The three best energy stocks to buy now include an ambitious technology startup seeking to transform the solar panel industry, an oil and gas corporation hot off an acquisition intended to drastically boost its bottom line and a utility company embracing renewable energy.

For most consumers, the power used to heat showers, fuel gas stoves or charge electric cars appears to be the same. However, there are few investment sectors as diverse as energy stocks.

The inelasticity and necessity of energy for human society have provided suitable niches for a wide variety of businesses. Conventional oil and gas producers ExxonMobil (NYSE:XOM) and Chevron Corp. (NYSE:CVX) yield consistent dividend payments for retirement funds, while green energy startups Plug Power (NASDAQ:PLUG) and SunRun (NASDAQ:RUN) provide alternatives for growth investors in traditionally mature industries.

PLUG and RUN are among our top renewable energy stocks to buy.

Jeff Bezos famously stated that he makes his investment decisions based on whether they will change people’s lives. Electricity allows human innovation and progress to occur at all hours. Natural gas heats homes and food. Petroleum enables people to commute to and from work. Energy is arguably humanity’s most essential commodity, and there is possibly no better time than now to invest.

Recent climate talks, most notably in Glasgow, Scotland, in November 2021, have all but affirmed the energy revolution initially promoted by the 2015 Paris Climate Accords. The energy sector is in the process of a drastic shift away from fossil fuels and towards renewable energy. Even traditional fossil fuel companies have embraced the change, best evidenced by BP’s (NYSE:BP) net carbon zero by 2050 pledge.

The revolution towards green energy presents an opportunity for investors to generate significant returns in a sector traditionally characterized as low risk, low reward. Renewable energy startups have the potential to become the new giants in the energy sector, while traditional energy companies have become undervalued despite many displaying incredible adaptability. Here are the three best energy stocks to buy now to help you capitalize on the energy revolution.

3 Best Energy Stocks to Buy Now: #3

Vistra Corp (NYSE:VST)

Vistra Corp. (NYSE:VST) is an American electric utility company headquartered in Irving, Texas. The company emerged as a standalone entity following Energy Future Holdings’ bankruptcy in 2016. Vistra serves more than five million customers across 20 states, Canada and Japan and is a Fortune 275 company with a market capitalization (market cap) of $10.8 billion.

Vistra’s expansive operations abroad and domestically showcase the company’s willingness to compete across a wide range of differing markets. Vistra utilizes a wide range of energy sources to supply power to its customers, from coal to nuclear to natural gas. The company is the largest competitive residential electricity provider in the United States.

Since utilities in the United States are state-protected monopolies, they are unable to profit from power. Utilities are mandated by law to sell energy to customers without any markup. Instead, utility companies generate earnings from construction and development projects such as substations, power lines and transformers. Vistra’s potential is derived from its exceptional proficiency at developing renewable energy infrastructure.

Investing in renewable energy can be a risky endeavor because many companies are still startups. VST is an established entity that offers investors the chance to capitalize on the potential of green energy. Vistra owns and operates more than 50 renewable energy facilities, including the largest battery storage facility in the world located in Moss Landing, California. The company has nearly $1 billion worth of renewable energy and battery developments underway, with an additional $4 billion worth of projects expected to occur by 2030.

Vistra’s emphasis on renewable energy also provides the company a cost advantage over traditional utilities. Utility-scale wind and solar have become the cheapest form of energy production, even if unsubsidized, due to recent declines in costs. In many instances, it has even become more affordable to build new wind and solar farms than to continue operating existing coal plants.

Utilities are often characterized as low-risk, low-reward investments for individuals seeking safe and stable stocks, often with high dividend yields. Vistra, however, is not a low-reward investment. The company has an average sales growth of 17.3% and a return rate of 69.6% over the last five years, while still paying a 2.7% dividend yield.

Vistra is projected to continue its strong growth with 20.1% revenue gains in 2021 and 31.0% in Q1 2022. The company also announced in November 2021 that it would return at least $7.5 billion to shareholders by the end of 2026 through stock buybacks and dividends.

As a result, VST possesses a Stock Rover sentiment score of 98/100 and has seen its share price climb by 27.2% over the past year. VST’s movement over the trailing 12 months is graphed below, along with a 50-day moving average.

Chart provided by Stock Rover

Since power is an inelastic product independent of international supply chains, utility stocks are an excellent hedge to our current economic volatility. Utilities typically do not have to contend with geopolitical uncertainty other energy stocks encounter from the Organization of the Petroleum Exporting Countries, unfriendly federal administrations, etc. Vistra follows the trend of other utility companies with a beta of 0.78, meaning its share price is not well correlated with macroeconomic fluctuations.

Vistra’s stock did drop in March 2021 due to the Arctic freeze that hit Texas, which resulted in a $1.3 billion financial hit for the company. The company accounts for nearly one-third of the state’s electricity consumers. However, Vistra Chief Executive Officer Curtis Morgan stated that the loss was “not a liquidity crisis for this company… [and] a short run-material hit.” VST has since largely recovered.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $26.20, 17.3% higher than its latest closing price of $22.33, earning VST a “STRONG BUY” recommendation from Stock Rover and a place among our three best energy stocks to buy now.

3 Best Energy Stocks to Buy Now: #2

Enphase Energy Inc. (NASDAQ:ENPH)

Enphase Energy Inc. (NASDAQ:ENPH) is an all-in-one solar solution company providing products and services from solar panels to battery storage to energy management. Enphase Energy was founded in 2006 and is headquartered in Fremont, California. The company primarily operates in the United States and possesses a market cap of $25.5 billion.

The appeal of home solar panels is obvious. Solar panels allow homeowners to reduce or eliminate their electricity bills, earn tax credits and rebates, increase their property value and help the environment. The solar power industry is already worth $10.8 billion in the United States and is projected to grow by 11.0% annually over the next five years.

However, solar panels can still be a difficult industry for companies to navigate, as illustrated by Elon Musk’s failed Solar City venture. Despite significant reductions in price in recent years, the cost of residential solar panels remains high. The average cost of home solar panel installation, after federal tax credits, is approximately $14,800. As a result, solar companies typically have to offer cheap financing options to incentivize homeowners to switch from traditional electrical utilities to solar, increasing the installer’s risk and creating a barrier to expansion.

Enphase Energy has seemingly been immune to expansion obstacles common in the solar panel industry. The company’s solution has been to pursue an aggressive financing business model using debt. Enphase uses the cash raised through borrowing to provide financing to homeowners looking to switch to solar. Enphase Energy currently possesses $1.4 billion in cash on its balance sheet and a compound annual growth rate (CAGR) of 125.3% over the last five years. The company had $24 billion in cash at the end of 2016. Enphase has increased its total debt by a CAGR of 95.6% over the same period, up from $36 million in 2016 to $1.0 billion in 2021.

Although risky, Enphase Energy’s borrowing has allowed the company to grow its revenue exponentially in recent years. Enphase has seen average annual revenue growth of 32.9% over the last five years, 59.5% over the past three years and 71.5% over the trailing 12 months. Its success has rewarded its investors with a 15,519.8% return over the last five years. Enphase Energy’s aggressive financing play also has allowed it to reach profitability, a rarity among startups. The company recorded a net income of $134 million in 2020, despite COVID-19.

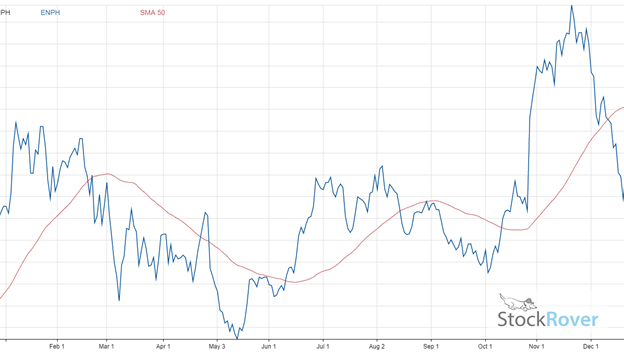

Enphase’s rapid growth is expected to continue, with sales projected to increase by 49.9% in Q4 2021 and 40.1% in 2022. The company has seen a 15.0% increase in share price over the trailing 12 months. ENPH’s climb is displayed below. The graph also contains a 50-day moving average to help better track change in share price.

Chart provided by Stock Rover

Enphase Energy’s bold business strategy centering around zealous debt financing may worry some investors. However, the company’s balance sheet remains strong. ENPH possesses a strong Stock Rover quality score of 80/100. The company also has $648 million more in total assets than total liabilities on its balance sheet, $2.2 billion compared to $1.6 billion, respectively. Enphase’s balance sheet cash, $1.4 billion, alone is almost enough to cover its total liabilities. As a result, despite the company’s recent borrowing spree, ENPH carries more than enough cash and assets to be financially stable.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $255.17, 34.8% higher than its latest closing price of $189.33, earning ENPH a “BUY” recommendation from Stock Rover and a place among our three best energy stocks to buy now.

3 Best Energy Stocks to Buy Now: #1

EQT Corp (NYSE:EQT)

EQT Corp (NYSE:EQT), founded in 1888, is an independent crude oil and natural gas production company headquartered in Pittsburgh, Pennsylvania. The company primarily operates out of the Marcellus and Utica shales in the Appalachian Basin on the American East Coast. EQT is the largest natural gas producer by volume in the United States and has a market cap of $8.0 billion.

Renewable energy is undoubtedly the future. Every hour, 430 quintillion joules worth of sunlight energy strikes the Earth, providing enough to power all of human society for more than a year. However, green energy faces many hurdles, especially pertaining to battery technology, before it can fully meet societal demand.

Since wind turbines and solar panels can only generate power when it is windy and sunny, respectively, energy must for periods with little-to-no wind or sunlight. Unfortunately, the battery technology and infrastructure required to store and supply renewable energy efficiently for down periods is not available. Currently, it would cost more than $2.5 trillion to create the battery storage system necessary to meet just 80% of American energy needs.

It is expected to take decades for renewable energy to phase out fossil fuels entirely. The U.S. Department of Energy estimates that 76% of American energy consumption will still be supplied by fossil fields in 2050. As a result, many experts view natural gas as a critical component in reducing our global carbon footprint by filling renewable energy supply shortages.

Despite also being a fossil fuel, natural gas is seen as a cleaner energy source than petroleum and coal, making it a viable long-term investment despite the increasing global focus on renewable energy. Natural gas emits 30% less CO2 than oil production and between 50% to 60% less carbon dioxide than traditional coal plants. Furthermore, natural gas’s molecular structure makes it a viable solution to be used in green materials for solar panels and wind turbine blade production. As a result, natural gas is the only fossil fuel projected to grow beyond 2030, with global demand peaking in 2037.

As the United States’ largest natural gas producer, EQT is positioned to profit significantly in the coming decade. Although EQT does produce and sell crude oil, approximately 98.5% of its revenue is derived from its natural gas and natural gas liquids business segments.

As a sign of natural gas’s potential, EQT announced a $2.9 billion acquisition of Alta Resources Development in May 2021 to significantly expand its Marcellus shale holdings to boost its natural gas production. The purchase is forecast to increase EQT’s free cash flows by $300 to $400 million annually. The company is projected to see a 59.0% increase in revenue in Q4 2021 and a 20.2% rise in 2022 as the global natural gas demand rebounds from the pandemic.

EQT’s strong future forecasts have caused its share price to surge by 56.7% over the past year. The company’s stock price growth is illustrated below alongside a 50-day moving average.

Chart provided by Stock Rover

EQT has suffered substantial losses in recent quarters due to natural gas prices trending upward due to supply chain disruptions. The good news is that the losses are not a result of EQT’s underlying business model. The increased gas prices played against the company’s derivative hedges against the commodity. Although the losses are a concern in the short term, EQT is forecast to rebound in the coming months as the global economy recovers, rewarding patient investors. The company’s long-term potential is evidenced by the fact that the number of hedge funds holding EQT increased from 43 at the end of Q2 2021 to 57 at the end of Q3 2021.

Renewable energy investments have garnered significant investor attention in recent years, and for a good reason. However, as a result, traditional energy investments such as EQT have become undervalued, making them an excellent choice for value investors.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $31.29, 47.7% higher than its latest closing price of $21.19, earning EQT a “STRONG BUY” recommendation from Stock Rover and a place among our three best energy stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)