervalued relative to its potential. The company’s (share) price-to-earnings (P/E) ratio, currently at 35.4, is expected to dip to 16.0, below the current industry average of 23.0.

For dividend investors, Corning also possesses above-average dividend payouts. The company’s dividend yield of 2.5% and a payout ratio of 84.4% is more than double the S&P 500 averages of 1.2% and 37.5%, respectively.

Simply put, GLW is a well-rounded stock with a high potential growth rate, established cash flow, good dividend yields and low downside for investors.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $46.43, 20.25% higher than its latest closing price of $38.61, earning GLW a “STRONG BUY” recommendation from Stock Rover and a place among our three best 5G stocks to buy now.

3 Best 5G Stocks to Buy Now: #2

T-Mobile US, Inc. (NASDAQ:TMUS)

T-Mobile US, Inc. (NASDAQ:TMUS), headquartered in Bellevue, Washington, was created from a 2013 merger of T-Mobile USA with MetroPCS. The deal was orchestrated by Deutsche Telekom, the majority stakeholder in T-Mobile. In 2020, T-Mobile acquired Sprint Corporation for $26 billion, transforming the company into the third-largest mobile carrier in North America by market capitalization at $166.8 billion.

One of the most immediate and apparent benefactors of the 5G revolution, which started in late 2018, are American telecommunication (telecom) giants. With 260 million smartphone users, the United States is the third-largest mobile communications market in the world by customer base, trailing only India and China. In 2020, the big three telecommunication companies (AT&T (NYSE:T), Verizon (NYSE:VZ) and T-Mobile) generated approximately $368.5 billion in revenue from the U.S. market alone.

Although T-Mobile is the smallest by revenue and market cap out of the big U.S. three telecom companies, it is currently the dominant force in the United States 5G market. The company possesses the largest 5G network in the country, covering 280 million individuals.

According to an April 2021 OpenSignal report, T-Mobile leads in 5G availability, reach, download speed and upload speed between the big three. A RootMetrics study performed in mid-2021 backed up OpenSignal’s report. After surveying 85 out of the 125 most populous metros in the United States, RootMetrics discovered T-Mobile led in availability in 57 of the 85 markets. Second place AT&T led in only 27 cities.

T-Mobile’s gamble on 5G has already begun to pay dividends. In the approximately three years since telecom companies began their 5G rollout across the United States, TMUS has experienced an average annual sales growth of 23.8% and a return rate of 104.0%. The industry average over the same period stands at 17.3% and 20.5%, respectively.

Outside of 5G, the company has continued its growth despite COVID-19. In 2020, T-Mobile expanded its 4G Long-Term Evolution (LTE) network to cover 328 million people, or 99% of the United States population. It has seen its customer base skyrocket from 26.1 million individuals in 2012 to 102.1 million by the end of 2020, a compound annual growth rate (CAGR) of 18.6%. T-Mobile capped off last year by surpassing AT&T to become the number two wireless provider in the United States by customer.

As a result of its investments in 4G and 5G coverage, 2020 was the company’s best year ever financially, with a 160% jump in revenue, from $22.7 billion in 2019 to $36.3 billion in 2020. T-Mobile’s share price has climbed by 17.0% over the trailing 12 months. The change in stock price is plotted below, alongside a 50-day moving average.

Chart provided by Stock Rover.

Although T-Mobile’s P/E ratio of 41.8 is high relative to the industry average of 13.2, the company’s price-to-sales (P/S) ratio is very much in line with the norm. The company currently possesses a P/S ratio of 2.1 compared to the industry average of 1.5. With T-Mobile projected to experience an EPS growth of 43.3% over the next fiscal year, a slightly higher P/E ratio in the short term is well worth it for a company boasting a 98/100 Stock Rover growth score.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $170.28, 27.4% higher than its latest closing price of $133.67. With analysts projecting an 18.0% growth in sales for 2021, TMUS received a “STRONG BUY” recommendation from Stock Rover and a place among our three best 5G stocks to buy now.

3 Best 5G Stocks to Buy Now: #1

Qualcomm Inc. (NASDAQ:QCOM)

Qualcomm Inc. (NASDAQ:QCOM), founded in 1985, is an American semiconductor manufacturer based in San Diego, California. The company is the third-largest semiconductor producer globally, with a current market cap of $159.7 billion.

The song and saying that “money makes the world go round” should be revised to “money AND the semiconductors make the world go round.” Semiconductors are an integral part of nearly every electronic device we use, from smartphones to refrigerators to magnetic resonance imaging (MRI) machines. Its usefulness derives from its sensitivity to electronic and magnetic fields, making them excellent sensors. Prior to the invention and popularization of semiconductors, computers relied on tubes and dials to operate. As technology advances in our everyday lives, demand for semiconductors is expected to skyrocket.

The introduction of 5G only raises further opportunities for the semiconductor industry. For companies and products to fully realize 5G’s potential in connectivity, semiconductors must be used to power those devices. If Tesla (NASDAQ:TSLA) wants to build a fleet of connected and self-driving smart cars or if HCA Healthcare (NYSE:HCA) plans to implement remote surgeries through 5G, they must first invest in better semiconductors to power the processors for their computers and sensors. Already worth $425.96 billion in 2020, the global semiconductor industry is projected to rise to $803.15 billion by 2028.

Qualcomm is better positioned to benefit from the upcoming 5G boom than other semiconductor manufacturers. The company profited greatly from the introduction of 3G and 4G networks, which drove the smartphone explosion in the 2000s and 2010s. Out of Qualcomm’s portfolio of 140,000-plus current and pending patents, its primary intellectual property (IP) for the past two decades has revolved around Code Division Multiple Access (CDMA) and orthogonal frequency-division multiple access (OFDMA) technology, the backbone of 3G and 4G networks. As a result, Qualcomm’s IP is licensed by nearly all wireless device makers, from Apple (NASDAQ:AAPL) to Huawei. The company already possesses more than 150 5G licensing agreements.

In March 2021, Piper Sandler analyst Harsh Kumar stated that Qualcomm is primed to reap handsome profits from the upcoming influx of consumers switching to 5G devices. He expects “5G handset sales to double in 2021, and grow nearly 50% in 2022.” The company has already experienced a 62.9% rise in revenue and a ridiculous 237.6% jump in EPS over the past year. Qualcomm is forecasted to further back Kumar’s claims, with a projected 52.5% growth in revenue in 2021.

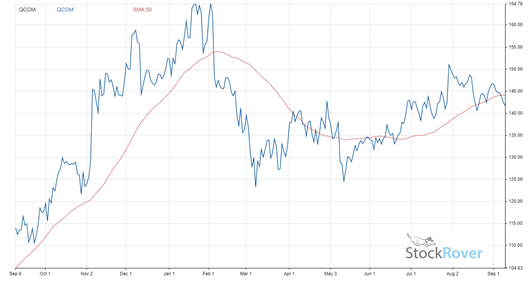

QCOM has seen a 29.0% increase in price over the past year, despite a drop in share price in February 2021 due to a more “bullish” Q2 2021 outlook due to supply shortages. The company is forecasted to experience a 36.3% increase in revenue this quarter (Q3 2021). The graph below depicts QCOM’s performance over the trailing 12 months, along with a 50-day moving average.

Chart provided by Stock Rover.

Even if Qualcomm experiences no future growth in revenue, which will not happen, QCOM is surprisingly cheap. The company possesses a P/E ratio of 17.7 and a P/S ratio of 5.0, compared to the industry averages of 33.2 and 7.0, respectively.

Very few established companies possess the same growth potential as Qualcomm, and none are as underpriced as QCOM. Qualcomm is the closest stock imaginable to a no-brainer 5G investment.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $174.82, 23.5% higher than its latest closing price of $141.58, earning QCOM a “BUY” recommendation from Stock Rover and a place among our three best 5G stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)