“Forecast a number a number or a date, but not both.” — “The Maxims of Wall Street”

In 1999, two economists, James Glassman and Kevin Hassett, published a book with the outlandish title, “Dow 36,000.” At the time, the Dow Jones Industrial Average hit a record 10,000.

For investors, Dow 10,000 was a milestone, a culmination of a massive bull market in the 1990s since the stock market crash on October 19, 1987.

In the summer of 1989, I participated in a major debate in Orlando, Florida, in front of a thousand people. The topic was, “The 1990s: Prosperity of Depression?” I took the optimistic side, making the case for a bull market and economic prosperity.

Alas, I lost the debate because the prophet of doom displayed a chart showing the hyperbolic rise in AIDS cases. He said the AIDS epidemic would bankrupt the insurance companies and the economy.

Years later, the AIDS epidemic subsided, and the 1990s turned out to be a booming decade.

I made two unlikely predictions during this debate in the summer of 1989: the Berlin Wall would come down, and the federal government would balance the budget. Both predictions were met with derisive laughter.

I did not name a specific date when either one would occur. Perhaps in the next 10 years, I said. It turned out that the Berlin Wall fell a few months later in 1989, and Congress balanced the budget in 1999-2000, thanks to the combined efforts of a Republican Congress and a Democratic president (Bill Clinton).

Forecasting is a difficult business, and few are any good at it. The crystal ball is always cloudy, and like St. Paul said, “We see things through a glass darkly.”

I’ve made my fair share of accurate predictions in my newsletter, Forecasts & Strategies, but nobody is perfect.

In the mid-1990s, I predicted the Nasdaq would double and then double again. But I was still bullish on the Nasdaq in the year 2000, when it fell in half and then halved again by 2003.

Dow 36,000 — Finally!

Similarly, Glassman and Hassett predicted that the Dow would hit 36,000 “very quickly.” It took 22 years for their prophecy to come to pass. This week, the Dow hit 36,000.

Timing is everything in forecasting, and if your prediction is off by several decades, nobody is going to listen. One pundit has been predicting that Russia will engage in a sneak attack on the United States using nuclear weapons. He has been predicting this apocalyptic scenario for 30 years now.

Whenever my forecast is wrong, I always ask myself, “What am I missing?” It helps to improve one’s forecasting ability.

Glassman Now Predicts 1,000,000 on the Dow!

In Wednesday’s Wall Street Journal, James Glassman followed up with another prediction: The Dow would go over 1,000,000 in 50 years.

He wrote, “The Dow Jones Industrial Average stood at 825.86 as trading closed on Nov. 2, 1971. It closed Tuesday, Nov. 2, at 36,052.63. That is almost a 43.7-fold increase. Do the math. If the Dow continues to rise at the same rate, 50 years from now it will be 1,573,865. In other words, “Dow One Million.”

He bases his prediction on his belief that “the past is the best clue to the future, and the stock market has a long and consistent history.”

Dare I point out that his statement depends on which stock market he’s talking about. If he means the U.S. stock exchange (the Dow or S&P 500), then he’s right. But Wall Street is exceptional, outperforming all other country stock indexes for the past 122 years.

The stock markets in Japan, Canada and Argentina would show a very different picture, none of them as consistently profitable as ours.

Moreover, there’s no guarantee that the U.S. market will continue to outperform for the next 50 years. America is exceptional because it attracts the best and the brightest entrepreneurs. But if the United States adopts the policies of the Biden-Harris regime, we could see a lot of bear markets in the future as those entrepreneurs are taxed and regulated to death.

Remember, “Bull markets don’t die of natural cases, they are killed by bad government policies.” (“Maxims of Wall Street,” p. 109).

Who Will Win in 2022 and 2024?

Tuesday’s elections sent a strong message to President Biden and the radical Democrats. They are taking the country down the wrong road. I hope they are listening.

The Biden regime has blundered repeatedly in both domestic and foreign policy, to the extent that it is likely now that the Republicans will win back the House and maybe the Senate. I expect gridlock between 2022 and 2024.

Who will be the next president in 2025? It could be this man:

Last month, my wife, Jo Ann, and I met Florida Governor Ron DeSantis for the first time and heard him speak before the Claremont Institute’s annual banquet in Huntington Beach, California.

Gov. DeSantis made a point of contrasting his state with California. He noted that Florida is ranked the “freest state in the union,” while California is ranked #48 and New York #50, according to the Cato Institute’s “Economic and Personal Freedom Index.” Florida has the lowest tax burden, and California has one of the highest.

According to the governor, 99% of votes in Florida were reported on election night last November, compared to taking a month in California. In Florida, IDs are required to vote, and ballot harvesting (collecting ballots for other voters) is forbidden.

The governor is so popular that for the first time in years, there are now more registered Republicans than Democrats in the state.

The Florida economy is booming. He said that among last month’s 194,000 new jobs created in the nation, 84,500 came from Florida.

Not surprisingly, DeSantis is leading in the polls to be the next president of the United States. The only person keeping him from the Republican nomination is Donald Trump, but the former president will be 78 in 2024, and DeSantis will be only 48 years old. It’s time for new blood.

But as Yogi Berra famously said, “It’s tough to make predictions, especially about the future.”

Why ‘Maxims of Wall Street’ Makes an Ideal Holiday Gift

J. Paul Getty gave us good advice when he wrote the following in his book, “How to be Rich”: “The seasoned investor buys his stocks when they are low, holds them for the long-pull rise, and takes in-between dips and slumps in their stride.”

This sound advice is found on p. 138 in the new, 10th-anniversary edition of “Maxims of Wall Street” under the category “Long-term Investing.”

It applies to all of the stocks and funds recommended in my services. Short-term slumps are inevitable, but they are good buying opportunities if the long-term trend is upward.

Take Tesla for example. The stock was selling for $65 a share when I organized a big main-stage session on the future of Tesla at FreedomFest 2018. Today, the stock is selling for $1,100 a share, and that’s after a five-to-one split last summer.

In between, Tesla has fallen 30% or more from time to time. It pays to stay invested for the long run and take dips and slumps in stride, as J. Paul Getty advised.

That’s why I decided to publish “The Maxims.” Investors will benefit tremendously by following the advice of sound financial gurus.

My “Maxims” book now has sold more than 40,000 copies and has been endorsed by Warren Buffett, Jack Bogle, Dennis Gartman, Alex Green and Barron’s. Kim Githler said, “It’s my favorite book. Every quote is a lesson in finance.”

Kim Githler holding a copy of the “Maxims.”

Half Off Holiday Special

As the holiday season approaches, now is the time to put in your order for “The Maxims.” Each copy is numbered, dated and autographed. It makes an excellent gift to family, friends, clients and your favorite stockbroker.

The retail price is $24.95, but you pay only $20 for the first copy, and all additional copies are $10 each. I pay the postage if they are mailed to a U.S. address.

To order, go to www.skousenbooks.com.

Good investing, AEIOU,

![]()

Mark Skousen

You Nailed It!

A Tale of Two Stock Markets

When it comes to investing in the stock market, America is exceptional.

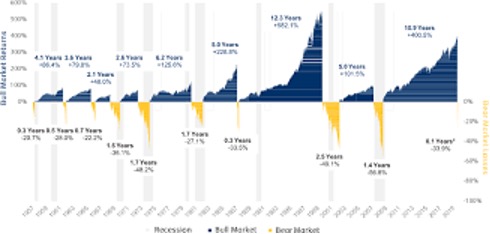

Not only has the U.S. stock market outperformed all other country index funds over the past 122 years, but bear markets are relatively short-lived on Wall Street. See the following chart:

Source: RBC GAM, Bloomberg. As of March 24, 2020. S&P 500 TR (USD)

As you can see, bear markets don’t last long in the United States, with the exception of the Great Depression in the 1930s.

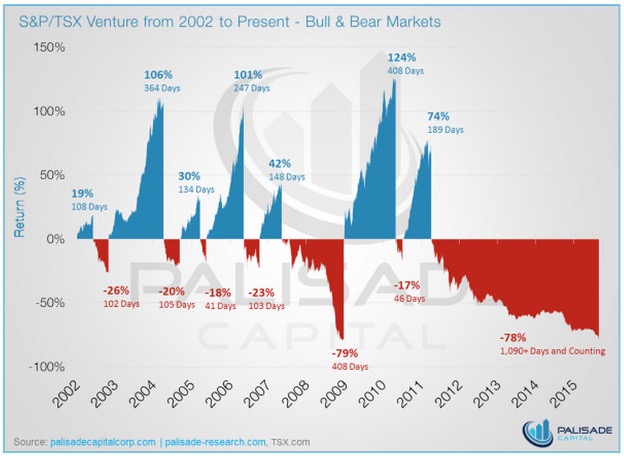

Meanwhile, in Canada, it’s a different story. See the following chart of the Toronto Stock Exchange (TSE) index:

What made the difference?

In the United States, we have a well-diversified portfolio of various industries, most of which benefit from the entrepreneurs that are attracted to America.

In Canada, the TSE index is heavily dependent on commodity prices, energy and mining in particular, which topped out in 2011 and went into a major long-term bear market. The TSE index is only recovering now.

But there’s no guarantee that the U.S. market will perform as well as it has in the past. As long as the United States preserves its reputation as a free-market capitalist economy that attracts inventors and entrepreneurs from around the world, we will flourish. But if we vote for bigger, more intrusive government, watch out below.