Five farm equipment investments to buy as Russian President Vladimir Putin’s invasion of Ukraine pulverizes peace are among the best choices for growing portfolios amid the missiles and cluster bombs that have killed thousands and turned more than 2 million innocent people into refugees.

The five farm equipment investments to buy feature three stocks and two funds that are positioned to profit as Putin’s perilous policies threaten to pummel the agricultural sales of both Russia and Ukraine as grain-producing powers. Prices of agricultural products should rise as Ukrainian men aged 18-60 and volunteers defend their country against an estimated 150,000 troops that Putin has deployed in Russia’s neighboring nation to wage war by razing residential areas, hitting 34 hospitals and shelling more than 200 schools.

Putin has given no indication of pulling his troops back to Russia, and he is encountering determined resistance from Ukrainians trying to protect their homeland and freedom under the leadership of the nation’s democratically elected President Volodymyr Zelenskyy, who is rallying his countrymen to fend off the invaders. Zelenskyy, in rousing remarks to the British Parliament via a live video presentation from the Ukraine on March 8, seemed to be channeling former U.K. Prime Minister Winston Churchill during World War II by vowing, “we will not give up and we will not lose.”

Five Farm Equipment Investments to Buy as Zelenskyy Rallies Countrymen

Even though Zelenskyy said Ukrainians will keep fighting for their land “whatever the costs,” the toll in innocent lives has been high with Russian missile strikes killing 406 civilians, including dozens of children, while injuring 801 others since hostilities began on Feb. 24, according to the United Nations (UN). However, the exact figures are likely much higher, as the invasion and Russia’s unrelenting attacks hinder reports about casualties in many parts of Ukraine.

“The scale and strength of Ukrainian’s resistance continues to surprise Russia,” according to U.K. Defence Intelligence.

However, Russian troops are targeting populated areas in multiple locations, including the Ukrainian cities of Kharkiv, Chernihov and Mariupol, in an apparent effort to weaken morale of the defenders, the agency reported. Russia previously put in play similar tactics in Chechnya during 1999 and in Syria during 2016 by using both air and ground-based munitions, British Defence Intelligence added.

In Russia, some 12,700 people have been arbitrarily arrested for holding peaceful anti-war protests, despite new criminal code amendments to impose heavy fines and prison terms of up to 15 years for reporting information deemed fake by the authorities or criticizing what Putin calls a “special military operation.” The UN expressed concern about these and other “overly broad and repressive laws” that restrict freedom of expression, including media reports, and curb other civil and political rights.

Former Army Paratrooper Picks One of Five Farm Equipment Investments to Buy

Cummins Inc. (NYSE: CMI), a Columbus, Indiana-based global manufacturer of diesel and alternative fuel engines, electrical generators, components and technology, serves its customers through its network of 600 company-owned and independent distributor facilities and more than 7,200 dealer locations in 190-plus countries and territories. Despite the market’s volatility, Cummins remains a recommendation of Jim Woods, a former U.S. Army paratrooper.

“Shares of Cummins, Inc. have been hit because of the war in Ukraine, as the company announced that it expected ‘some impact’ to its business in Russia and is analyzing and preparing for current and anticipated sanctions,” said Jim Woods, editor of Intelligence Report investment newsletter, which has a long position in diesel engine maker’s stock.

Paul Dykewicz meets with Jim Woods, editor of Intelligence Report.

Income investors may like the 3.06% dividend yield of Cummins. Dividend-paying stocks typically fall less than the market during downturns such as the current one triggered by Russia’s invasion of Ukraine.

“The recent pullback in CMI shares represents a good buying opportunity for long-term investors looking for value as well as a good dividend yield,” said Woods, who also leads the Successful Investing newsletter, as well as the Bullseye Stock Trader and High Velocity Options trading services.

Chart courtesy of www.stockcharts.com

Cummins Ranks as One of Five Farm Equipment Investments to Buy

Since its first engine for agriculture was built in 1919, Cummins has powered equipment for some of the world’s largest manufacturers. Roughly 1 million Cummins engines are in operation worldwide in applications from combine harvesters, tractors and sprayers to specialist and autonomous equipment.

Cummins’ agriculture engines, ranging from 2.8 to 19 liters, are tailored for farm performance. The company’s products are designed to work in North America’s hayfields, South America’s nut orchards and Asia’s vegetable farms. Cummins powers equipment for more than 20 agricultural original equipment manufacturers (OEMs), and its worldwide service reaches more than 190 countries across six continents.

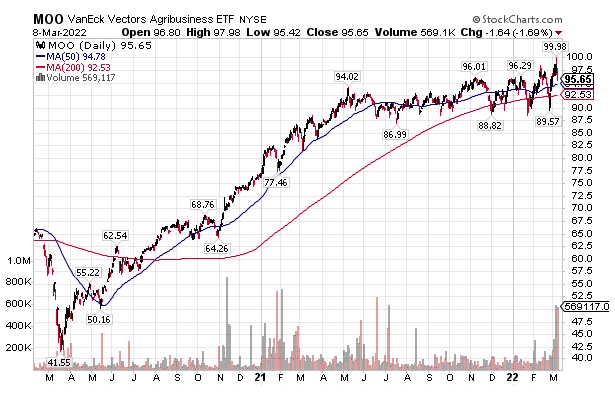

Pension Chief Chooses MOO Among Five Farm Equipment Investments to Buy

Investors should consider the ETF VanEck Agribusiness (MOO), said Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter. The fund seeks to track the MVIS Global Agribusiness Index, which is composed of companies that generate at least 50% of revenues from agrichemicals, animal health and fertilizers, seeds and traits, farm/irrigation equipment, farm machinery, aquaculture, fishing, livestock and more, Carlson counseled.

Bob Carlson, head of Retirement Watch, speaks with columnist Paul Dykewicz.

MOO’s largest holdings recently were Deere & Co. (NYSE: DE), 8.25%; Nutrien (NYSE: NTR), 7.66%; Bayer (OTCMKTS: BAYRY), 7.24%; Zoetis (NYSE: ZTS), 6.51%; and Archer-Daniels Midland (NYSE: ADM). It owns 55 stocks and has 58% of the fund in the 10 largest positions.

MOO is up 3.23% in the last four weeks, 4.94% over three months and 1.96% for the year to date. For the past 12 months, MOO is up 15.64%.

Chart courtesy of www.stockcharts.com

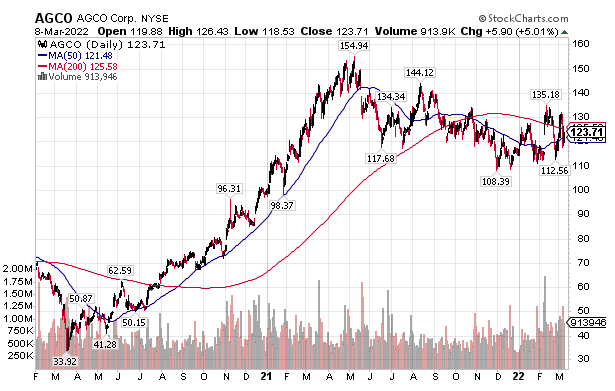

Perry Picks Two Stocks for List of Five Farm Equipment Investments to Buy

One of two farm equipment investments favored by seasoned investment professional Bryan Perry is AGCO Corporation (NYSE: AGCO), an agricultural machinery manufacturer founded in 1990 and headquartered in Duluth, Georgia. AGCO designs, produces and sells tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding and tillage equipment.

Paul Dykewicz interviews Bryan Perry, who heads the Cash Machine newsletter.

Western companies that could find fertile opportunities to step up their production of farm equipment may be interested in buying tractors and other agricultural machinery from AGCO. The stock also offers a modest current dividend yield of 0.65%.

AGCO’s fourth-quarter earnings, reported on Feb. 9, showed record sales and margins, buoyed by strong agriculture markets worldwide. The company’s share price jumped 5.01% on March 9, while it fell 1.75% during the past month. AGCO’s three-month return reached 4.03% and its year-to-date gain hit 6.80%, while it slid 3.57% in the past year.

Chart courtesy of www.stockcharts.com

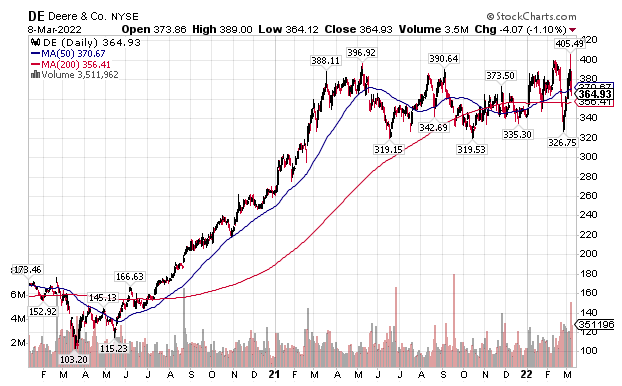

Deere Is Perry’s Second Pick Among Five Farm Equipment Investments to Buy

A second stock that Perry picked among the five farm equipment investments to buy is Deere & Co., of Moline, Illinois. The company manufactures agricultural machinery, heavy equipment, forestry machinery, diesel engines and drivetrains used in heavy equipment and lawn care equipment.

The prospect that additional farm equipment may be needed to fill any supply void left by Russia and the Ukraine adds to the appeal of Deere, Perry told me. Perry, who leads the Cash Machine investment newsletter, as well as the Premium Income, Quick Income Trader, Breakout Options Alert and Hi-Tech Trader services, is a Wall Street veteran.

Chart courtesy of www.stockcharts.com

Michelle Connell, CFA, president and owner of Portia Capital Management, of Dallas, Texas, also likes Deere and said it makes sense to invest in industrial companies that are at the forefront of the “green” movement. These companies will help the U.S. offset its long-term dependence on foreign oil, she added.

“Deere is considered one of the sustainability champions of agriculture and construction equipment,” Connell said.

The company has aggressive goals for sales of electric and hybrid equipment, as well as carbon footprint reduction, Connell continued. While the stock is one of the few winners of 2022, up 8% so far, she predicted its upside potential is 15%.

Fifth of Five Farm Equipment Investments to Buy Is JPMorgan Fund

The dream to go “green” also is a reason to buy shares in JPMorgan Sustainable Leaders Fund (JIISX), Connell said. The fund only launched in September 2021 but is appealing due to its focus on companies that provide climate policy solutions and assist in the transition to a low carbon economy, she added.

“JPMorgan has one of the best research teams in the investment world,” Connell counseled.

For investors who want environmental, social and corporate governance (ESG) friendly investments that still provide investment results, JPM has the money and intellectual talent to deliver, Connell commented.

Michelle Connell, CEO, Portia Capital Management

A U.S. ban on Russian oil imports announced by President Biden on March 9 could boost prices for the black gold to $150 per bbl., a new all-time high, as markets brace for further supply disruption, said Ben Laider, a global markets strategist at social investment network eToro. Such a ban is not yet a policy all of Europe is ready to take.

“These US restrictions will likely be unilateral, with Europe remaining on the restriction sidelines for now, given its much greater dependence on Russian energy,” Laider said. “Russia produces 11% of the world’s oil but supplies 30% of Europe’s oil needs and 40% of its natural gas. By contrast, Russian oil imports make up under 1% of U.S. oil consumption.

“Soaring oil prices will worsen the near-term global economic outlook, by both slowing growth and boosting already high inflation. The only silver-linings are that global growth is currently robust.”

COVID-19 Deaths Top 6 Million Worldwide

COVID-19 deaths worldwide topped 6 million to total 6,014,742 on March 9, according to Johns Hopkins University. Cases across the globe are on the verge of reaching 450,000,000, with the number hitting 449,742,480 on March 9.

U.S. COVID-19 cases, as of March 9, topped 79,369,007, with deaths rising to 961,843. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

As of March 8, 254,205,456 people, or 76.6% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. The fully vaccinated totaled 216,273,632, or 65.1% of the U.S. population, according to the CDC.

The five farm equipment investments to buy for profiting from Putin’s pulverization of peace between Russia and Ukraine offers opportunities to produce positive returns even when the market is volatile and oil prices are hitting new highs. With Russia’s invasion of Ukraine causing heavy civilian deaths and injuries, as well as endangering the agricultural sales prospects for each country, the five farm equipment investments to buy could help to plow profitability for portfolio owners.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

![[tractor mowing wheat]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_48384775.jpg)