**************************** Personal Invitation ******************

Each year, at this time, I invite a handful of investors to join my exclusive Income Alliance 100. This includes all my services for a lifetime with just a one-time fee (which, for the first time ever, we are discounting by $1,000) and small annual maintenance fee afterward. This is your invitation to join us now to become a member of all six of my services. But hurry, this offer ends on May 31, and we only opened up 100 slots. To learn more and secure your spot, call Grant Linhares at 202-677-4492 for your personalized quote — every one of my current subscribers will get a prorated refund for any product they currently have (in addition to the $1,000 discount) when they join (meaning you pay less than others!).

******************************

Debt ceiling talks are ongoing and both sides have promised that there will be no default, yet the principals are miles apart on terms. There is little time for brinkmanship, and yet, once again, it looks like the midnight oil is going to burn into the deadline. The government will likely be pushed to the point of partial shutdowns to buy time, as has been the case in the past.

Turning to the market, some beaten-down sectors (energy, banks) are getting a bounce, but the focus of the bulls remains on big-cap tech, home-building and various special situations in the health care space where there is some merger and acquisition activity. A resolution to the debt ceiling, a Fed pause, some further proposed backstopping by the Federal Deposit Insurance Corporation (FDIC) per the regional banks and a continuation of inflation trending lower opens the way for the market to maintain its range or even break higher as these clouds lift.

The jury is out on what, if any, kind of landing the U.S. economy will endure, but safe to say both anecdotal and empirical evidence shows the consumer is being more watchful of his or her spending habits. There is no sugarcoating the numbers on how the consumer is spending his or her discretionary dollars. They are down and trending lower.

It was reported on May 12, the University of Michigan’s gauge of consumer sentiment fell to a preliminary May reading of 57.7 from an April reading of 63.5. That is the lowest level since November last year. Economists polled by the Wall Street Journal had expected a May reading of 63 — a fairly substantial miss.

Americans’ view on near-term inflation moderated slightly in May. They now expect the inflation rate in the next year to average about 4.5%. Inflation expectations had surged to 4.6% in April from 3.6 in March. The Current Economic Conditions Index, a gauge that measures what consumers think about their financial situation, and the current health of the economy, fell to 64.5 from 68.2 in April. The Index of Consumer Expectations, another measure that asks about expectations for the next six months, moved down to 53.4 in May from 60.5 in the prior month. Again, we saw a sharp move down.

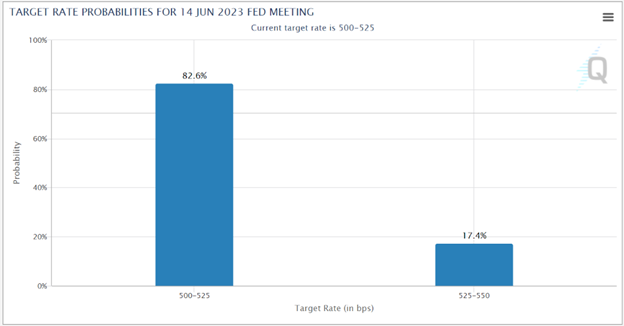

With the consumer caution flag out, there is good reason for investors to check his or her stock and exchange-traded fund holdings carefully heading into what could be a period of extended uncertainty for the broad market. In my view, the market has priced in some form of a debt ceiling deal, as well as a timeout on a further rate hike at the upcoming June 14 Federal Open Market Committee meeting. I think it remains unclear as to whether the recent good news on inflation trending lower is anywhere near being considered “mission accomplished” by all the Fed tightening. And I also think the waters ahead for the regional banks will remain very choppy and worrisome if short-term rates stay at the 5.0%+ level.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

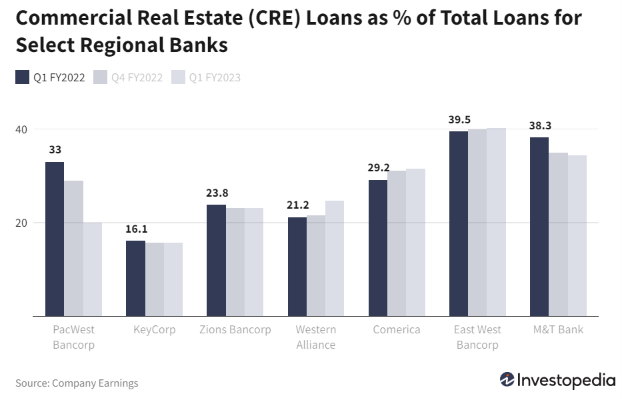

To get a handle on the numbers impacting the regional and community bank sector regarding commercial real estate exposure, one doesn’t have to look hard to get the latest data. In the most recent Financial Stability Report issued by the Fed, it clearly states commercial real estate poses a clear and present danger, especially to smaller, regional lenders exposed to the sector.

Of the 60% of commercial real estate (CRE) loans held by banks, more than two thirds of those are held by lenders with less than $100 billion in assets as defined by the Fed. Collectively, they have nonfarm, nonresidential CRE loan portfolios totaling $1.55 trillion, of which $500 billion is invested in office and downtown commercial real estate.

Losses on CRE loans will depend on the borrower’s degree of leverage, as property owners with high equity cushions are less likely to default, according to the report. Also, banks that issue loans with higher loan-to-value (LTV) ratios are more likely to experience financial difficulty as these loans are harder to refinance or modify. When real estate prices fall, as they have in recent months, LTV ratios rise.

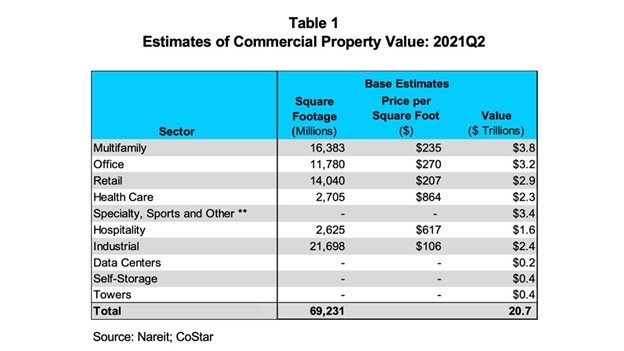

While many economists have warned about commercial real estate as a broad sector, most of the worst distress has been confined to office properties, which make up 24.2% of the $10+ trillion CRE market. But estimates vary quite a bit on the total value of the CRE market. Nareit/CoStar shows the total market worth over $20 billion as of 2021.

“Among the categories of CRE, only offices — particularly those in big cities — are struggling right now due to the rise of remote work, along with certain retail properties like restaurants that depend on office workers,” said Joseph Wang, CIO at MonetaryMacro.com.

Loans on office properties are disproportionately issued by the smallest lenders, which have greater exposure to the sector than big banks and mid-sized regional lenders.

“The smallest banks — those which few people have heard of — tend to be the most exposed to commercial real estate and are most at risk,” Wang said. “I don’t believe this crisis is systemic, as big banks and even most regional lenders have little exposure,” Wang added.

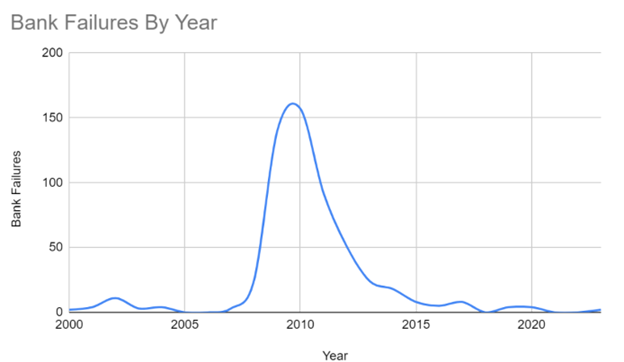

This last statement about big banks and regional lenders having little exposure should be somewhat gratifying to markets in the short-term, but unless rates come down significantly from current levels, refinancing office properties with high vacancy rates and low occupancy levels could trigger a wave of defaults. During the Great Recession, 140 banks failed in 2009, 157 in 2010, 92 in 2011, 51 in 2012, 24 in 2013, 18 in 2014 and about 5 per year thereafter average. 2021 and 2022 saw zero failures before this year’s three storied failures by SVB, Signature Bank and First Republic.

https://www.forbes.com/advisor/banking/list-of-failed-banks/

“You have fundamentals under pressure from work from home at a time when lending is less available than [it has been] over the last decade,” said Rich Hill, head of real estate strategy at Cohen & Steers. “Those two factors will lead to a pretty significant decline in valuations.”

The leading research firm analyzing commercial real estate debt, Trepp, has a front-row seat to the reckoning. About $270 billion in commercial real estate debt is coming due this year, Trepp said, which means that landlords will need to refinance their properties at today’s higher interest rates — and face significantly higher monthly payments. Roughly $80 billion, nearly a third, are on office properties.

So, while some of the strife related to deposit outflows seems to have calmed, investors should brace for a wave of headlines regarding troubled or failed office property refinancings when properties are valued well below where they were when first financed years ago, against an environment of considerably higher rates and tighter loan terms. It is not an overnight problem like the run on deposits, but one that looms exponentially larger in scope, scale and potential risk to the banking system.

P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.